The market’s momentum continued into today’s trading session, with the index showing some signs of weakness but quickly rebounding thanks to the strong performance of penny and mid-cap stocks. The VN-Index closed up nearly five points, approaching the 1,269 mark with a positive breadth of 270 gainers versus 187 losers.

The most impressive sector during today’s trading was transportation, ports, and logistics. A slew of stocks in this sector surged, including MVN, which rose 9.1%, PHP up 7.9%, SGP gaining 7.06%, HAH climbing 4.83%, a 2.52% increase for VTP, SGN up 6.35%, and VOS also rising 2.52%. This sector is expected to benefit from the new US President Donald Trump’s 10% tariff on Chinese goods, as manufacturers may consider relocating to Vietnam to avoid negative consequences. As a result, the ports and logistics sector is poised to reap the rewards.

The telecommunications and information technology sectors are recovering from the DeepSeek-induced slump. Many stocks in these sectors, including FPT, CMG, VGI, and CTR, have been on an upward trajectory since yesterday. Basic materials also witnessed robust growth, particularly in state-owned enterprises, with KSV surging to its daily limit, and fertilizers and chemicals posting modest gains.

Money is flowing into mid and small-cap stocks, while the banking and real estate sectors recorded more modest gains of 0.44% and 0.78%, respectively. On the other hand, financial services, mainly securities, witnessed a slight decline of 0.4% after a robust performance in the previous session.

Total trading volume across the three exchanges reached nearly VND 15,000 billion. A positive sign was the slowdown in foreign selling, with net selling value at VND 412.3 billion, and matched transactions at VND 364.2 billion.

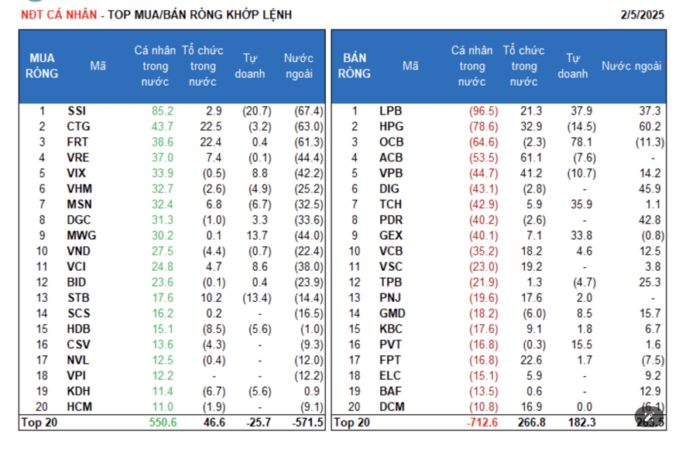

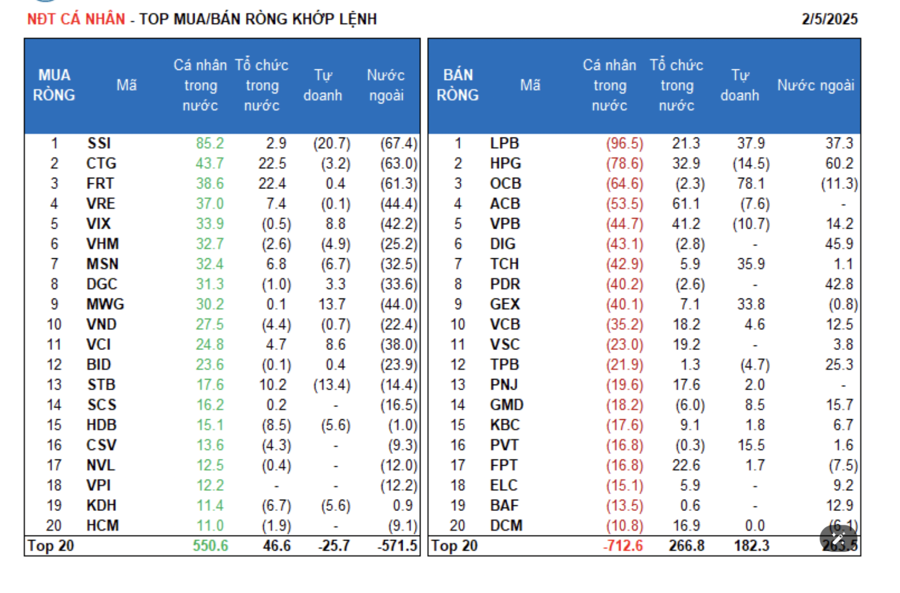

Foreign investors’ main net buying on the matched transactions was focused on Basic Resources, Goods & Industrial Services. The top net bought stocks by foreigners included HPG, DIG, PDR, LPB, TPB, GAS, GMD, VPB, BAF, and VCB.

On the selling side, financial services dominated the net selling on the matched transactions. The top net sold stocks by foreigners were SSI, CTG, FRT, VRE, MWG, VCI, DGC, MSN, and VHM.

Individual investors net sold VND 221.7 billion, including VND 116.8 billion in net selling on the matched transactions. On the matched transactions, they net bought 9 out of 18 sectors, mainly in the Financial Services sector. The top net bought stocks by individual investors included SSI, CTG, FRT, VRE, VIX, VHM, MSN, DGC, MWG, and VND.

On the net selling side of the matched transactions, they net sold 9 out of 18 sectors, mainly in the Banking and Goods & Industrial Services sectors. The top net sold stocks included LPB, HPG, OCB, ACB, VPB, DIG, PDR, GEX, and VCB.

Proprietary trading accounted for a net buy of VND 319.6 billion, with a net buy of VND 107.7 billion on the matched transactions.

On the matched transactions, proprietary trading net bought 10 out of 18 sectors, with the strongest being Banking and Goods & Industrial Services. The top net bought stocks included OCB, LPB, TCH, GEX, PVT, MWG, VIX, VCI, GMD, and CSM. The top net sold stocks were in the Oil & Gas sector, including SSI, PVD, VCG, HPG, STB, VPB, ACB, DPM, MBB, and SBT.

Local institutional investors net bought VND 267.3 billion, with a net buy of VND 373.3 billion on the matched transactions.

On the matched transactions, local institutions net sold 4 out of 18 sectors, with the largest value being in the Power, Water & Gas sector. The top net sold stocks included HDB, KDH, GAS, GMD, PLX, PC1, VND, VNM, CSV, and GEE. The largest net bought sector was Banking. The top net bought stocks included ACB, VPB, HPG, FPT, CTG, FRT, LPB, VSC, VCB, and PNJ.

Today’s negotiated trading value reached VND 1,485.7 billion, a decrease of 36.5% from the previous session, contributing 10.0% to the total trading value.

Notably, there was a significant transaction in MBB, with domestic proprietary trading buying 18.9 million units worth VND 425.3 billion from other stakeholders (individual investors, local institutions, and foreign institutions).

Additionally, local institutions and individual investors negotiated the purchase of more than 6 million GEE shares (valued at VND 229.3 billion) from domestic proprietary trading. Individual investors continued to focus on the Banking sector (MSB, HDB), large-cap stocks (MWG, VJC, HPG, VNM, MSN), and DIG.

The money flow allocation increased in Real Estate, Retail, Oil Equipment & Services, Software & Services, Warehousing, Logistics & Distribution, and Textiles & Apparel, while decreasing in Banking, Securities, Construction, Steel, Agriculture, Food, and Mining.

On the matched transactions, the money flow allocation increased in the mid and small-cap stocks (VNMID and VNSML) while decreasing in the large-cap stocks (VN30).

The Foreigners’ Sell-Off: Unraveling the Nearly 500 Billion Dong en-masse Sell-Off and the Stocks in the Eye of the Storm

The banking stock SHB witnessed a substantial net buying spree of 108 billion VND, with VCI also experiencing robust net buying of 65 billion VND.