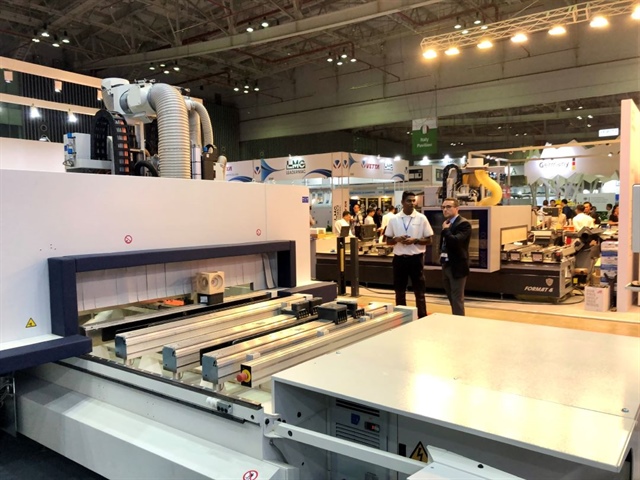

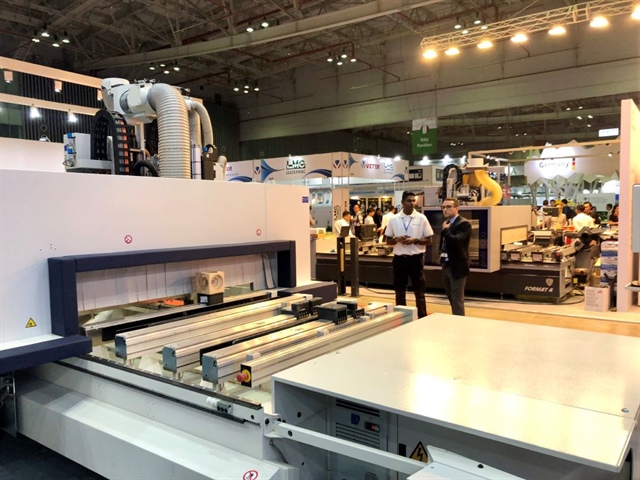

An urgent call to ‘tighten’ product origin to protect Vietnamese goods. Photo: LH |

Responding to the situation of origin fraud

As import markets tighten their regulations on product origin, strengthening state management in inspecting and monitoring product origin is crucial to protect Vietnamese goods.

This will not only encourage exporting enterprises but also enhance Vietnam’s competitiveness in the context of volatile global trade, especially in the face of tariff negotiations with the US.

The increasing acts of fraud and forgery of product origins, especially for products bearing the “Made in Vietnam” label to evade taxes and take advantage of trade preferences, have prompted authorities to implement stricter control measures.

Recently, the Ministry of Industry and Trade issued Directive 09/CT-BCT to strengthen state management in inspecting and monitoring product origin. This move is considered timely, not only in the context of tightening import market rules of origin but also amid escalating trade tensions due to retaliatory tariff policies from the US.

According to economic experts, this will facilitate domestic enterprises in consolidating their production activities and preventing origin fraud, meeting the requirements of major markets such as the US and FTA partners. This proactive step aims to adapt to the new situation and move towards balanced and sustainable trade.

Notably, the Ministry of Industry and Trade has decided to revoke the authority to issue Certificates of Origin (C/O), Certificates of Non-change in Origin Status (CNM), and REX codes from the Vietnam Chamber of Commerce and Industry (VCCI).

Economic experts like Dr. Huynh Thanh Dien assert that international trade is currently complex and unpredictable, especially with the US imposing retaliatory tariffs on various countries, including Vietnam. In the upcoming tariff negotiations, the US will require Vietnam to tightly control product origins before considering tariff reductions.

Moreover, all 17 free trade agreements (FTAs) that Vietnam is implementing require goods to meet rules of origin to benefit from preferential tariffs.

Experts emphasize that certifications like C/O, CNM, and REX codes are considered the “trade passport” of goods, ensuring that products are manufactured in Vietnam and comply with rules of origin under the FTAs. Failing to meet these standards may result in Vietnamese goods being subjected to rigorous scrutiny by foreign partners.

Dr. Dien underscores that VCCI is a social organization rather than a state management agency. Transferring the authority to issue product origin certifications to the Ministry of Industry and Trade strengthens state management in inspecting and verifying product origins. This move is necessary to counter increasingly sophisticated origin fraud in the volatile global trade environment. It helps mitigate risks associated with origin fraud.

While there are concerns about more complex and time-consuming procedures for enterprises, Dr. Dien believes that with today’s digital advancements, businesses will not face significant challenges in complying with the new regulations.

At the same time, this process will enable the state to build a unified database, thereby better managing product traceability. This becomes crucial as international markets tighten rules on product origins.

“While this may cause delays for businesses, tighter control over product origins is necessary to ensure the safety of the textile industry and many other sectors,” said Mr. Pham Xuan Hong, Chairman of the Ho Chi Minh City Textile, Embroidery, Knitting, and Sewing Association (Agtex).

Seeking alternative raw materials to mitigate tax risks

An urgent call to ‘tighten’ product origin to protect Vietnamese goods. Photo: LH |

VCCI’s loss of authority to issue C/O and CNM may create difficulties for enterprises processing goods with raw materials from China. However, representatives from industry associations believe this is a necessary step in the current situation.

In reality, many businesses have proactively invested in transparent product origin traceability. For instance, Hoa Phat Dung Quat Steel was exempt from the EU’s 12.1% anti-dumping tax due to its ability to prove its entirely domestic production process, unrelated to the investigated markets.

In the textile industry, Mr. Pham Van Viet, Vice Chairman of Agtex, emphasized that the US is tightening controls over product origins. Any raw materials originating from China will likely be detected. Therefore, enterprises must seek alternative sources to avoid tax-related risks. VitaJean Company, with 35% of its raw materials from China, is now looking for suppliers from India, Indonesia, Thailand, and domestic sources to reduce risks.

Mr. Song Jae Ho, CEO of Thanh Cong Textile Garment Investment Trading Joint Stock Company (TCM), stated that the US decision aims to exclude products with raw materials from China. His company now produces yarn instead of buying it from China.

In the wood industry, Mr. Nguyen Chanh Phuong advised enterprises to thoroughly prepare for product origin governance, similar to how they prove product origin when exporting to Europe. “Vietnam should negotiate to have a unique model for goods exported to the US, making it easier for businesses to comply,” he said.

“The wood industry has a localization rate of over 50%, and this should not be difficult as domestic wood materials account for nearly 60%,” Mr. Phuong added, suggesting that “the Vietnamese wood industry needs to continue enhancing its competitiveness and using imported wood materials from the US to ensure legality.”

Experts point out that enterprises in the wood, textile, leather, and footwear industries have no choice but to develop strategies to procure raw materials from other countries in the region, excluding China, or to develop them domestically. The demand for transparent product origins is increasingly crucial to take advantage of tariff preferences from FTAs and avoid trade remedy measures.

Governing product origins is not only the responsibility of the state but also the duty of each enterprise. In the context of a volatile global market, a clear and standard understanding of product origins will enable Vietnamese enterprises not just to survive but also to thrive sustainably.

Le Hoang

– 07:00 28/04/2025

The Domestic Market: A Lifeline, Not a Solution to the Timber Industry’s Tariff Troubles

The wood industry representative acknowledged: “Despite being an indispensable support for businesses in the context of volatile global trade, the domestic market is not yet large enough to compensate for export activities.”

Vietnam-Canada: Strengthening Ties, Building Opportunities.

Strengthening cooperation and building strong ties with Canadian provinces such as Saskatchewan is a key strategy to enhance bilateral relations between our nations. With a focus on diverse sectors, we aim to unlock the potential of our countries and bring about a positive change. Saskatchewan, with its vibrant economy and diverse sectors, offers a plethora of opportunities for cooperation and collaboration. By joining forces, we can create a mutually beneficial partnership that will not only strengthen our bond but also bring about a positive impact on our respective communities.