The VN-Index struggled to maintain its high position this morning as blue-chip stocks continued to diverge and weaken. Of the top 10 largest market cap stocks, only 5 saw gains, fortunately including VIC and GAS. Turnover decreased by 10% compared to yesterday morning, with a balanced market breadth confirming the tug-of-war between buyers and sellers. A bright spot was foreign investors, who unexpectedly bought a net of 367 billion VND after 16 consecutive mornings of net selling.

Concerns about VIC and VHM have not yet turned negative. VIC continued to test its August 2023 high this morning, rising another 2.13%, while VHM gained 0.82%. GAS surged 13.4% to its highest level in 20 sessions. These three stocks alone contributed more than 2.3 points to the VN-Index, while the index’s total gain was 3.62 points (+0.29%).

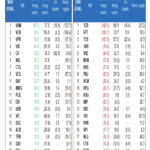

The VN30 blue-chip stocks were not particularly strong. The representative index of this basket fluctuated between green and red from around 10:45 am. The morning session closed with a negligible gain of 0.05%, with 14 gainers and 12 losers. Excluding VIC and GAS, the remaining gainers in the basket were mid-cap stocks: BVH rose 2.63%, BCM increased by 2.5%, GVR climbed 1.85%, and LPB rose 1.26%.

Except for SSB and VIB, the rest of the VN30 basket witnessed price declines to a certain extent compared to their peaks. The VN30-Index and VN-Index reached their highest levels around 9:50 am, after which they weakened. 9 stocks in this group fell by more than 1% from their highs. Even strong performers like GVR gave back around 1.45%, while GAS lost 1.79%. Turnover in this basket decreased by 15% compared to yesterday morning, reaching only 3,653 billion VND in matching value, indicating that the buying force was not strong enough.

The impact of the large-cap stocks was quite evident, as even when the VN-Index was at its strongest, the market breadth was only 175 gainers to 84 losers. At the end of the morning session, the HoSE had 147 gainers and 146 losers, with the majority fluctuating slightly. Specifically, among the gainers, only 73 stocks rose more than 1%, accounting for 34.9% of the total turnover on the exchange. On the losing side, 71 stocks fell by more than 1%, accounting for 16.3%.

In terms of sentiment, the declining stocks did not exhibit much strength, and there were no significant forced selling. The stocks that fell the most had insignificant turnover; the largest decliners in terms of turnover were TDH, which fell 5.73%, CCC dropping 5.7%, and DCL declining 3.16%, with a turnover of less than 10 billion VND each. The remaining stocks in the red with higher turnover included MWG, down 1.98% with a turnover of 241.5 billion VND; SSI, falling 1.3% with 232.5 billion VND; VCI, decreasing by 1.22% with a turnover of 175.5 billion VND; DGC, down 1.39% with a turnover of 66.2 billion VND; and GMD, falling 1.13% with a turnover of 52.3 billion VND… In fact, out of the 71 stocks that fell by more than 1%, only 14 had a turnover of over 10 billion VND.

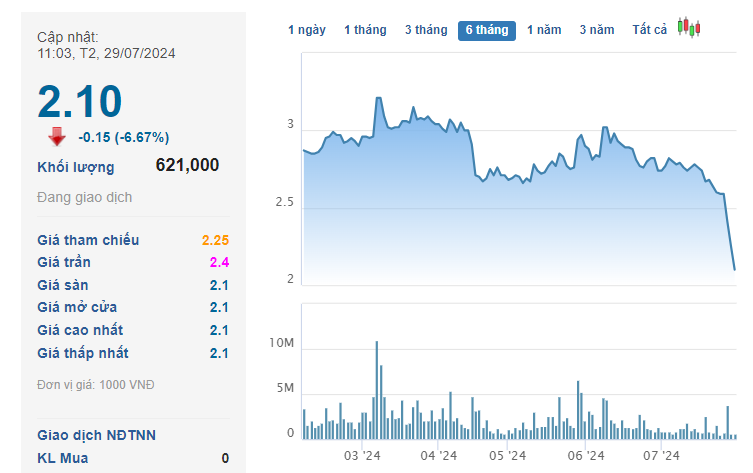

The most notable price movement this morning was the sliding range: About 42.2% of the stocks that traded in the VN-Index lost 1% or more compared to their intraday highs. The market is facing short-term profit-taking pressure at higher price levels, and the extent of the price decline reflects this pressure.

On the upside, although many stocks remained significantly above the reference price, they failed to maintain their strongest levels. For example, among the 73 best-performing stocks on the HoSE, 10 stocks had a turnover of over 100 billion VND, most of which fell by at least 1% from their peaks. NVL, the stock with the highest turnover in this group, traded 378.3 billion VND, with its price rising as much as 6.53% at one point but closing only 2.86% higher. POW, with a very high turnover of 248.5 billion VND, saw its price slip by about 1.15%, still a 5.74% gain compared to the reference price. KBC, DXG, and PDR followed a similar pattern, with their strength limited to a certain extent.

Foreign investors were another bright spot this morning as they turned net buyers, purchasing nearly 367 billion VND worth of stocks. Their buying force increased significantly, rising by 38% compared to yesterday morning and reaching 1,194.7 billion VND. This was the only morning session in the last 11 sessions where net buying exceeded one trillion VND. The stocks that were net bought were GEX (+74.6 billion VND), NVL (+48.8 billion VND), NLG (+45.7 billion VND), KDH (+36.8 billion VND), POW (+36.5 billion VND), DXG (+32.2 billion VND), HVN (+31.5 billion VND), and STB (+30.3 billion VND). On the net selling side, SSI (-28.8 billion VND), VRE (-23.9 billion VND), and VTP (-21.3 billion VND) saw outflows.

The Ho Chi Minh Stock Exchange witnessed another day of net foreign buying, with VIC shares being the most accumulated.

The markets are buzzing with activity as intraday trading volume reaches a whopping 20.5 trillion VND. Foreign investors showed a keen interest, with a net buy of 246 billion VND, primarily accumulating VIC, MBB, HPG, MSN, DXG, CTG, and HCM stocks, while offloading VHM.

The Market Wary of Tariff Talks: Foreign Investors Turn Net Sellers

This morning, the market witnessed a significant cautious sentiment as preliminary and unofficial news regarding the first meeting on tariff issues was circulated. Despite an impressive surge in VIC, the second-largest market cap stock, the VN-Index fluctuated and posted a modest gain amid declining liquidity and a strong net sell-off by foreign investors.

The Big Money Rush: Stocks Soar as VN-Index Recovers from Tariff Trauma

The lethargic morning trading pace took an unexpected turn within the first 15 minutes of the afternoon session. Leading stocks, notably FPT, witnessed a dramatic surge in volume, swiftly triggering a frenzied buying spree. HoSE’s afternoon matching volume skyrocketed by 66% compared to the morning session, with the VN-Index closing at its strongest gain in 16 sessions.

Will Foreigners Return to Strong Net Buying in the Last 6 Months?

With expectations of progress in the Vietnam-US trade negotiations and the prospect of an upgraded stock market status, there is optimism that foreign investors will return to net buying on Vietnam’s stock market in the latter half of the year.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)