At the 2025 Annual General Meeting of Hoang Quan Trading Consulting Services Real Estate Joint Stock Company (stock code: HQC) held in Ho Chi Minh City on May 10, the atmosphere became particularly vibrant as Chairman of the Board of Directors, Truong Anh Tuan, directly answered a series of “hot” questions from shareholders.

Concerns surrounding business performance, the drop in stock price to a low level, tax debt, dividends, and the future of the company were frankly addressed by Mr. Tuan.

Mr. Truong Anh Tuan answering shareholders’ questions

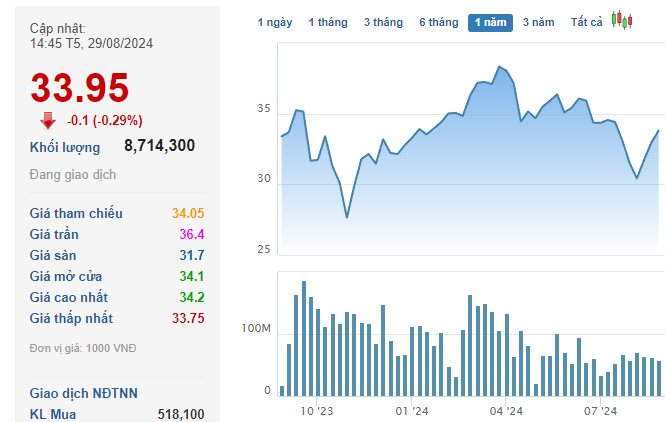

He acknowledged that 2024 was a challenging year for the company. The current stock price of VND 3,300 is a result of multiple factors, including internal difficulties such as legal hurdles delaying some projects and completed projects not meeting profit expectations. He conceded that the current price reflects the true value of the company at this point.

Regarding the company’s previous reprimand for delayed disclosure of information, Mr. Tuan downplayed its severity, asserting that “Hoang Quan always upholds the law.”

A key highlight of Mr. Tuan’s presentation was his optimism about the wave of investment in social housing. He perceives this as an opportunity for Hoang Quan, a company with experience and capabilities in this field. Alongside the opportunities lie numerous challenges, and the company must exert significant efforts to overcome them.

Mr. Tuan shared that in 2025, the company will focus on recovering capital from projects they have invested in over the years, particularly in provinces like Dak Lak, Can Tho, and Tay Ninh. He believes this will be a pivotal phase for the company to “bounce back” and set the stage for stronger revenue and profit growth.

At the meeting, the Chairman of Hoang Quan also drew attention with his candid response to a shareholder’s direct question: “Does the Chairman care about shareholders, given the company’s consecutive years without dividend payments?” He did not evade the question and answered emotionally: “I care about shareholders, and I also care about myself and my family. My family owns the most HQC shares. We feel the pain when the stock price drops. We introspect when business results fall short of expectations.”

He further shared that Hoang Quan had completed the repayment of over VND 200 billion in tax debt in March, a significant milestone demonstrating the company’s resilience. With the support of partners, banks, and a dedicated team, he believes the company is regaining its stable foundation and is ready for the new phase. According to him, “the investment opportunity in HQC stock is opening up.”

Mr. Truong Anh Tuan Remains as Chairman of the Board

At the conclusion of the meeting, shareholders approved the targets of VND 1,000 billion in revenue and VND 70 billion in after-tax profit for 2025. The majority of this will come from the Golden City social housing project in Tay Ninh, along with revenues from the new urban area project in Tra Vinh and HQC Tan Huong in Tien Giang. “If favorable conditions prevail, the stock price can reach VND 10,000 to 15,000 during this term,” Mr. Tuan anticipated.

Additionally, shareholders elected the Board of Directors and Supervisory Board for the 2025–2030 term. Mr. Truong Anh Tuan continues to hold the position of Chairman of the Board of Directors.

Unveiling the List of 848 Tax-Defaulting Businesses in Quang Ninh Province

The Regional Tax Department III has released a list of 848 businesses that owe taxes and other financial obligations to the state budget in Quang Ninh Province, totaling nearly VND 1,285.7 billion.

HQC Shareholder Meeting: Halt 198-hectare Project with Hai Phat in Binh Thuan, Continue Seeking Land Opportunities for Social Housing with NVL.

HQC Chairman Truong Anh Tuan continued his “refrain” about the challenges that have prevented the company from achieving its goals for over a decade. The annual general meeting, held on the morning of May 10, 2025, saw lively discussions on addressing debts, implementing social housing projects, succession planning, and tackling ESG initiatives.

HQC: Missing Targets for 9 Consecutive Years, 2 “Mysterious Women” Emerge as Major Shareholders with 52 Million Shares

In March 2024, HQC announced the successful completion of a private placement of 100 million shares to strategic investors. The real estate company raised 1,000 billion VND from this transaction, a remarkable feat given the challenges faced by many other real estate businesses in raising capital. However, HQC’s financial performance has fallen short of shareholders’ expectations, as the company has failed to meet its business plan for nine consecutive years.