Preliminary and unofficial content from this morning’s first session on tariff issues spread, causing significant market caution. Despite the second-largest market cap stock, VIC, posting impressive gains, the VN-Index fluctuated and rose marginally amid declining liquidity and strong foreign net selling.

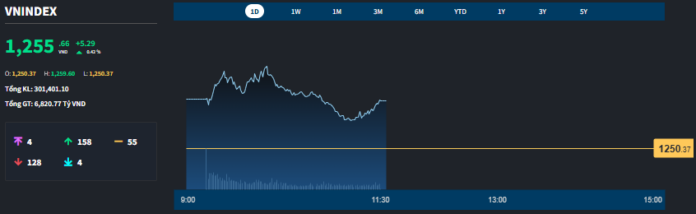

The VN-Index performed well in the first half of the session, peaking at around 10 a.m., up 9.23 points from the reference level. However, it then slid and closed just 5.29 points higher, equivalent to a 0.42% increase. The breadth of the index at its peak showed 187 gainers and 85 losers, and at the close, there were 158 gainers and 128 losers.

Matching volume on the HoSE also decreased by about 5% compared to yesterday morning, reaching VND 6,826.7 billion. Including the HNX, transactions decreased by more than 4%, reaching VND 7,297.4 billion. Compared to the week before the April 30 holiday, the morning’s liquidity was still relatively low (approximately VND 8,879 billion per session).

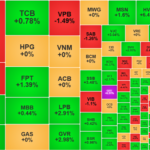

Nevertheless, the market still witnessed well-performing stocks with vibrant trading. These were more individual cases rather than a broad trend. Among the blue-chips, VIC stood out with a booming morning session, surging 5.04% with leading liquidity of VND 299.2 billion. This was VIC’s second consecutive strong gain, following yesterday’s 4.11% rise, and it marked an almost continuous eight-session upward trend that pushed the stock price to its highest level since June 2022, surpassing the April 2025 and August 2023 peaks.

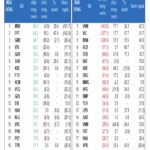

VIC was also one of the few blue-chips actively bought by foreign investors this morning, accounting for approximately 37.4% of the total matched volume and net value, equivalent to VND 91 billion. The VN30 basket, in general, remained range-bound, with its representative index edging up 0.39%, including 14 gainers and 12 losers. In addition to VIC, GVR rose 6.44%, BCM 2.63%, LPB 2.48%, and PLX 1.19%, but these stocks are relatively small in terms of market cap.

On the downside, there weren’t many blue-chips that witnessed significant selling pressure. MWG performed the weakest, falling 1.66%, followed by VJC with a 1.24% loss, and BVH, which declined by 1.12%. In the top 10 market caps of the VN-Index, there were only three gainers and four losers. GAS and MBB were the other two gainers, but their advances were modest, and none of the losers declined by more than 1%, with FPT posting the most considerable loss of 0.64%.

Expanding to the entire HoSE, the breadth was slightly better on the upside, but there weren’t many outstanding performers. Exactly 70 stocks rose more than 1%, mostly comprising mid-cap stocks. The most notable was HHS, which hit the daily limit-up with a liquidity of approximately VND 166.5 billion. TCH, EVF, NLG, BSR, SZC, DPM, TCM, PHR, and SBT were also relatively prominent in terms of matching volume compared to the rest. The combined liquidity of these 70 stocks accounted for only 23.3% of the total HoSE transactions.

Stocks that declined with high liquidity included MWG and NVL, both trading in the hundreds of billions of VND. MWG fell 1.66% under considerable pressure from foreign investors, whose selling volume accounted for nearly 30% of the total, equivalent to a net sell of VND 61.8 billion. NVL dropped 1.98%, mainly driven by domestic investors. Out of the 128 losers in the VN-Index, only 58 stocks declined by more than 1%, accounting for 13.6% of the HoSE’s total liquidity.

In essence, the market rose but remained predominantly range-bound. VIC’s influence is evident, and as long as the other pillars do not fluctuate significantly, VIC alone can push the VN-Index higher. In reality, most blue-chips in the VN30 basket faced certain pressure this morning, and their prices slipped slightly from the day’s highs. VIC also retreated by about 0.52% from its peak. Others like FPT, LPB, MWG, SHB, SSI, and VCB faced more evident pressure, all losing over 1% and some even reversing into negative territory.

Foreign investors, after an enthusiastic net buying session yesterday, returned to net selling. Buying volume on the HoSE this morning decreased by 28% compared to yesterday morning, reaching VND 855 billion. Net selling value stood at VND 475.4 billion, while net buying was VND 366.9 billion yesterday. On the net selling side, in addition to MWG, there were VHM (-VND 128 billion), FPT (-VND 91.1 billion), SSI (-VND 58.9 billion), VPB (-VND 45.6 billion), and VRE (-VND 32.5 billion). On the net buying side, besides VIC, there were MBB (VND 30.6 billion), HPG (VND 26.8 billion), DXG (VND 25.3 billion), and GVR (VND 22 billion).

“Stocks Slide as Selling Pressure Weakens, Blue-chips Rebound Ahead of Derivatives Expiry”

The market witnessed a positive shift in the afternoon session as selling pressure eased. Prices gradually climbed, especially after 2:15 pm when the VN30-Index calculations started influencing the final settlement prices. A steady ascent of blue-chip stocks propelled the VN-Index and VN30-Index to surpass the reference levels and close at their highest points for the day.

The Ultimate Guide to VIX’s Ambitious Plans: Targeting Billion-Dollar Profits with a Massive Share Offering of 73 Million.

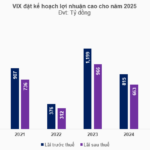

The upcoming 2025 Annual General Meeting of VIX Securities Joint Stock Company (HOSE: VIX) is set to take place on the morning of May 23, 2025, with a packed agenda. Notably, the company plans to present its ambitious pre-tax profit target of VND 1,500 billion and a post-tax profit of VND 1,200 billion. Additionally, they will propose the issuance of nearly 73 million shares as dividends for the year 2024 and seek approval for changes to the board of directors, including the exemption and election of a new member.

Trade Tax Talks Begin, Markets Await News With Bated Breath

The Vietnamese market cautiously welcomed the news of Vietnam initiating negotiations with the US on the evening of April 23rd. While it was expected that this would happen and the “scheduling” is a positive step, the market is essentially waiting for results. The balanced tug-of-war between buyers and sellers, coupled with a significant drop in liquidity, indicates that both sides are mostly observing for now.

The Great Sell-Off: Foreigners Dump Real Estate Stocks en Masse

Individual investors sold a net amount of 516.1 billion VND, including 541.1 billion VND in matched orders. The top stocks sold were VHM, VIC, MSN, ACB, STB, BAF, DXG, MWG, and HPG.

“The Super Pillar” Returns: VN-Index Surges Past 1220 Points as Foreign Investors Turn Net Buyers

The morning’s trading conundrum continued for a few minutes into the afternoon session, culminating in an explosive surge. VIC and VHM, the prominent large-cap stocks, led the charge, propelling a host of other blue-chips to significant gains. The VN-Index closed above the crucial 1220-point mark, as foreign investors also unexpectedly ramped up their buying activity.