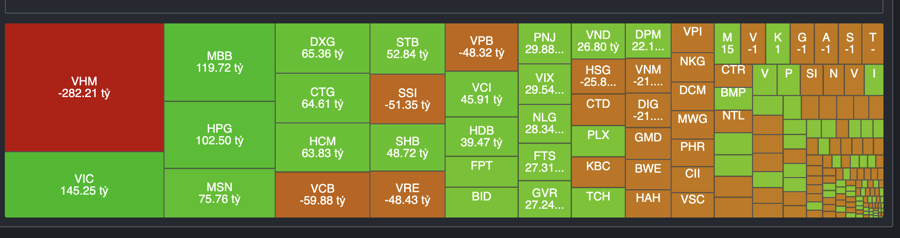

The VN-Index continued its upward trajectory, albeit modestly, during the morning session. However, the market unexpectedly surged in the afternoon, leaving investors puzzled and surprised. At the closing bell, the index had gained 19.43 points, corresponding to a 1.55% increase, reaching a level of 1,269.80. The market breadth was overwhelmingly positive, with 230 gainers dominating over 92 losers.

Real estate stocks have been consistently leading the market rally from one session to the next. Notably, VIC, on the back of news about Vinpearl’s upcoming listing of 1.8 billion shares at a debut price of 71,300 VND per share, surged to its daily limit-up with a buying queue of 1.25 million shares. Apart from VIC, other stocks in the sector, including VRE, VHM, KDH, and DXG, posted modest gains. Meanwhile, industrial real estate stocks witnessed a strong bounce, with BCM and KBC rising 5.08% and 1.03%, respectively, amid ongoing tariff negotiations.

Securities stocks also witnessed robust gains across multiple tickers, such as VND, HCM, VIX, FTS, DSE, and BSI. Sectors that were previously impacted by high retaliatory tariffs imposed by the US, such as exports and transportation, showed signs of recovery amid expectations of a tariff reduction to 20-28%, as reported by Reuter. However, the magnitude of their gains was not significant. The market’s upward momentum was primarily driven by a few key pillars, including VIC and GVR, both of which hit their daily limit-ups.

Most other sectors followed suit, resulting in a broad-based market advance. However, investors’ portfolios did not reflect a corresponding increase. Apart from the aforementioned stocks, FPT, BID, TCB, MSN, and BCM also made positive contributions to the market’s performance today. While the banking sector witnessed a mild uptick, it displayed a high level of consensus, with no stocks in the red.

On a positive note, institutional investors have started to participate more actively, with total matched transactions across the three exchanges reaching 20,500 billion VND. Foreign investors net bought 246 billion VND worth of shares, primarily accumulating VIC, MBB, HPG, MSN, DXG, CTG, and HCM, while offloading VHM.

Proprietary trading arms of securities firms net sold 275 billion VND worth of shares, offloading MWG, CII, TCB, MBB, STB, PLX, and HPG. Conversely, they net bought HSG, GAS, HDB, VND, and PNJ.

Will Foreigners Return to Strong Net Buying in the Last 6 Months?

With expectations of progress in the Vietnam-US trade negotiations and the prospect of an upgraded stock market status, there is optimism that foreign investors will return to net buying on Vietnam’s stock market in the latter half of the year.

Stock Market Insights: Chasing the ‘Odd-Lot’ Money Trail

Today’s trading session witnessed a slowdown with declining liquidity and a preponderance of stocks in the red. The exuberant upward momentum observed yesterday was confined to a select few stocks, notably FPT and LPB. However, their capacity to spearhead a broader market rally is questionable, particularly as other leading stocks also exhibit signs of weakness.

What Was F88’s Business Model Before Going Public?

“F88, a familiar name in the industry, has officially become a public company and is preparing for its UPCoM listing. This significant move has sparked questions among investors and market observers alike: Is F88 truly ready for the stock market? With its transition into the public eye, F88 enters a new phase, inviting scrutiny and high expectations.”

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)