According to preliminary statistics from the General Department of Vietnam Customs, the country’s plastic imports in April 2025 reached approximately 800,576 tons, with a value of nearly $1.06 billion. This marks a decrease of 2.5% in volume and a 2.3% decline in trade value compared to the previous month.

Cumulative imports of plastic raw materials for the first four months of 2025 totaled 3.08 million tons, with a value of $4.09 billion. This represents a 24.1% increase in volume and a 19.4% rise in trade value compared to the same period in 2024.

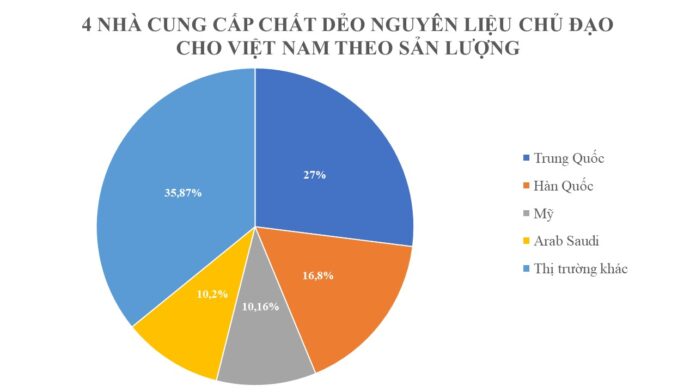

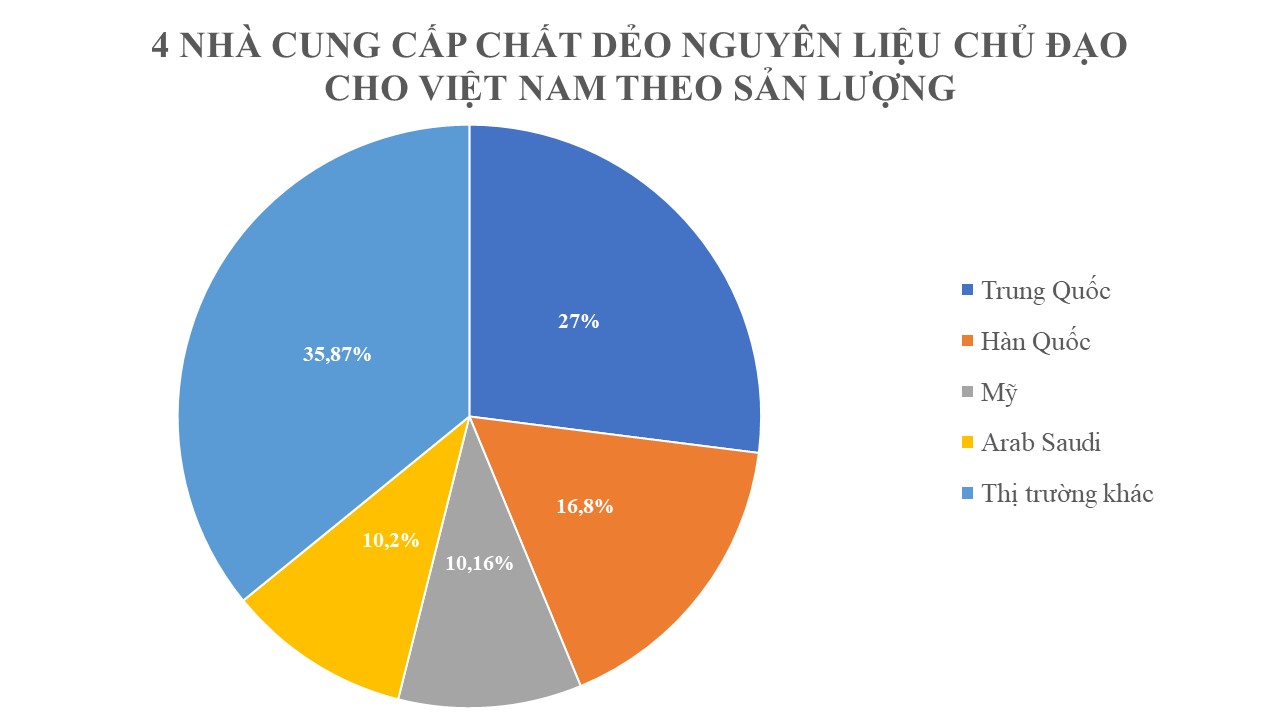

China remained the largest supplier of plastic raw materials to Vietnam, accounting for 27% market share. Imports from China totaled 833,506 tons, equivalent to $1.18 billion, reflecting a significant increase of 39.6% in volume and 38.5% in value compared to the first four months of 2024. The average price stood at $1,419 per ton, a slight decrease of 0.8% from the same period last year.

South Korea was the second-largest supplier, with 517,743 tons of plastic raw materials worth $727.49 million. This indicates a substantial increase of 31.9% in volume and 33.4% in trade value compared to the corresponding period in 2024. The average price was $1,404 per ton, a 1% rise in price compared to the first four months of the previous year.

Saudi Arabia secured the third position, contributing 314,831 tons of plastic raw materials, valued at $322.71 million. This represents an increase of 28.7% in volume and 29.1% in trade value. The average price was $1,025 per ton, a marginal increase of 0.39% from the first quarter of 2024.

Notably, the United States has also significantly increased its exports of plastic raw materials to Vietnam. During the same period, imports from the US reached 313,756 tons, valued at $346.12 million, reflecting a substantial increase of 41.13% in volume and 40.67% in trade value compared to 2024. The average price stood at $1,103 per ton, a slight decrease of 0.27%.

Plastic, also known as polymer, is a crucial raw material used in manufacturing a wide range of products that cater to human needs and support various economic sectors such as electricity, electronics, telecommunications, transportation, fisheries, and agriculture. Importing affordable plastic raw materials enables Vietnamese businesses to reduce production costs, enhance their competitiveness, and expand their export markets.

Vietnam is capable of producing various raw materials such as PVC, PP, PET, PS, and PE, with a total capacity of nearly 3 million tons per year. Domestic raw material sources can meet 30% of the domestic market demand, while the remaining 70% is imported from countries like Saudi Arabia, South Korea, Thailand, Japan, the United States, China, Taiwan, Malaysia, and Singapore.

The United States is a significant supplier of plastic raw materials to Vietnam, especially for polyethylene (PE) and polypropylene (PP). As there is no bilateral free trade agreement between Vietnam and the US, imports from the US are typically subject to preferential import tax rates. Consequently, the import tax rate for plastics such as Polyethylene (PE), Polypropylene (PP), Polystyrene (PS), and Polyvinyl Chloride (PVC) is approximately 5% for products originating from the United States.

Vietnamese plastic products are now exported to over 160 countries worldwide, including demanding markets such as the US, Japan, Australia, and European countries like Germany, France, the UK, Italy, the Netherlands, and Spain. The Vietnamese plastics industry comprises nearly 4,000 enterprises, 90% of which are small and medium-sized businesses, mainly concentrated in the southern region of the country.

Unlocking Export Potential: A Strategic Approach to Tapping into the US Market

The government and its ministries are taking a firm stand against the potential 46% retaliatory tariffs. They are actively engaging in consultations and negotiations with the United States to find common ground and resolve the issue.