Pre-COVID-19, cash dividends were considered a primary income source for bank shareholders. However, during the pandemic years, following the State Bank of Vietnam’s (SBV) directive, banks were instructed to limit cash dividends and encourage stock dividends to boost capital and allocate resources for risk management. As the economy gradually recovered, some banks resumed cash dividends, but at lower rates than before.

In their 2025 plans, several banks are making efforts to distribute cash dividends, but the rates are still lower compared to stock dividends. ACB offers a total dividend rate of 25% (10% in cash and 15% in stock). VIB has a total dividend rate of 21%; 7% in cash and 14% in stock. MB provides a 35% dividend, but only 3% in cash and 32% in stock. SHB’s dividend rate is 18%; 5% in cash and 13% in stock. OCB plans a 7% cash dividend, while VPBank offers a 5% cash dividend. TPBank also intends to distribute a 10% cash dividend.

However, the majority of banks continue to retain profits, refraining from distributing dividends or opting for full stock dividends to increase charter capital. Some banks, mainly those undergoing restructuring and focusing on bad debt settlement post-merger, have not paid dividends for several years.

This situation raises a question: should banks prioritize cash dividends to satisfy shareholders or retain profits to strengthen their financial foundation, especially amid an uncertain macroeconomic environment?

Global Economic Uncertainty – Mounting Internal Pressure

2025 begins with a volatile global economic landscape, characterized by central banks’ interest rate reduction trends, geopolitical conflicts, sluggish global trade recovery, and tax policy disputes among major economies. These factors are having noticeable impacts on Vietnam’s domestic economy, particularly in credit-related sectors such as real estate, consumer spending, and exports.

In this context, banks are compelled to exercise caution, especially in managing their capital, controlling bad debt risks, and maintaining their capacity to meet Basel II standards and progress towards Basel III.

Undeniably, cash dividends are what shareholders anticipate, especially individual investors. They represent tangible cash flow, allowing shareholders to realize the “present value” of their investment.

However, in an unstable economic environment with latent risks, high cash dividend payouts mean a significant loss of financial resources for banks, affecting their capital enhancement plans, bad debt management, technology investments, and digital transformation.

For long-term shareholders, immediate cash flow is less valuable than retaining profits to increase owners’ equity, fostering stable growth, and enhancing stock valuation.

At ACB’s recent Annual General Meeting of Shareholders (AGM) held on April 8, a long-term shareholder inquired about the bank’s decision to distribute a 10% cash dividend instead of paying it entirely in stock. In response, Mr. Tran Hung Huy, Chairman of ACB’s Board of Directors, explained that in previous years, shareholders had expressed their desire for ACB to strive for cash dividends. Before deciding on the dividend structure, ACB carefully considered how to optimize shareholders’ capital in the medium and long term, not just for the next six months.

On the other hand, stock dividends enable banks to rapidly increase their charter capital more cost-effectively than raising funds from the market. Simultaneously, banks can improve their CAR (Capital Adequacy Ratio), facilitating credit expansion when the economy recovers. It also provides the necessary capital for investments in digital transformation, risk management, and new financial services, creating growth momentum for future profits.

From a long-term perspective, this approach sows the seeds for sustainability. While shareholders may not receive immediate cash, they own more shares, and if the bank performs well, the stock price will reflect its true value—this is the ultimate reward for patient shareholders.

Balancing Present Interests with Long-Term Strategies

In the current situation, a combination of cash and stock dividends is a reasonable choice. It partially satisfies shareholders by providing a tangible cash portion while allowing banks to reinvest in their business, maintain liquidity, preserve financial strength, and be poised for growth when conditions become favorable.

The “balancing act” between the bank’s long-term vision and shareholders’ realistic expectations—building trust and retaining strategic investors—is being adopted by most banks.

While cash dividends may please shareholders today, stock dividends lay the foundation for sustainable growth in shareholder value tomorrow.

In the long run, banks with robust financial strength, good governance, adequate capitalization, and clear strategies will lead the recovery wave in the financial and banking market. Consequently, their stock prices will accurately reflect their intrinsic value, rewarding patient shareholders handsomely.

Cat Lam

– 12:00 29/04/2025

The Initiative of Top Business Leaders

Mr. Le Van Tan, Chairman of Lam Son Sugar Joint Stock Company, purchased 500,000 shares, while Mr. Le Hai Doan, Chairman of HIPT Group, registered to buy 1 million shares. Additionally, Mr. Nguyen Thanh Phong, a member of the Board of Management of Thu Dau Mot Water Joint Stock Company, registered to purchase 1 million shares as well.

The Ultimate Guide to Unlocking Dividend Rewards: Maximizing Your Returns with a 19% Cash Dividend Payout and a Leading Securities Firm at Your Service.

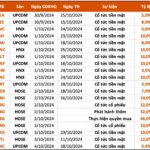

This week, a total of 17 companies are offering cash dividends, with rates ranging from a high of 19% to a low of 0.6%.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)