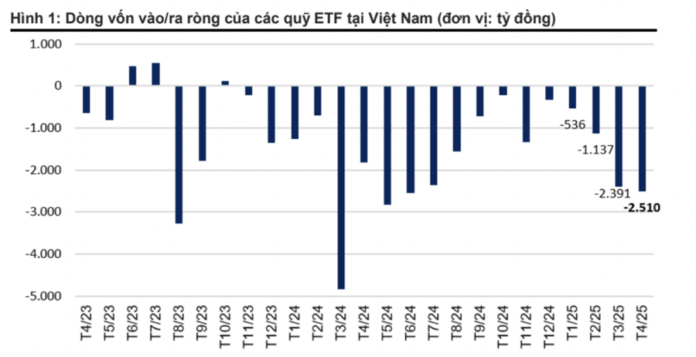

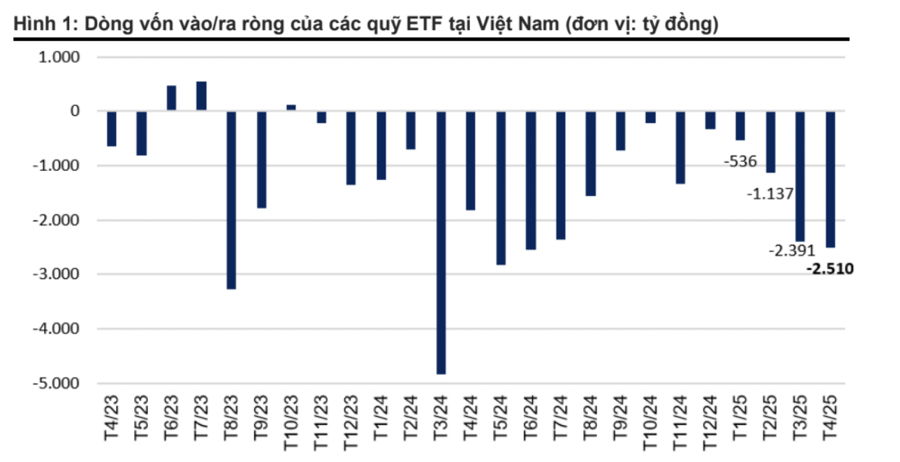

Vietnamese ETFs witnessed net outflows in April 2025, with a withdrawal value of nearly VND 2,510 billion. The total net outflow of ETFs in the first four months of 2025 was nearly VND 6,590 billion, 24% lower than the same period in 2024, according to statistics from VnDirect.

The net outflow from ETFs in April 2025 mainly came from the Fubon FTSE Vietnam ETF, with a net withdrawal of over VND 764 billion, followed by the VanEck Vector Vietnam ETF with a net outflow of more than VND 762 billion, and the DCVFMVN Diamond ETF with a net withdrawal of VND 600 billion. Additionally, the DCVFM VN30 ETF experienced a net outflow of over VND 252 billion, while the Xtracker FTSE Vietnam ETF saw an outflow of more than VND 127 billion.

On the other hand, the KIM Growth VN30 ETF was the only fund to record a net inflow of over VND 33 billion in April.

Foreign investors maintained their net selling position in April 2025, with a total net selling value of over VND 14,500 billion. ETF net selling accounted for about 17.3% of the total net selling value. In the first four months of 2025, the total selling value of foreign investors was over VND 42,400 billion, 2.5 times higher than the net selling value in the same period last year.

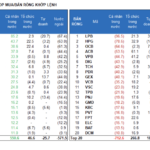

In April 2025, foreign investors net sold over VND 13,400 billion on the HoSE, VND 439 billion on the HNX, and VND 657 billion on the UPCoM. The stocks that foreign investors net sold the most in April 2025 were VIC, FPT, MBB, VCB, and VNM. On the buying side, the stocks with the largest net buying value in April 2025 included HPG, MWG, GEX, HVN, and BMP.

Amid escalating trade tensions and concerns about economic policy instability under the Trump administration, the Dollar Index witnessed a sharp decline below 100 points in April. Foreign investors gradually reduced their net selling value in the last trading sessions of April and started to net buy slightly in the first trading sessions of May.

VnDirect expects the Dollar Index to remain low in the coming period. Along with the expected progress in Vietnam-US trade negotiations and the prospect of an upgraded stock market, foreign investors are anticipated to return to net buying in the Vietnamese stock market in the second half of this year.

Stock Market Insights: Chasing the ‘Odd-Lot’ Money Trail

Today’s trading session witnessed a slowdown with declining liquidity and a preponderance of stocks in the red. The exuberant upward momentum observed yesterday was confined to a select few stocks, notably FPT and LPB. However, their capacity to spearhead a broader market rally is questionable, particularly as other leading stocks also exhibit signs of weakness.

What Was F88’s Business Model Before Going Public?

“F88, a familiar name in the industry, has officially become a public company and is preparing for its UPCoM listing. This significant move has sparked questions among investors and market observers alike: Is F88 truly ready for the stock market? With its transition into the public eye, F88 enters a new phase, inviting scrutiny and high expectations.”

“Stocks Slide as Selling Pressure Weakens, Blue-chips Rebound Ahead of Derivatives Expiry”

The market witnessed a positive shift in the afternoon session as selling pressure eased. Prices gradually climbed, especially after 2:15 pm when the VN30-Index calculations started influencing the final settlement prices. A steady ascent of blue-chip stocks propelled the VN-Index and VN30-Index to surpass the reference levels and close at their highest points for the day.