ACV Proposes Profit Distribution Plan for Accumulated Undistributed Post-tax Profit

Vietnam Airports Corporation JSC (coded ACV) has proposed a plan to distribute accumulated undistributed post-tax profits up to the end of 2023, totaling over VND 21,191 billion.

As suggested, ACV plans to allocate 30% of the profit, equivalent to over VND 7,132 billion, to the development investment fund. The remaining amount of over VND 14,059 billion will be used to pay stock dividends to existing shareholders.

Accordingly, ACV will issue over 1.4 billion new shares for dividend payment, equivalent to a dividend ratio of 64.58% (shareholders owning 100 shares will receive 64.58 new shares). If successful, ACV’s charter capital will increase from VND 21,771 billion to over VND 35,830 billion.

The issued shares will not include treasury shares and will not be restricted from transfer. The time of implementation is expected to be in 2025, depending on the decision of the Board of Directors regarding the entitlement date.

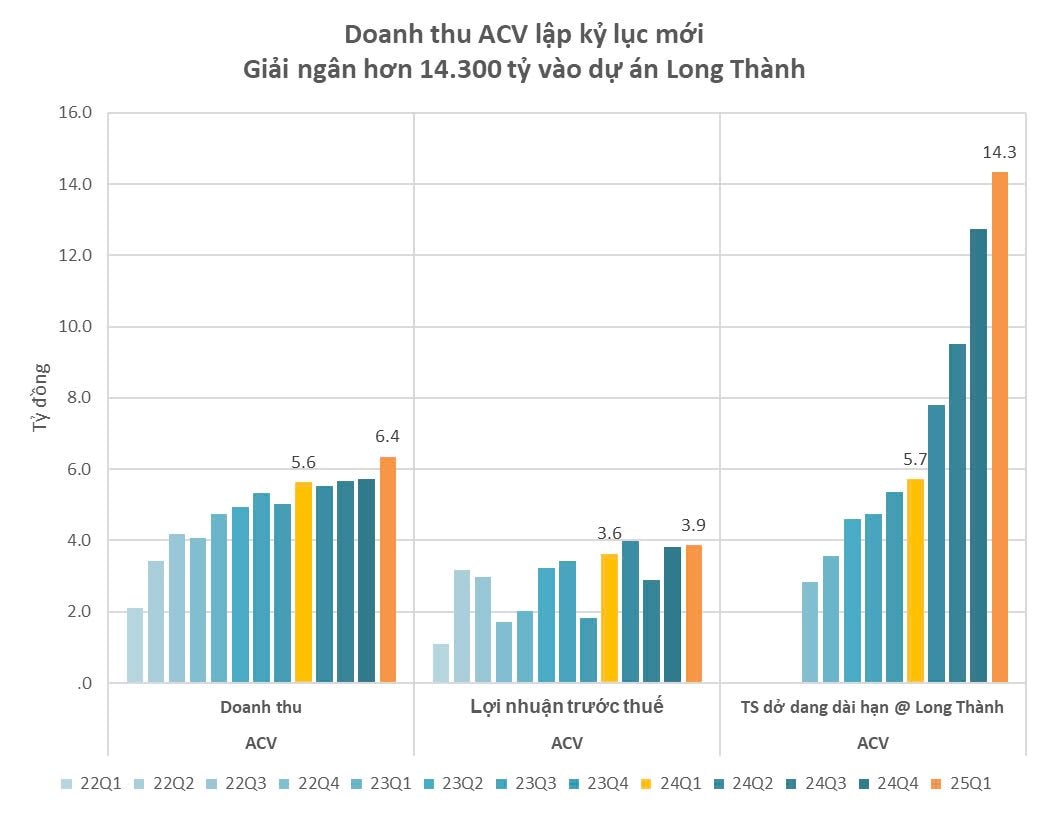

Regarding the business results for Q1/2025, ACV recorded revenue of over VND 6,368 billion, an increase of 12% compared to the same period last year. After deducting the cost of goods sold, the company’s gross profit reached over VND 4,337 billion, up more than 20% compared to Q1/2024.

During this period, financial expenses increased significantly, mainly due to foreign exchange rate differences in revaluation at the end of the period of nearly VND 227 billion. As a result, ACV recorded an after-tax profit of VND 3,014 billion, an increase of about 6% compared to the same period last year.

About ACV

Established in 2012, ACV is the result of the merger of three regional airport corporations in Northern, Central, and Southern Vietnam. In 2015, the corporation was equitized and officially operated as a joint-stock company from April 1, 2016, with a charter capital of VND 21,771 billion, of which the state-owned holding was 95.4%.

ACV currently holds a monopoly on providing aviation services to domestic and international airlines, including security, ground handling, passenger services, takeoff and landing services, etc. The corporation is in charge of managing, coordinating, and investing in the operation of a total of 22 airports across Vietnam, including 9 international and 13 domestic airports.

As of December 31, 2025, ACV’s total assets amounted to VND 75,595 billion. Cash and cash equivalents decreased significantly to VND 3,011 billion, while term deposits also decreased from VND 20,248 billion to VND 17,500 billion.

ACV is focusing its resources on the Long Thanh International Airport project, with a total investment of up to USD 16 billion, the largest project in Vietnam. As of Q1/2025, ACV has invested over VND 14,300 billion in this project.

In parallel with the Long Thanh project, ACV also disbursed over VND 7,500 billion for the Tan Son Nhat Airport Terminal 3 and the expansion of Noi Bai International Airport Terminal 2 projects.

The Ultimate Guide to ACV’s Digital Transformation: Unveiling the $175 Million Airport Project

The ACV invites bids for the selection of an investor to undertake Package 7.8, which includes the construction of Cargo Terminal 1 and auxiliary works at Long Thanh Airport.

The Ultimate Guide to Dividend Dates: Maximizing Your Returns with Up to 20% Cash Dividends, Get Ready for FPT’s “Record Date”.

This week, a total of 11 companies will be disbursing cash dividends, with rates ranging from a high of 20% to a low of 3.6%.