The deadline for registering to receive cash dividends for 2024 is set as May 23, 2025, with a payout ratio of 84% (equivalent to VND 8,400 per share). The company plans to make dividend payments on June 10, 2025.

With over 30 million shares outstanding, D2D Corporation will distribute more than VND 254 billion in dividends, thus completing the plan approved by the 2025 Annual General Meeting of Shareholders.

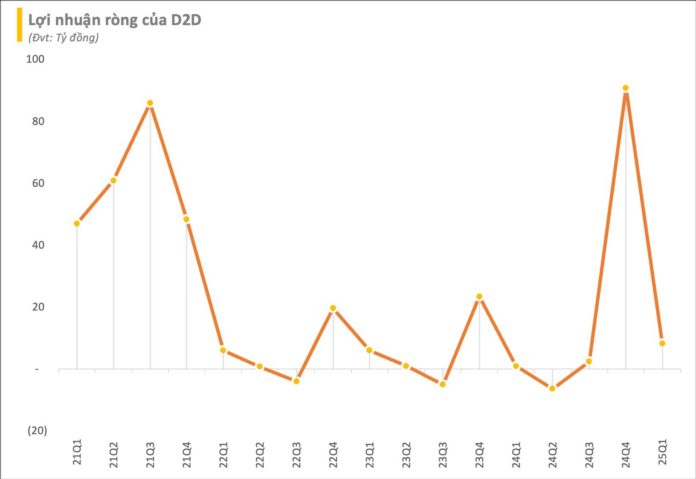

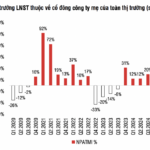

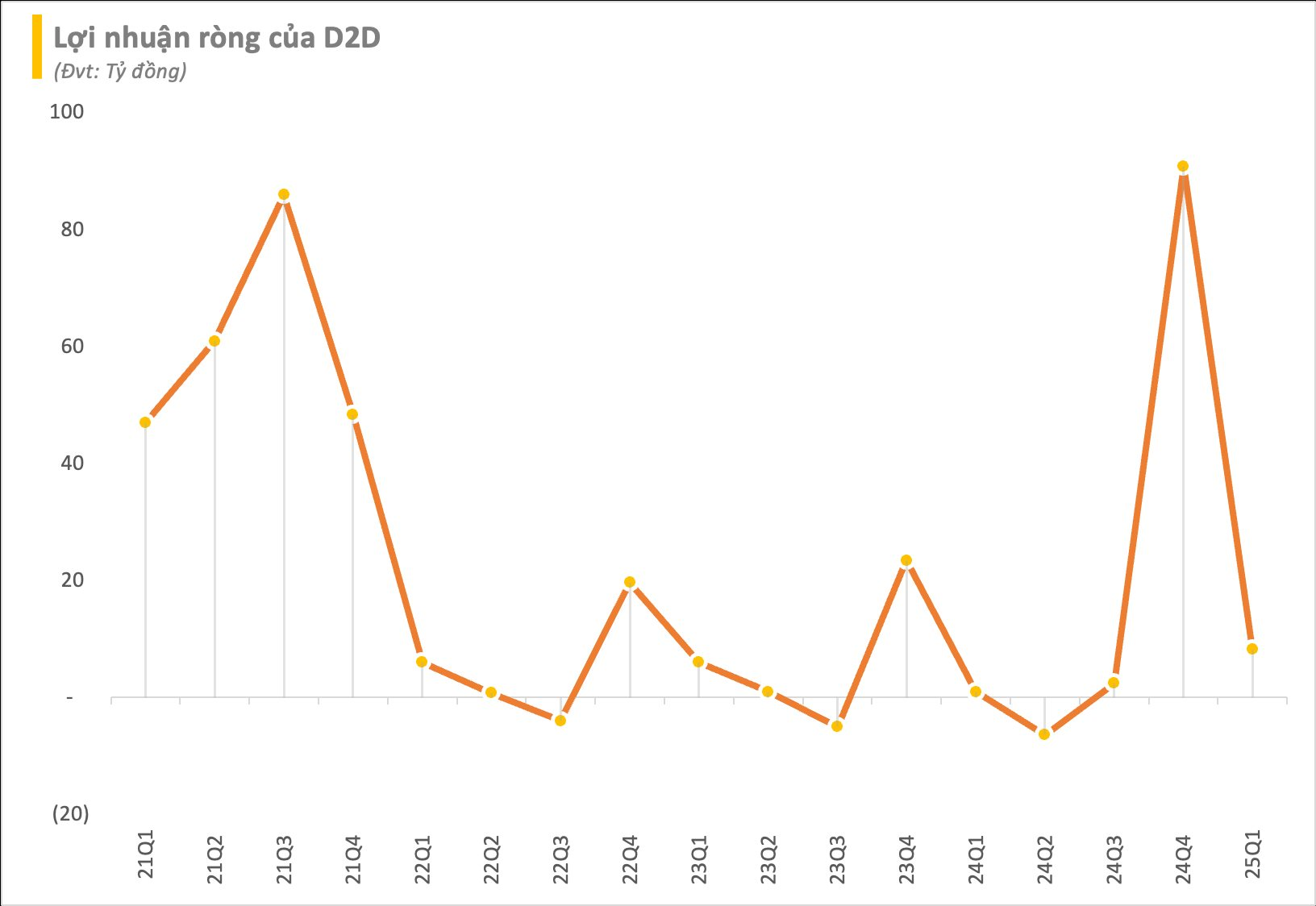

Regarding business performance, D2D Corporation has set ambitious goals for 2025, targeting nearly VND 665 billion in total revenue, a 90% increase from the previous year, and a net profit of nearly VND 176 billion, doubling that of 2024. As per the disclosed Q1 financial statements, the company recorded a three-and-a-half fold surge in net revenue to VND 92 billion compared to Q1/2024. Consequently, pre-tax profit skyrocketed by 707% to VND 10.5 billion, with a net profit of over VND 8.3 billion.

In their explanatory note, D2D Corporation attributed the impressive business results to the significant increase in land transfer revenue in Chau Duc Industrial Park, which boosted profits. The company has achieved 14% and 5% of its full-year targets, respectively.

As of March 31, 2025, D2D Corporation’s total assets stood at VND 1,641 billion, an 8% increase from the beginning of the year. Notably, cash holdings witnessed a substantial rise to nearly VND 222 billion, more than triple the previous amount. Payable debts amounted to nearly VND 886 billion, a 15% increase from the start of the year, with no financial borrowings.

Established in 1992 under the Construction Department of Dong Nai province, D2D Corporation underwent privatization in 2005 and listed its shares on the Ho Chi Minh Stock Exchange (HoSE) in August 2009. The company primarily engages in industrial park leasing and residential area development.

As part of its mid-to-long-term development strategy, D2D Corporation will continue to invest in the real estate sector, focusing on infrastructure development in new urban areas, particularly in Bien Hoa City, to address housing, urban development, and transportation challenges.

Additionally, the company plans to allocate resources to social housing projects for workers in industrial parks and consider investing in housing initiatives to support stable production and business operations for workers. The company aims for an average annual growth rate of 5% and a dividend payout ratio of 30%/year (a minimum of 10% in cases of charter capital increase).

In the market, D2D shares have surged by 37% since the beginning of the year, reaching a high of VND 43,750 per share, the highest level in over three months. Its market capitalization exceeds VND 1,300 billion.

Unlocking Profitability: MSB’s Strategic Cost-Cutting Measures Yield Fruitful Results, with Q1 Pre-Tax Profits Soaring to VND 1,631 Billion, a 7% Increase

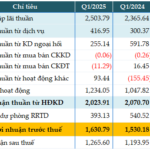

In the recently released consolidated financial statements for the first quarter of 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) reported a remarkable performance with a pre-tax profit of nearly VND 1,631 billion, reflecting a 7% increase compared to the same period last year. This impressive growth can be attributed to the bank’s effective management of credit risk provisions.

The Ultimate Guide to Captivating Copy: “Unleashing the Power of Words: Digiworld’s Generous Dividend Payout for 2024”

Digiworld plans to spend nearly VND 110 billion on dividends for the fiscal year 2024, offering a 5% payout ratio. The record date for shareholders to be eligible for this dividend is May 26, 2025.

The Big Money Rush: Stocks Soar as VN-Index Recovers from Tariff Trauma

The lethargic morning trading pace took an unexpected turn within the first 15 minutes of the afternoon session. Leading stocks, notably FPT, witnessed a dramatic surge in volume, swiftly triggering a frenzied buying spree. HoSE’s afternoon matching volume skyrocketed by 66% compared to the morning session, with the VN-Index closing at its strongest gain in 16 sessions.