Minister of Finance Nguyen Van Thang Clarifies Issues Related to the Special Consumption Tax Law Amendment

Minister of Finance Nguyen Van Thang provided clarification on issues raised by National Assembly delegates regarding the draft Law on Special Consumption Tax (amended), pertaining to taxation on gasoline. The minister stated that special consumption tax on gasoline has been in effect since 1998.

According to the minister, the Prime Minister committed at the COP 26 conference to the goal of net-zero emissions by 2050. Minister Nguyen Van Thang emphasized that this is a challenging commitment for Vietnam. Currently, European countries are taking strong measures to reduce emissions.

The Minister of Finance affirmed that with Vietnam’s commitment to net-zero emissions by 2050, it is imperative to include gasoline among the items subject to special consumption tax.

As per the draft law, this commodity will continue to be on the list of items subject to a special consumption tax of 7-10%.

Minister of Finance Nguyen Van Thang provides clarification on issues related to the Special Consumption Tax Law amendment

“Environmental pollution in Vietnam is increasing, and if we continue to encourage the use of gasoline-powered vehicles without taxation, it will be challenging to change behaviors,” said Minister Nguyen Van Thang. He emphasized the need to promote the use of electric vehicles and metro systems, and that this requires implementing various solutions, including those related to gasoline taxation.

The minister addressed the point made by some delegates that gasoline is currently subject to two types of taxes and fees. He explained that in most large and developed countries, similar taxes and fees are imposed, but they may have different names, such as CO2 fees or taxes.

“While the special consumption tax aims to regulate consumption behavior and increase state revenue, the environmental protection fee focuses on creating funds for environmental projects,” Minister Nguyen Van Thang elaborated.

The minister emphasized that the taxation is consistent with Vietnam’s commitment at COP 26 and the goal of net-zero emissions by 2050. Additionally, the combined amount of these taxes and fees is significantly lower than in other countries, especially in Europe.

Earlier in the discussion, delegate Nguyen Truong Giang (Dak Nong delegation) proposed excluding gasoline from the list of goods subject to special consumption tax.

Mr. Giang argued that the nature of the special consumption tax is to target luxury goods to regulate production and consumption. However, gasoline is an essential commodity for people’s lives and a critical input for many industries, and it is already subject to the environmental protection tax. He questioned the rationale of imposing an additional special consumption tax on gasoline for environmental protection.

Delegate Nguyen Truong Giang (Dak Nong delegation)

Delegate Nguyen Huu Thong (Binh Thuan delegation) agreed that including gasoline among the items subject to special consumption tax could have positive effects, such as encouraging the use of clean energy, reducing greenhouse gas emissions, and regulating gasoline consumption. However, he pointed out that gasoline is an essential input for production, transportation, and daily life, and taxation could increase costs, affecting low-income earners and contributing to inflationary pressure.

Given these considerations, Delegate Nguyen Huu Thong concurred with Delegate Nguyen Truong Giang’s suggestion to exclude gasoline from the special tax. However, if gasoline were to remain subject to the special tax, he recommended a reasonable roadmap to avoid sudden tax increases and corresponding adjustments to other taxes, such as the environmental protection tax and value-added tax, to prevent a double burden on citizens and businesses.

Tax Relief to Prevent Shocks for Businesses

Regarding taxed carbonated soft drinks, Minister Nguyen Van Thang stated that the drafting agency and the verifying agency have accepted the direction of staggering the tax rate, with 8% applied in 2027 and 10% in 2028. The drafting agency will review which items will be subject to the tax from January 1, 2026, and which will be postponed until 2027.

This approach aims to achieve the National Assembly’s goals while preventing shocks for businesses.

According to the minister, the National Technical Regulation on Soft Drinks, issued by the Ministry of Science and Technology, defines soft drinks as ready-to-drink products for quenching thirst, prepared from water and containing sugar, additives, etc.

Based on this definition, items that will not be subject to special consumption tax include milk and milk products, liquid nutritional products, bottled mineral water, fruit and vegetable juices, and coconut water, among others.

The drafting agency will accept and increase the capacity to above 24,000 BTU and below 90,000 BTU for taxation.

On the taxation of air conditioners, the minister noted that a few countries tax this item to conserve energy and protect the environment, particularly regarding the use of refrigerants. This item was previously subject to the special consumption tax.

In the current draft law, air conditioners with a capacity of over 18,000 BTU to 90,000 BTU are subject to the special consumption tax. During today’s discussion, several delegates proposed increasing the capacity threshold. The drafting agency will accept this suggestion and adjust the capacity range to above 24,000 BTU and below 90,000 BTU for taxation.

The minister also cited the Prime Minister’s directive from 2024, which aims to restrict the production and importation of household air conditioners and air conditioner clusters that use HSC and heating agents that deplete the ozone layer by 2045.

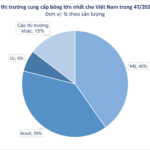

Hundreds of Thousands of Tons of ‘White Gold’ from the US Arrive in Vietnam at Dirt-Cheap Prices: 5% Import Tax, 1.5 Million Tons Annual Consumption

The United States has emerged as Vietnam’s top supplier of [specific product or service], solidifying its position as a leading trade partner. With a strong presence in the Vietnamese market, American businesses have showcased their expertise and competitiveness in this sector. This development underscores the growing economic ties between the two nations and highlights the potential for further collaboration and mutual growth.

The Truth Behind Vietnam’s Durian Losing its ‘Throne’

Despite being touted as the billion-dollar industry for Vietnamese agriculture, durian exports have only achieved 20% of the target since the beginning of the year. This situation not only impacts the overall goals of the industry but also leads to a significant dip in the domestic market value of durians.

The Independent Director’s Resignation from Phu Tai’s Board: A Scandal Unveiled

The Ho Chi Minh City Stock Exchange-listed Phu Tai JSC (HOSE: PTB) has received the resignation of Mr. Do Xuan Lap, an independent member of the Board of Directors. Prior to his resignation, Mr. Lap was arrested and detained for four months in connection with an illegal gambling operation in Ho Chi Minh City.

What Was F88’s Business Model Before Going Public?

“F88, a familiar name in the industry, has officially become a public company and is preparing for its UPCoM listing. This significant move has sparked questions among investors and market observers alike: Is F88 truly ready for the stock market? With its transition into the public eye, F88 enters a new phase, inviting scrutiny and high expectations.”