The Governor of the State Bank of Vietnam (SBV), Nguyen Thi Hong, has submitted a report to the National Assembly on the implementation of resolutions regarding banking-related issues.

Regarding the implementation of management solutions to stabilize the gold market, the SBV stated that in the first few months of 2025, global gold prices repeatedly broke previous records. The primary drivers of the increase in international gold prices were political instability, military conflicts, and escalating strategic competition worldwide.

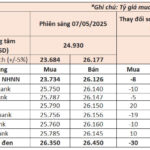

Domestic gold prices have surged recently. Photo: Dung Minh

Additionally, central banks and investment funds increasing their gold reserves played a significant role in the price hike. Gold prices were also impacted by US President Donald Trump’s announcement of high retaliatory tariffs on countries worldwide, causing investors to flock to gold…

Domestically, SJC gold bar prices moved in tandem with global prices. With synchronized management solutions, as of early April 2025, the difference between domestic and global gold prices remained controlled, maintaining a gap of approximately 3-5 million VND per tael (equivalent to around 5-7%). There were times when the gap narrowed to just over 1 million VND per tael (around 1-2%) at the beginning of 2025. However, by April 23, the difference between domestic SJC gold bar prices and global prices had widened to 14.48 million VND per tael (13.62%).

According to the SBV Governor, the primary reason for the faster increase in domestic SJC gold bar prices compared to global prices, and the widening gap since the beginning of April 2025, is mainly due to market psychology and expectations of further increases in global gold prices amid the Trump administration’s trade policies, which are expected to negatively affect the global economy; the unpredictable monetary policy path of the Fed; and escalating geopolitical tensions worldwide…

Another factor is the lack of additional gold bar supply in the market since the beginning of 2025. As the foreign exchange and gold markets have been relatively stable, the SBV has not had to intervene in the market so far this year.

“In addition to the above reasons, it cannot be ruled out that some businesses and individuals have taken advantage of market fluctuations to engage in speculation, price manipulation, and profiteering,” the SBV Governor’s report stated.

Despite the surge in domestic gold prices, these fluctuations have not yet affected monetary policy management and macroeconomic stability. The SBV will continue to closely monitor domestic and international gold market developments, coordinate with relevant agencies to enhance management, and take measures to stabilize the gold market within its authority.

Moving forward, the SBV will expeditiously develop a decree amending and supplementing a number of articles of Decree No. 24/2012/ND-CP through an abbreviated procedure.

The SBV will also coordinate with relevant ministries and sectors (Ministry of Public Security, Ministry of Industry and Trade, Ministry of Finance, etc.) to strengthen inspections of gold business activities, gold bar distribution shops and agents, and other participants in the gold market.

The Golden Crash: When World Gold Prices Plummet and Bitcoin, Stocks Soar.

The gold price took a significant dip following US President Donald Trump’s announcement of a trade deal with the UK, sparking hopes of similar breakthroughs with other nations. Global stock markets, cryptocurrencies, and oil prices rebounded, indicating a shift towards a more positive investor sentiment.

“Gold Prices Surge as the Dollar Weakens: SPDR Gold Trust Sells Over 6 Tons of Gold This Week”

Global gold prices rose on Friday, May 9, trading above the $3,300/oz mark after a brief dip below this level earlier in the session.