The market took a significant dip during the weekend session, losing the previous day’s enthusiasm after it was confirmed that preliminary information about tariff negotiation talks circulated yesterday was inaccurate.

Another contributing factor was the notable decline in momentum from leading stocks. VIC, after a few minutes of strong trading and gains at the open, fell sharply for the rest of the day, closing 2.55% lower than the reference price. VHM also traded sideways for the second consecutive session, while VCB and BID dropped 0.88% and 0.99%, respectively.

Among the ten largest stocks by market capitalization, only two ended in the green: TCB, up 0.73%, and FPT, up 1.49%. Another non-pillar stock, LBP, posted an impressive 4.39% gain, contributing over one point to the VN-Index.

The HoSE floor ended with a clear bias towards decliners, as 173 stocks closed in the red against 130 gainers. Within the VN30 group, only eight stocks managed to eke out gains, with decliners doubling that number. Following yesterday’s burst in liquidity, the market witnessed a retreat in trading volume today, with total trading value on the three exchanges falling 11% to VND 18,393 billion.

Real estate stocks, which had attracted cash flow and risen sharply in recent sessions, reversed course today, with many names in the sector posting substantial losses on high turnover. In addition to VIC, NVL, TCH, VCG, and KBC also witnessed sharp declines, each recording turnover of over VND 100 billion. The financial sector fared no better, with only 11 out of 27 bank stocks closing higher, mostly small-cap names like VAB, LPB, KLB, and NVB, while the large-cap banks were mostly weaker and mostly lower.

Foreign investors sold a net VND 92.9 billion, with a net sell of VND 89.4 billion in matched orders. Their net buys in the matched orders were focused on Basic Resources and Information Technology. The top net bought stocks in the matched orders by foreign investors included FPT, MBB, HPG, PNJ, DXG, MSN, NLG, VIX, CTR, and LPB.

On the sell side, their net sells in the matched orders were focused on the Banking sector. The top net sold stocks in the matched orders by foreign investors included VCB, VHM, NVL, VCG, SSI, VCI, VNM, STB, and PDR.

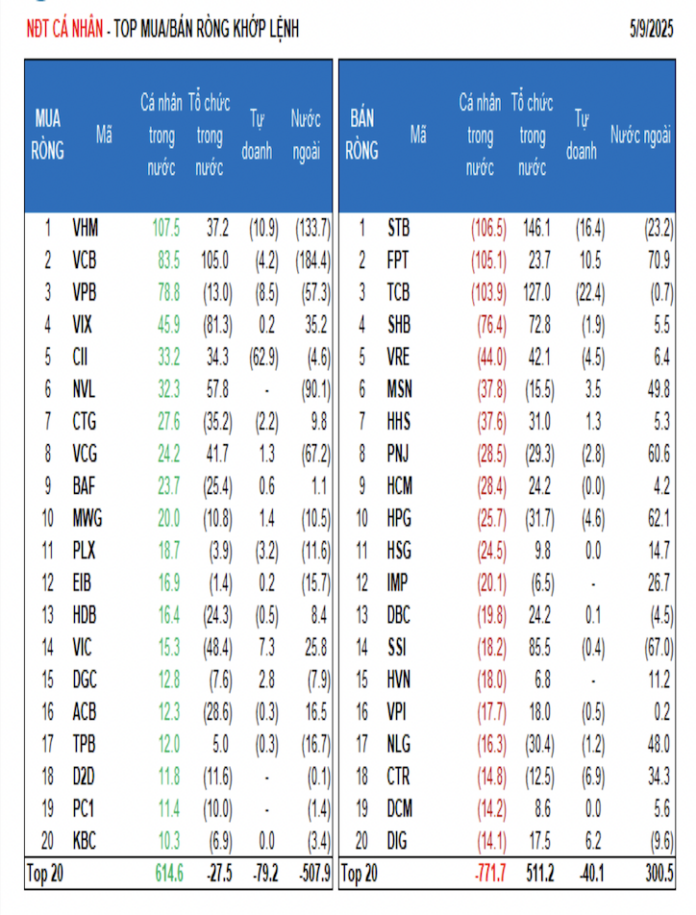

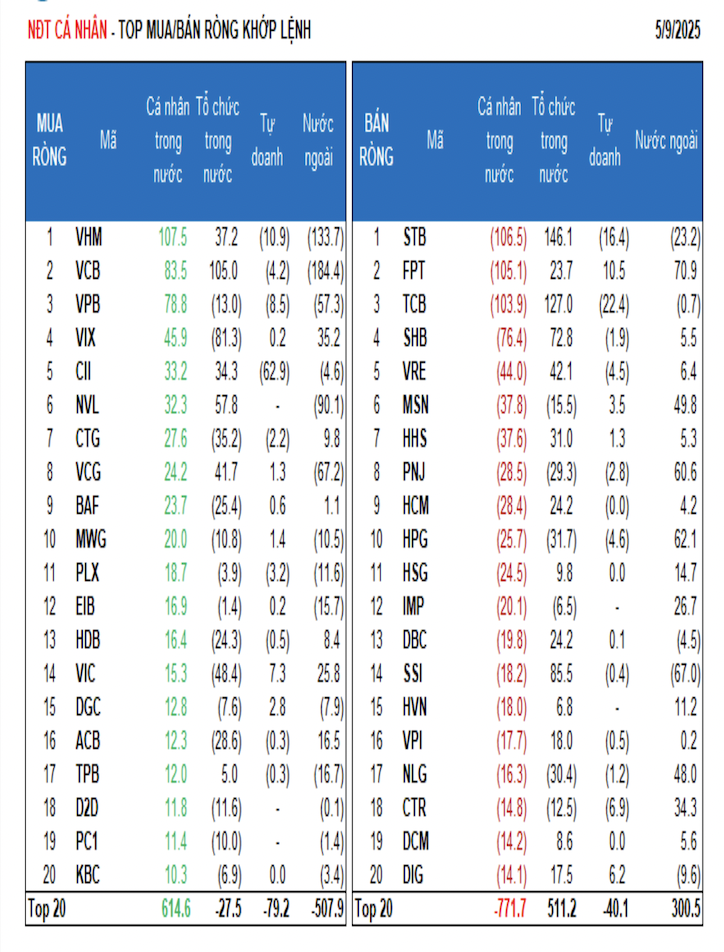

Individual investors sold a net VND 117.3 billion, including a net sell of VND 110.3 billion in matched orders. In terms of matched orders, they were net buyers in 8 out of 18 sectors, mainly in the Real Estate sector. Their top net bought stocks included VHM, VCB, VPB, VIX, CII, NVL, CTG, VCG, BAF, and MWG.

On the net sell side in matched orders, they net sold 10 out of 18 sectors, mainly in the Information Technology and Basic Resources sectors. The top net sold stocks included STB, FPT, TCB, SHB, VRE, MSN, PNJ, HCM, and HPG.

Proprietary trading arms of securities firms were net sellers to the tune of VND 194.7 billion, including a net sell of VND 181.5 billion in matched orders. In terms of matched orders, they were net buyers in 4 out of 18 sectors. The top net bought stocks by proprietary trading arms in today’s session included FUEKIV30, FPT, FUEVFVND, VIC, DIG, MSN, DGC, TCH, PDR, and E1VFVN30. On the sell side, they net sold the Banking sector. The top net sold stocks included ClI, MBB, TCB, STB, VHM, VNM, VCI, VPB, BID, and CTR.

Domestic institutions bought a net VND 401.6 billion, including a net buy of VND 381.2 billion in matched orders. In terms of matched orders, domestic institutions were net sellers in 10 out of 18 sectors, with the largest net sells in the Personal & Household Goods sector. Their top net sold stocks included VIX, DXG, VIC, MBB, FUEKIV30, CTG, HPG, VND, NLG, and PNJ. On the buy side, they net bought the Banking sector. The top net bought stocks included STB, TCB, VCB, SSI, SHB, NVL, VNM, VRE, VCG, and VHM.

Block deals today totaled VND 1,574.1 billion, up 52.2% from the previous session and accounting for 8.4% of the day’s total trading value. Notable block deals included a transaction of over 9.2 million ACB shares worth VND 224.5 billion between foreign institutions. There were also block deals among domestic institutions in the Banking sector (HDB, STB, TCB, SHB), as well as in SBT, NBB, and MWG.

In terms of matched orders, large-cap VN30 stocks saw their cash flow allocation decrease, while mid-cap VNMID and small-cap VNSML stocks attracted more cash flow.

The Ho Chi Minh Stock Exchange witnessed another day of net foreign buying, with VIC shares being the most accumulated.

The markets are buzzing with activity as intraday trading volume reaches a whopping 20.5 trillion VND. Foreign investors showed a keen interest, with a net buy of 246 billion VND, primarily accumulating VIC, MBB, HPG, MSN, DXG, CTG, and HCM stocks, while offloading VHM.

Stock Market Insights: Chasing the ‘Odd-Lot’ Money Trail

Today’s trading session witnessed a slowdown with declining liquidity and a preponderance of stocks in the red. The exuberant upward momentum observed yesterday was confined to a select few stocks, notably FPT and LPB. However, their capacity to spearhead a broader market rally is questionable, particularly as other leading stocks also exhibit signs of weakness.

“Billions for Boats: Âu Lạc’s Bold Maritime Move”

Eu Lac Joint Stock Company (OTC: ALC), a leading marine petroleum and chemical transportation company chaired by entrepreneur Ngo Thu Thuy, has gained shareholder approval for its ambitious plan to invest in a new fleet of tanker vessels for the 2025-2030 period.