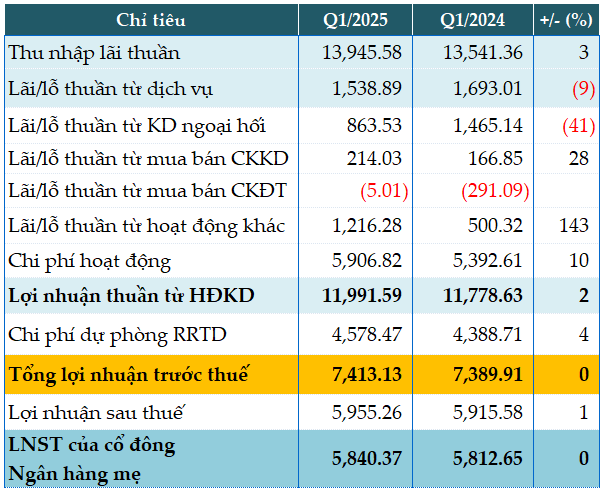

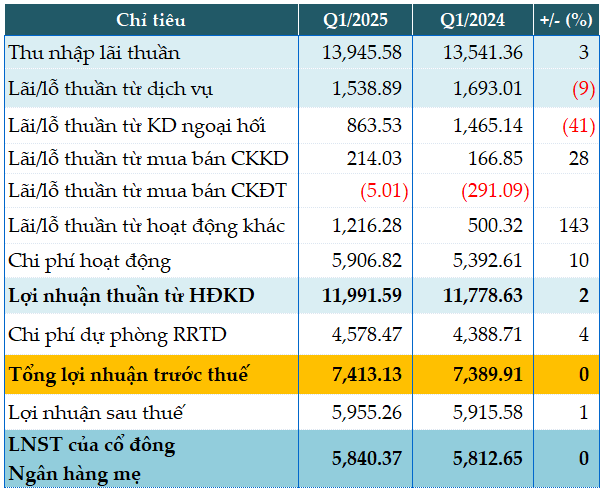

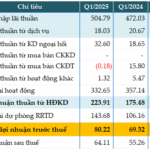

In Q1, BIDV’s net interest income reached nearly VND 13,946 billion, up 3% compared to the same period last year.

Non-interest income streams showed varied performance, with service income down 9% (to VND 1,539 billion), foreign exchange trading income down 41% (to VND 864 billion), while securities trading income increased by 28% (VND 214 billion).

Notably, other activities generated over VND 1,216 billion in interest income, more than double that of the previous year.

Operating expenses rose 10% to VND 5,907 billion, resulting in a 2% increase in profit from business operations, totaling VND 11,992 billion.

BIDV set aside VND 4,578 billion for credit risk provisions, a 4% increase, thus maintaining pre-tax profit at VND 7,413 billion.

|

BID’s Q1 financial results in trillions of VND

Source: VietstockFinance

|

As of Q1-end, BIDV’s total assets grew slightly by 3% from the beginning of the year to nearly VND 2.86 quadrillion. Specifically, funds deposited with the SBV decreased by 30% (to VND 65,199 billion), while those deposited with other credit institutions increased by 24% (to VND 333,399 billion). Customer loans and deposits also witnessed a slight increase of 2% and 1%, respectively, totaling over VND 2.1 quadrillion and nearly VND 1.98 quadrillion.

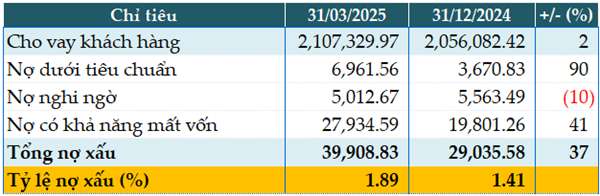

As of March 31, 2025, BIDV’s total non-performing loans stood at VND 39,908 billion, marking a 37% increase from the beginning of the year. Consequently, the non-performing loan ratio rose from 1.41% to 1.89% during this period.

|

BID’s loan quality as of March 31, 2025, in trillions of VND

Source: VietstockFinance

|

Han Dong

– 7:34 PM, April 29, 2025

“VietinBank Reports Over VND 2,000 Billion in Other Operating Income, Boosting Q1 2025 Pre-Tax Profit by 10%”

In the recently released consolidated financial statements for the first quarter of 2025, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank, HOSE: CTG) reported a remarkable performance with a profit before tax of over VND 6,823 billion, reflecting a 10% increase compared to the same period last year.

“Vietcombank Reports Flat Profit in Q1 2025 Despite Significant Cut in Provisions”

In the first quarter of 2025, the Joint Stock Commercial Bank for Foreign Trade of Vietnam, known as Vietcombank (HOSE: VCB), reported a slight increase in pre-tax profits, reaching nearly VND 10,860 billion, a 1% rise compared to the same period last year. This positive result is attributed to a significant reduction in provision for risks.

“VN-Index Surges to 1,520 Points: VNDirect Securities Targets 2.3 Trillion VND Profit in 2025 with Billion-Dong Bonuses for Employees”

“VNDirect has announced its plans to distribute a cash dividend of 5% (VND 500 per share) for the fiscal year 2024. This anticipated payout underscores the company’s commitment to rewarding its shareholders and fostering long-term value creation.”