Recognizing the challenges faced by SMEs in terms of access to capital, cost management, process optimization, and the urgent need for digital transformation, a comprehensive solution is offered through the collaboration between VIB’s financial expertise, Visa’s global payment network, and VNPAY’s technological capabilities. This synergy creates an integrated ecosystem that effectively addresses the diverse needs of SMEs.

A Financial Solution to Empower Vietnamese Businesses

Mr. Ho Van Long, Deputy General Director and Director of VIB’s Retail Banking Division, shared: “Deeply understanding the pivotal role of SMEs in Vietnam’s economy and the significant challenges they face in accessing capital and financial management, VIB has designed a comprehensive financial solution to accompany and bring optimal benefits to the SME community. This is an integrated financial product ecosystem, encompassing capital access, cash flow optimization, and digital transformation support, helping businesses save time and costs while enhancing governance and competitiveness for sustainable development in the new era.”

With this solution, VIB introduces a trio of products to meet diverse needs for capital, cost management, and efficient payment solutions for businesses: VIB Business Card credit card, VIB Business Loan for working capital supplementation, and VIB Business digital banking.

The VIB Business Card, integrated with prominent features, serves not just as a payment tool but also as a powerful business management aid. It offers two exceptional benefit options: a lifetime waiver of annual fees with a credit limit of up to VND 1 billion and an industry-leading interest-free period of up to 58 days, or unlimited cash back on all spending. The card also includes convenient features such as direct payment from linked accounts, flexible statement date selection, a minimum payment ratio of 1%-20%, and automatic debit arrangements tailored to business needs. All transactions are recorded and updated in real-time via the VIB Business digital banking app (for SMEs and small businesses) and VIB Corp (for large enterprises), enabling managers to promptly and accurately track expenses on each card issued to their employees. Notably, businesses spending VND 500 million or more annually per card will be entitled to unlimited lounge access and FastTrack for cardholders.

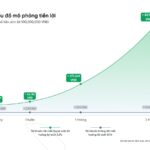

Addressing the need for working capital supplementation, VIB provides diverse financial solutions, notably the working capital loan package with a maximum limit of up to VND 150 billion, competitive interest rates starting from 6.7%/year, and a loan-to-value ratio of up to 90%. This timely and abundant source of capital empowers businesses to seize market expansion opportunities while effectively managing their production and operations.

VIB also introduces VIB Business digital banking as a pivotal component of its comprehensive financial solution, enabling businesses to effortlessly manage their accounts and transact anytime, anywhere. In addition to features for managing payment and spending limits according to the enterprise’s authorization system, VIB Business integrates three breakthrough technological solutions: Voice Alert (transaction notifications via voice messages), SoftPOS (transforming smartphones into POS devices for card payments), and QR Merchant (generating unique QR codes for each store for convenient payments). These innovations enhance sales activities and operational efficiency for business owners.

Digital Transformation Solutions for SMEs

To further propel digital transformation for SMEs, VIB has collaborated with Visa and VNPAY to offer comprehensive digitization solutions.

Visa’s Business Payment Solutions (BPSP) on the VNPAYB2B platform enable VIB cardholders to make payments to any payee account, even if the recipient business has not enabled card acceptance. This improves cash flow with attractive early payment discounts, enhances expenditure control, and reduces operational tasks for businesses through digitized processes and data utilization.

Businesses can also smartly manage electronic invoices with VNPAY Invoice, a comprehensive solution for issuing, sending, managing, and reporting electronic invoices. The system ensures speed, compliance, and high security while significantly reducing costs associated with paper invoices.

With VNeDOC, enterprises can create, sign, and manage contracts, documents, and records online. This solution optimizes workflows, saves time and costs on printing and transportation, enhances security, and facilitates easy information retrieval.

Representing Visa, Ms. Dang Tuyet Dung, Director of Visa Vietnam and Laos, shared: “Visa is committed to driving digital payments, especially in the SME segment. Through our collaboration with VIB and VNPAY, we aim to facilitate SMEs’ access to modern, secure payment solutions, contributing to optimizing cash flow and enhancing their business performance.”

Mr. Tran Manh Nam, Director of the Enterprise Division at VNPAY, stated: “Digital transformation serves as a quick, efficient, and effective lever for SMEs. VNPAY’s technological platform, with solutions such as VNPAY Invoice, VNeDOC, and VNPAYB2B, plays a crucial role in digitizing core operational processes for businesses. Integrating these solutions into VIB and Visa’s financial ecosystem will create a synergistic effect, enabling SMEs to comprehensively and effectively realize their digital transformation journey.”

The private sector, with SMEs constituting 98% of all enterprises, remains pivotal to Vietnam’s socio-economic development. This sector currently contributes over 50% of GDP, 30% of the state budget revenue, and generates over 40 million jobs, equivalent to more than 82% of the total workforce. However, to achieve rapid and sustainable growth in terms of scale and quality, the SME community still faces challenges, particularly in accessing capital, enhancing governance capabilities, and embracing digital transformation.

On March 25, 2025, the Prime Minister issued Directive No. 10/CT-TTg on promoting the development of small and medium-sized enterprises. The directive sets the goal of having at least 1 million new SMEs by 2030, along with enhancing support infrastructure, improving access to finance, credit, and human resources for SMEs.

The comprehensive financial and digital solutions offered by VIB, Visa, and VNPAY, along with VIB’s upcoming initiatives, are specifically designed to empower Vietnamese SMEs. These solutions are expected to become a valuable aid, helping SMEs overcome challenges and optimize their operations in financial management, cost efficiency, sales, and internal processes, thereby propelling their robust and sustainable development in the new era.

“Bridging the Gap: Forging Connections Between State-Owned Enterprises and the Private Sector.”

State-owned enterprises need to continue to thrive and play a pivotal role in the country’s rapid and sustainable development. With a well-directed mindset, appropriate strategies, and effective actions will follow suit, leading to success. A crucial aspect of this direction is fostering a strong and efficient connection between state-owned enterprises and the private business sector.

The Evolution of Vietnam’s E-commerce Landscape: An “Ever-changing, Ever-challenging” Narrative

Users today can view products on TikTok, order on Shopee, lodge complaints via Facebook, and return items in-store. This paints a picture of diverse, ever-evolving, and challenging consumer behavior.

Revolutionizing Retail Management: The Digital Transformation Imperative for Savvy Store Owners

In the evolving world of cashless payments, BVBank introduces DigiStore – an all-in-one digital platform designed to empower F&B merchants with efficient transaction management, streamlined cash flow control, and enhanced customer experiences. With just one app, DigiStore simplifies operations, making every task effortless and swift.

The Eighth Wonder of the World: Unlocking Double Interest with VPBank NEO

Albert Einstein once referred to compound interest as “the eighth wonder of the world”, believing that “he who understands it, earns it”. Today, VPBank has brought the power of compound interest closer to everyone, thanks to the application of modern technology, innovation, and a deep understanding of customer needs. With just a few simple steps on VPBank NEO, you can unlock the wonders of compound interest and watch your money grow.