TNC’s Q1/2025 Financial Report: A Shift in Revenue Streams

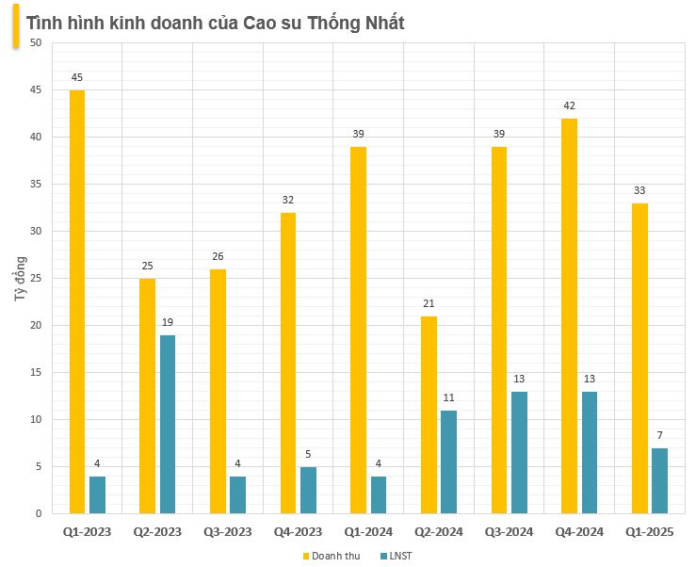

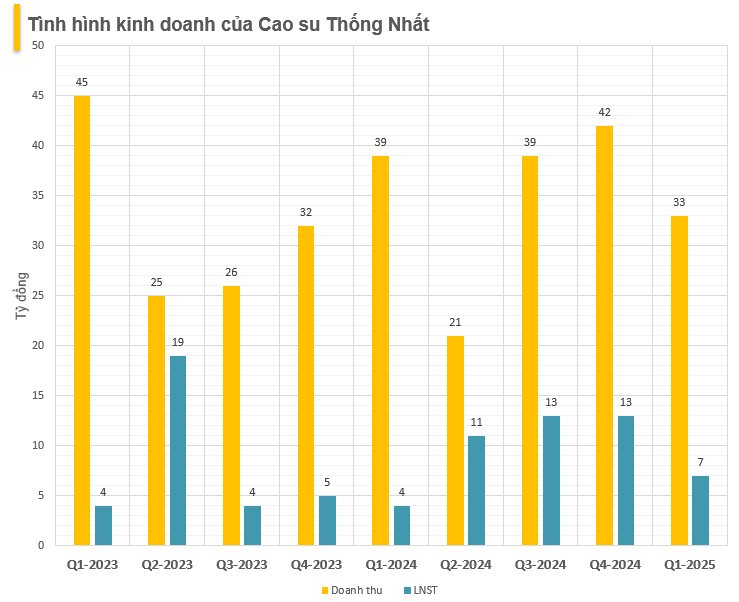

CTCP Cao su Thống Nhất (HOSE: TNC) has released its Q1/2025 financial report, revealing an interesting shift in revenue streams. While the company’s net revenue decreased by 16% compared to the same period last year, reaching VND 33.3 billion, its gross profit saw a significant increase of 95%, totaling VND 11.9 billion. This impressive growth in gross profit can be attributed to an improved gross profit margin, which rose from 21% to 36%.

Despite increases in selling and management expenses, with figures reaching VND 2.6 billion and VND 2.44 billion, respectively, TNC’s pre-tax profit for the quarter stood at VND 7.88 billion, reflecting a 95% increase year-over-year. The company’s net profit settled at nearly VND 7 billion.

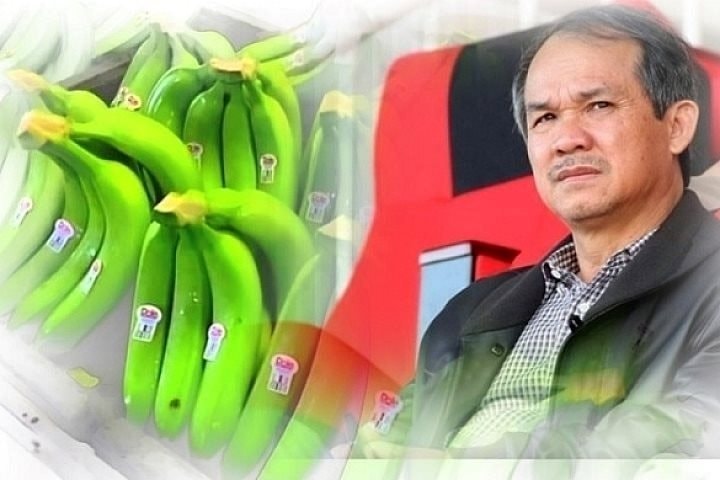

According to TNC, the primary driver of this positive performance was the rise in banana prices during the first quarter of 2025, which led to a substantial increase in profits from banana production and sales, amounting to over VND 3.5 billion.

A closer look at the report reveals that revenue from rubber sales for the quarter totaled VND 12.6 billion, marking a 28% decrease from the previous year. In contrast, banana sales brought in approximately VND 19.8 billion, only a slight dip compared to the previous year.

This indicates that TNC’s revenue from banana sales significantly outperformed its traditional rubber sales, highlighting a notable shift in the company’s primary revenue stream.

About CTCP Cao su Thống Nhất: Diversifying Agriculture

Established in 1991, CTCP Cao su Thống Nhất has traditionally focused on rubber cultivation and extraction but has since diversified into other agricultural products, including bananas and cashew nuts. With a range of farms and production facilities, the company has successfully expanded its operations.

In recent years, bananas have emerged as a new flagship product alongside rubber. In 2024, banana sales generated VND 68 billion in revenue, while the rubber segment contributed nearly VND 64 billion. This dynamic shift in revenue streams showcases the company’s adaptability and success in diversifying its agricultural offerings.

Peer Comparison: HAGL’s Banana Boom

Another listed company, Hoàng Anh Gia Lai (HAGL), has also experienced significant financial gains due to its banana business. HAGL’s Q1/2025 financial report showed an 11% growth in net revenue, totaling VND 1,380 billion. The fruit segment, largely driven by banana sales, contributed VND 1,000 billion to this figure, marking a 13% increase year-over-year. Additionally, the company’s merchandise sales soared by 591%, reaching VND 311 billion. In contrast, their livestock segment took a downturn, decreasing from VND 292 billion in Q1/2024 to VND 76 billion in the same period this year. Ultimately, HAGL recorded a net profit of nearly VND 341 billion, reflecting a 59% increase compared to Q1/2024.

HAGL attributed this impressive performance to the substantial growth in gross profit from banana sales, coupled with reduced financial expenses and the recovery of financial investment provisions.

SIP Posts Highest Q1 Profit in 4 Years, Reaching Nearly 50% of Annual Target

Saigon VRG Joint Stock Company (HOSE: SIP) has announced its Q1 2025 financial results, reporting a net profit of over VND 351 billion, a remarkable 43% increase from the same period last year and the highest since Q1 2021. This achievement marks a strong start to the year, with the company already nearing 50% of its annual profit plan.

Ricons Profits Soar to Nearly VND 160 Billion in 2024, the Highest in Three Years

Impressive business results in the final quarter of 2024 propelled Ricons JSC’s annual profits to a three-year high, far surpassing expectations.