On May 7, Vice Chairman of the Provincial People’s Committee Tran Nam Hung chaired a meeting with representatives from departments, sectors, and businesses to address challenges in debt collection.

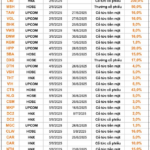

According to reports, as of May 5, Quang Nam had 35 residential and urban projects owing over VND 2,080 billion. This included VND 2,011 billion in land use fees, VND 68.8 billion in one-time land rental fees, and over VND 224 billion in late payment fees.

The land use fee collection rate from organizations reached only 1.8% of the annual estimate, posing a significant challenge to the province’s budget collection task.

Many projects have been delayed in payment since 2021, including the Ha My Complex Urban Area project, which owes nearly VND 80 billion, along with over VND 24.6 billion in late payment fees. The Dien Minh Urban Residential Area project, invested by Minh Son Construction JSC, owes more than VND 240 billion. Phu Thinh Urban Area (Phuoc Nguyen Service and General Services Co., Ltd.) owes nearly VND 280 billion.

Projects such as the Anh Duong Urban Area, Binh An 2 New Residential Area, An Phu, and An Binh Riverside are also subject to enforcement measures.

The Dong Phu Ward project owes nearly VND 76 billion in land use fees. Photo: Ha Nam |

Notably, over VND 500 billion of the debt is related to compensation and site clearance costs advanced by enterprises. However, financial agencies and district-level People’s Committees have not yet completed the settlement, preventing enterprises from recording revenue and expenditure in the state budget.

Many enterprises have paid land use fees and land rents into the budget, and the remaining debt mainly involves compensation and site clearance costs that have not been settled. Some projects in this category include the Thong Nhat Residential Area, KDC Block 5 Dien Ban, KDC Nhi Truong – Con Thu, Thien An Urban Area, and KDC along the extended Dien Bien Phu Street…

According to Mr. Tran Nam Hung, Vice Chairman of the Quang Nam Provincial People’s Committee, the province has facilitated enterprises by allowing them to stagger project implementation and issue land use rights certificates by block to address difficulties.

Enterprises must focus on resolving bottlenecks and completing the projects. Only then can they obtain land use rights certificates according to regulations.

The province also requested that departments and sectors resolve legal obstacles and create favorable conditions for enterprises to complete their projects promptly. Enterprises subject to the third tax invoice enforcement must pay land use fees before June 30; otherwise, they will face tax enforcement and license revocation.

Ha Nam

– 19:30 07/05/2025

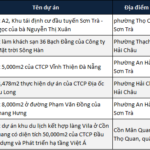

Unlocking the Potential: Unraveling the Details of Da Nang’s Resort Projects with Resolution 170

With the National Assembly’s resolution on special mechanisms, 49 projects in Da Nang were named and given guidance to overcome obstacles.

The Vibrant Metropolis: Ho Chi Minh City’s Fiscal Might in 2025 with a Staggering Budget of Over 506,000 Billion VND

According to Ho Chi Minh City Vice Chairman Nguyen Van Dung, the city is expected to collect over VND 506 trillion in revenue by 2025, as per the Central Government’s mandate.