The Vietnam Export Import Commercial Joint Stock Bank (Eximbank) has made its first adjustment to savings interest rates for May 2025. In this adjustment, Eximbank tends to decrease interest rates for some short-term deposits while increasing rates for certain long-term deposits across various savings products, effective from May 5th.

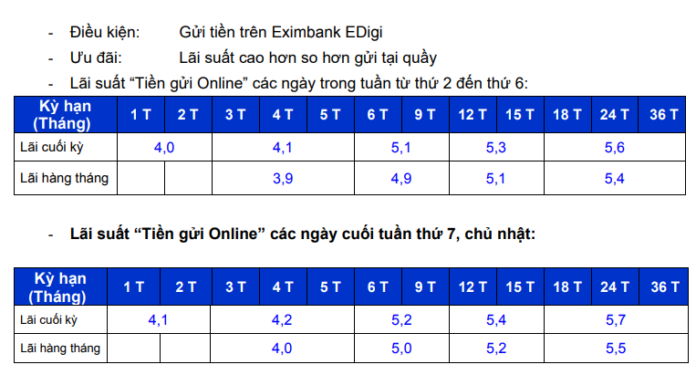

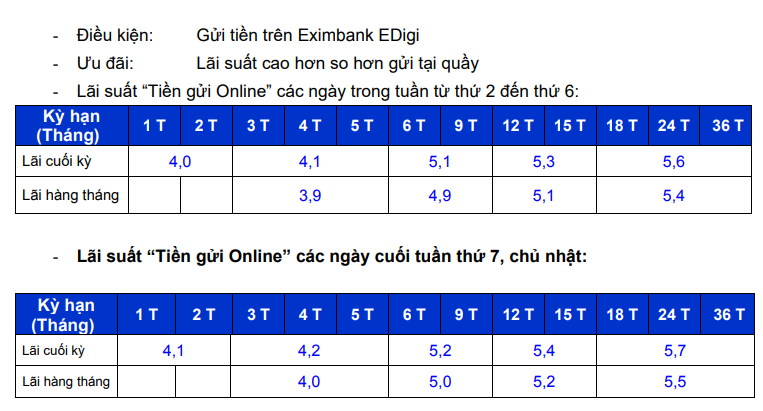

For online deposits via the Eximbank Edigi application for individual customers, the following interest rates apply from Monday to Friday:

The online deposit rate for individual customers with interest paid at maturity, the rate for 1-2 month term deposits is 4%/year. Among them, the interest rate for the 1-month term remains unchanged, while the rate for the 2-month term decreases by 0.1%/year.

For 3-5 month term deposits, the rate is 4.1%/year. The interest rate for the 3-month term remains unchanged, while the rates for the 4 and 5-month terms decrease by 0.1%/year.

The new rate for 6-9 month term deposits is 5.1%/year. The interest rate for the 6-month term remains the same, while the rate for the 9-month term decreases by 0.1%/year.

For 12-15 month term deposits, the rate is 5.3%/year. The interest rate for the 12-month term is unchanged, while the rate for the 15-month term decreases by 0.3%/year.

For 18-36 month term deposits, the rate is 5.6%/year. The interest rates for the 18 and 24-month terms decreased by 0.1% and 0.2%/year, respectively, while the rate for the 36-month term increased by 0.3%/year.

For online deposits during the weekend (Saturday and Sunday), Eximbank also decreased rates for most short-term deposits, with reductions ranging from 0.1-0.3%/year, and only increased the rate for the 36-month term by 0.3%/year.

Currently, the rates for 1-2 month, 3-5 month, 6-9 month, 12-15 month, and 18-36 month term deposits are 4.1%/year, 4.2%/year, 5.2%/year, 5.4%/year, and 5.7%/year, respectively.

Screenshot

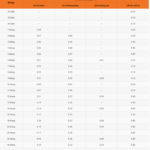

In addition, Eximbank has also adjusted interest rates for its “Long-term Deposit Program,” “Thịnh Vượng 50+ Savings,” “Self-selected Term Savings,” and other products.

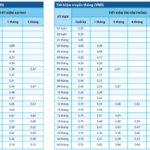

Eximbank has also adjusted savings interest rates for corporate customers. Specifically, the online deposit rate for corporate customers with a 2-month term has decreased by 0.1%/year to 4%/year; the rates for 4-5 month and 9-11 month terms have decreased by 0.1%/year to 4.1%/year and 5.1%/year, respectively; the rate for the 15-month term has decreased by 0.3%/year to 5.3%/year; the rates for 18-24 month terms have decreased by 0.3%/year to 5.6%/year, and the rate for the 36-month term has increased by 0.3%/year to 5.6%/year.

The Big Three Shake Up Savings: Techcombank, VPBank, and MSB Kick Off December With a Bang by Hiking Deposit Rates

In the first week of December, several banks adjusted their savings interest rates, with the highest increase reaching 0.7% per annum. This move underscores a shift in the financial landscape, as institutions recognize the importance of competitive rates to attract and retain customers.