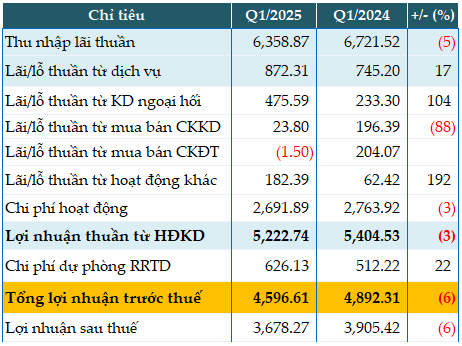

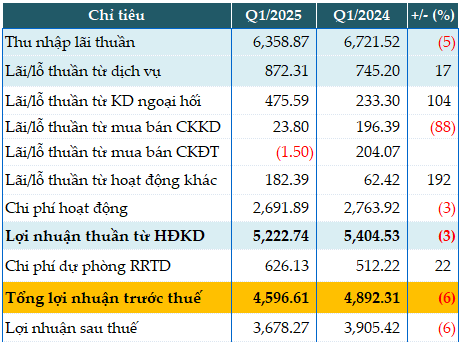

ACB’s net interest income for Q1 decreased by 5% year-on-year, reaching VND 6,359 billion.

The growth in core service fees was higher by 17% year-on-year, with a notable 161% increase in card business activities, significantly contributing to ACB’s non-interest income. In this period, ACB’s non-interest income rose by 7.5%. The ratio of non-interest income to total revenue increased to 20%, up from 18% in the previous year.

Consequently, profits from service activities increased by 17% to VND 872 billion. Foreign exchange operations also doubled their profits from the previous year, reaching nearly VND 476 billion. Profits from other activities tripled year-on-year, surpassing VND 182 billion.

On the other hand, profits from securities trading decreased by 88%, amounting to just under VND 24 billion. Investment securities trading activities shifted from profit to loss.

During the quarter, the bank reduced operating expenses by 3%, totaling nearly VND 2,692 billion. As a result, net profit from business operations decreased by 3%, amounting to nearly VND 5,223 billion. The cost-to-income ratio (CIR) was maintained at 34%.

ACB increased its credit risk provision by 22%, allocating over VND 626 billion in Q1. Consequently, the bank’s pre-tax profit decreased by 6%, totaling nearly VND 4,597 billion. ACB attributed this profit performance to its proactive implementation of interest rate support programs for customers, promoting economic growth. Despite the slight profit decline, ACB maintained a high ROE ratio of over 20% in this period.

In relation to the full-year target of VND 23,000 billion in pre-tax profit, ACB has accomplished 20% of this goal in Q1.

|

ACB’s Q1/2025 Business Results in VND billion

Source: VietstockFinance

|

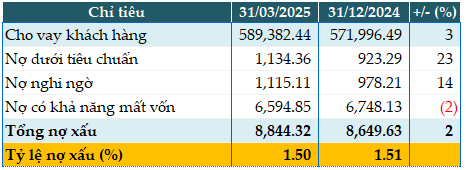

As of the end of Q1, the bank’s total assets increased by 3% from the beginning of the year to VND 891,674 billion. Customer lending grew by 3% to VND 598,805 billion, while customer deposits increased by 2% to VND 550,375 billion.

The loan-to-deposit ratio (LDR) stood at 79.8%, the ratio of short-term capital used for medium and long-term loans was 18.8%, and the consolidated capital adequacy ratio (CAR) exceeded 11%.

|

ACB’s Loan Quality as of 31/03/2025 in VND billion

Source: VietstockFinance

|

Excluding VND 9,423 billion in margin lending by ACB Securities Co., Ltd. (ACBS), as of 31/03/2025, ACB’s total bad debt reached VND 8,844 billion, a 2% increase from the beginning of the year. The bad debt ratio decreased slightly from 1.51% at the beginning of the year to 1.5%.

Han Dong

– 16:50 28/04/2025

“No Equity Issuance to Existing Shareholders in 2025-2027”

On May 9, 2025, DXG Corporation (HOSE: DXG) held its 2025 Annual General Meeting of Shareholders with a participation rate of 51.27% of the total outstanding shares as of 8:30 am.