Continuing the 9th session of the 15th National Assembly, on the morning of May 9, Chairman of the National Assembly’s Committee for Economic and Financial Affairs Phan Van Mai presented a report explaining, adopting, and editing the draft Law on Special Consumption Tax (amended); at the same time, the National Assembly discussed in the hall about some contents of the draft law that are still different opinions. This bill was presented to the National Assembly for discussion at the 8th session.

PROPOSAL TO ADJUST TAX RATES FOR ALCOHOL AND BEER ACCORDING TO OPTION 1 FROM 2027

Notably, according to the draft law on taxable objects, air conditioners have become popular to meet the needs of the people. Therefore, receiving the opinions of the National Assembly deputies, the Standing Committee of the National Assembly agreed with the Government’s proposal to edit the draft Law in the direction of stipulating that air conditioners with a capacity of over 18,000 BTU to 90,000 BTU are subject to special consumption tax (not subject to tax). tax for air conditioners with a capacity of less than 18,000 BTU and over 90,000 BTU).

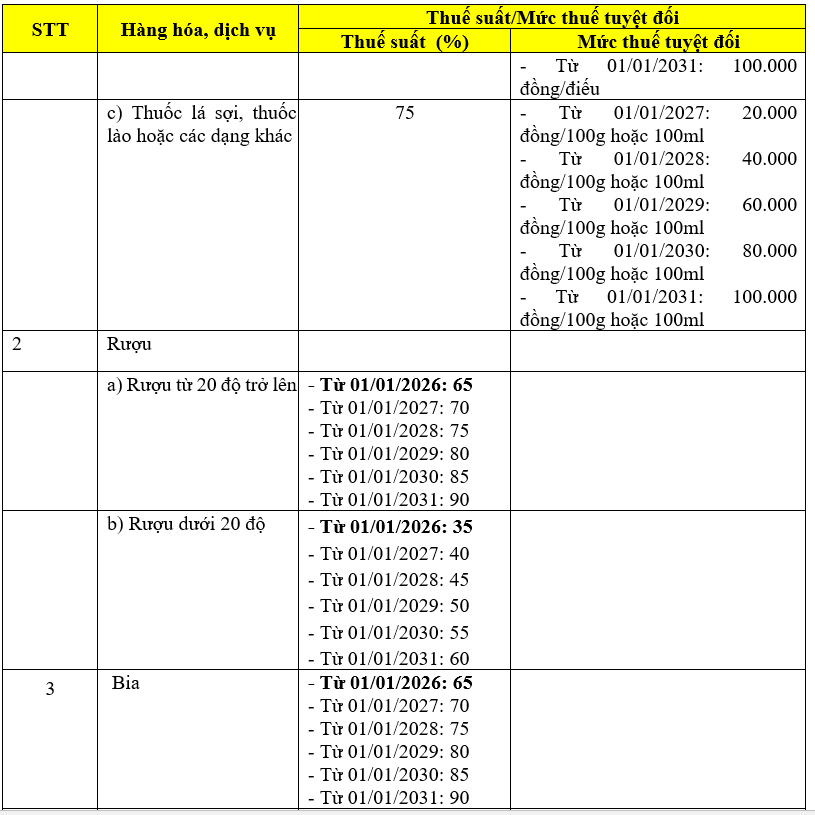

Regarding the tax rate for alcohol, beer, and tobacco products, in order to strongly affect the selling price of goods that are harmful to health, reduce consumption, and overcome the serious consequences of alcohol and beer abuse and the harm of tobacco, the draft Law presented to the National Assembly at the 8th session proposed 2 options to increase taxes and proposed to apply Option 2 (which is a more thorough tax increase) for alcohol, beer, and tobacco.

However, according to Mr. Phan Van Mai, Chairman of the National Assembly’s Committee for Economic and Financial Affairs, in the current socio-economic context, along with the goal of achieving growth of 8% or more, the Government proposed to apply Option 1 with a lower tax rate than Option 2 and start applying from 2027 to suit the new context and situation.

Therefore, the National Assembly’s Standing Committee asked the National Assembly to edit the draft Law as proposed by the Government (as reflected in Article 8 of the draft Law).

Regarding pickup trucks, the draft Law presented to the National Assembly at the 8th session raised the tax rate for this type of vehicle to 60% of the special consumption tax rate applied to cars with 9 seats or less with the corresponding capacity.

However, in the current situation, this regulation may significantly affect the production and business activities of enterprises as well as the investment environment of Vietnam. Therefore, receiving the opinions of the deputies, the Standing Committee of the National Assembly agreed with the Government’s proposal to edit the draft Law in the direction of stipulating an increase in the tax rate of 3%/year and starting to apply from 2027 for pickup trucks (reducing the tax rate increase and extending the roadmap for tax increase compared to the draft Law submitted to the National Assembly)

Regarding the addition of sugary drinks to the taxable category, the proposal to tax sugary drinks is the first step in implementing solutions to limit the production and consumption of products with a high sugar content in food and beverages, thereby orienting production and consumption.

According to Mr. Mai, this is one of the main causes of obesity and non-communicable diseases related to diet. Therefore, the National Assembly’s Standing Committee asked to keep it as in the draft Law and suggested that the Government continue to study international experience to be able to consider the possibility of adding other products containing sugar to the taxable category.

In addition, since this item is newly added to the taxable objects, there needs to be a roadmap for businesses to have time to adapt, adjust production and business plans, and gradually switch to products with low sugar content. Therefore, receiving the opinions of the deputies, the National Assembly’s Standing Committee agreed with the proposal of the drafting agency to edit the draft Law in the direction of stipulating a roadmap for implementation: From 2027, apply a tax rate of 8%, from 2028, apply a tax rate of 10%.

EXPORT GOODS THAT HAVE PAID SPECIAL CONSUMPTION TAX WILL NOT BE TAXED WHEN RE-IMPORTED

Regarding non-taxable objects that are goods exported abroad and returned by foreign countries for re-import into Vietnam, Mr. Mai said that in principle, goods exported abroad are not subject to special consumption tax. Therefore, when re-imported into Vietnam, special consumption tax must be levied similar to other imported goods.

However, for goods sold through trading enterprises for export, the seller (manufacturing or importing enterprise) has already paid special consumption tax. Thus, if it continues to be taxed when imported because it is returned by the customer, this item will be taxed twice.

To avoid double taxation on the same product, based on the Government’s proposal, the National Assembly’s Standing Committee edited this content in the direction of clearly stipulating that “Exported goods abroad that have paid special consumption tax and are returned by foreign countries when imported” are not subject to tax.

Regarding non-taxable objects that are goods imported from abroad into bonded warehouses and then exported to other countries, the draft Law has removed the regulation on non-taxation of goods placed in non-tariff areas under the current Law. Accordingly, even goods imported into bonded warehouses only for the purpose of sending and transiting and then exported to other countries will also be subject to special consumption tax.

According to Mr. Mai, this is not in line with the principle of special consumption tax, which is only levied on goods consumed in Vietnam. Therefore, receiving the opinions of the deputies, the National Assembly’s Standing Committee added these subjects to the non-taxable category, similar to other transit goods, and edited them accordingly at Point b, Clause 2, Article 3 (Transit goods according to the provisions of commercial law, foreign trade management law; transshipment goods, transit goods; goods imported from abroad into bonded warehouses and then exported to other countries according to the provisions of customs law)

The River Han Reclamation Project: Luxury Waterfront Residences Now Available for Pre-Sale

The Danang Department of Construction has issued a notice regarding the conditions for trading in future formed housing at the real estate and marina project in Danang.

“Proposal to Merge Provincial-Level Administrative Units: A Comprehensive Reform for Efficient Governance”

The National Assembly will discuss a range of critical issues at its 9th session, including resolutions on mechanisms and policies to foster private economic development. Additionally, a pilot scheme will be proposed, offering special mechanisms and policies to invest in developing the railway system. A proposal for the merger of provincial-level administrative units is also on the agenda, alongside other significant matters.