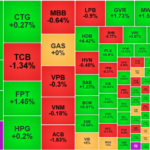

The market remained lackluster in the afternoon session, with stock prices showing little improvement. However, there was a surprising twist as foreign investors suddenly poured in significant capital, focusing on banking stocks during the ATC session. Unfortunately, these stocks had a minimal impact on the VN-Index, but they were strong enough to push the VN30-Index past the reference level.

HDB was the most surprising bank stock. At the end of the morning session, its shares were still down 1.6%. By the end of the continuous matching session, it had plunged deeper into the red, falling by 2%. However, during the ATC session, a massive buying volume of over 3.58 million shares pushed its price to the daily limit-up level. Foreign investors were net buyers of HDB, purchasing approximately 3.84 million shares, accounting for more than 36% of the total trading volume. The net buying value stood at nearly VND64 billion. This was also the first time HDB hit the daily limit-up price in 2024. This extreme volatility led to a significant gain of 13.89% in just five sessions and a 30.26% increase since mid-November.

STB and CTG were two other bank stocks that witnessed substantial buying pressure during the ATC session. STB’s price surged from VND36,850 to VND37,850, eventually closing 1.2% higher than the reference price, but it gained 2.71% in a single matching session. The ATC session volume for STB reached 3.89 million shares. Foreign investors accounted for approximately 40% of STB’s total daily volume, with a net buying value of VND154.9 billion. CTG saw ATC session trading of over 1.86 million shares, with its price jumping from VND38,450 to VND38,900. It closed 0.26% higher than the reference price but gained 1.17% in a single matching session. Foreign investors’ net buying made up 39.3% of the total volume, with a net value of VND87 billion.

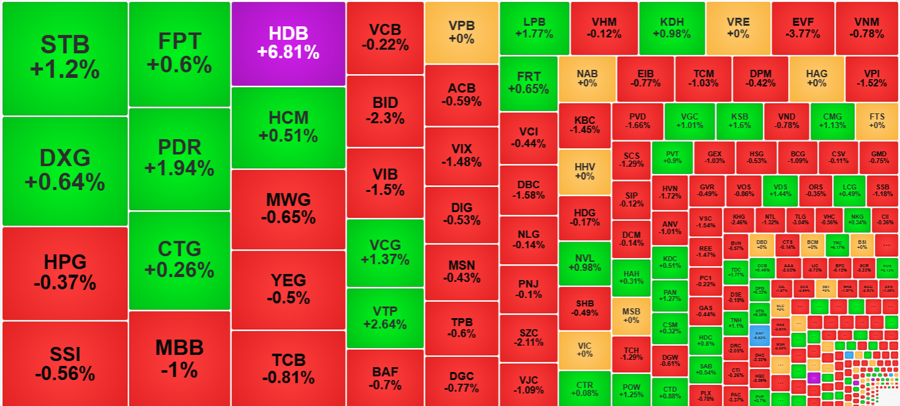

In contrast to the above-mentioned bank stocks, several other stocks in the same sector experienced heavy selling pressure during the closing session. BID was the most notable, with a selling volume of 1.53 million shares during the ATC session, causing an 1.8% drop in its price during that session alone. It eventually closed 2.3% lower than the reference price. Other bank stocks that witnessed significant declines at the close included VIB, down 1.5%; SSB, down 1.18%; and MBB, down 1%. Overall, out of the 27 bank stocks, 12 closed in the red, including major stocks like VCB, TCB, and BID.

The tug-of-war between banking stocks had a stabilizing effect on the VN-Index. HDB, LPB, STB, and CTG managed to offset some of the losses from BID and TCB. Among the ten largest stocks by market capitalization on the HoSE, only two were in the green: FPT and CTG. Nonetheless, the VN-Index posted a modest loss of 3.12 points, equivalent to a 0.24% decline. Thus, after a strong gain on December 25, the subsequent three subdued sessions only gave back slightly over two points.

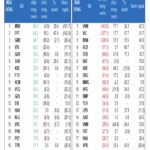

This afternoon, the price level was lower than in the morning session, with 99 stocks closing more than 1% lower (compared to 63 in the morning session). Their liquidity accounted for approximately 19.7% of the total matching value on the exchange. Bank stocks dominated the liquidity leaders, with MBB, BID, and VIB ranking in the top three positions, recording matching values of VND276.3 billion, VND155.3 billion, and VND151.6 billion, respectively. Mid-cap stocks also faced considerable pressure, with EVF falling 3.77% with a matching volume of VND95 billion, DBC declining 1.58% with VND82 billion, SZC dropping 2.11% with VND78.2 billion, and TCM slipping 1.03% with VND73.4 billion. Many of these stocks closed at their intraday lows, with high liquidity, indicating that selling pressure had completely overwhelmed buying interest.

The VN-Index’s breadth at the end of the session showed 122 gainers and 298 losers, slightly weaker than in the morning session. However, the group of outperformers was not too shabby. In addition to the notable performances of HDB and STB, PDR stood out with a 1.94% gain and impressive liquidity of VND289.4 billion. It was also heavily bought by foreign investors, who net purchased approximately VND74.3 billion, accounting for about 26% of the total trading volume. VCG also shone, rising 1.37% with a matching volume of VND147.3 billion. VTP climbed 2.64% with VND130.6 billion, while LPB advanced 1.77% with VND105.4 billion. Other mid-cap stocks, such as VGC, KSB, CMG, PAN, and VDS, also posted gains of over 1%, with liquidity exceeding VND30 billion each. Notably, the top 20 liquidity leaders among the gainers, with increases of at least 1%, accounted for 16.9% of the HoSE’s total trading volume. While their number was significantly lower than that of the decliners, the best-performing stocks still attracted a substantial portion of the market’s capital flow.

Foreign investors surprised the market this afternoon with their activity in bank stocks and some other stocks, as mentioned earlier. This contrasted with their calm behavior in the morning session. Specifically, foreign investors were net buyers in the afternoon session, injecting new capital of VND1,184.5 billion, more than four times the amount invested in the morning session. Their net buying value stood at VND439.9 billion, a stark contrast to the net selling of VND88.2 billion in the morning session.

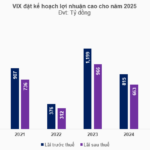

The Ultimate Guide to VIX’s Ambitious Plans: Targeting Billion-Dollar Profits with a Massive Share Offering of 73 Million.

The upcoming 2025 Annual General Meeting of VIX Securities Joint Stock Company (HOSE: VIX) is set to take place on the morning of May 23, 2025, with a packed agenda. Notably, the company plans to present its ambitious pre-tax profit target of VND 1,500 billion and a post-tax profit of VND 1,200 billion. Additionally, they will propose the issuance of nearly 73 million shares as dividends for the year 2024 and seek approval for changes to the board of directors, including the exemption and election of a new member.

Trade Tax Talks Begin, Markets Await News With Bated Breath

The Vietnamese market cautiously welcomed the news of Vietnam initiating negotiations with the US on the evening of April 23rd. While it was expected that this would happen and the “scheduling” is a positive step, the market is essentially waiting for results. The balanced tug-of-war between buyers and sellers, coupled with a significant drop in liquidity, indicates that both sides are mostly observing for now.

The Great Sell-Off: Foreigners Dump Real Estate Stocks en Masse

Individual investors sold a net amount of 516.1 billion VND, including 541.1 billion VND in matched orders. The top stocks sold were VHM, VIC, MSN, ACB, STB, BAF, DXG, MWG, and HPG.

“The Super Pillar” Returns: VN-Index Surges Past 1220 Points as Foreign Investors Turn Net Buyers

The morning’s trading conundrum continued for a few minutes into the afternoon session, culminating in an explosive surge. VIC and VHM, the prominent large-cap stocks, led the charge, propelling a host of other blue-chips to significant gains. The VN-Index closed above the crucial 1220-point mark, as foreign investors also unexpectedly ramped up their buying activity.

The Red Hot Electric Board: VN-Index Plunges Below the 1200-Point Mark, Foreigners Sell Off in the Highest 7 Sessions

The significant weakening of pillars, coupled with unfavorable developments in the international market, sent Vietnamese stocks into a sharp decline this morning. Investors tried to offload their positions, and while it didn’t quite turn into a panic sell-off, it still resulted in hundreds of stocks plunging. The VN-Index tumbled to 1,189.07 points…