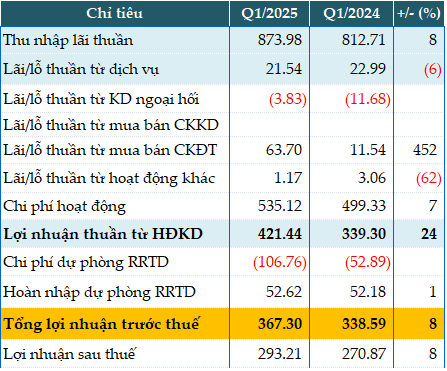

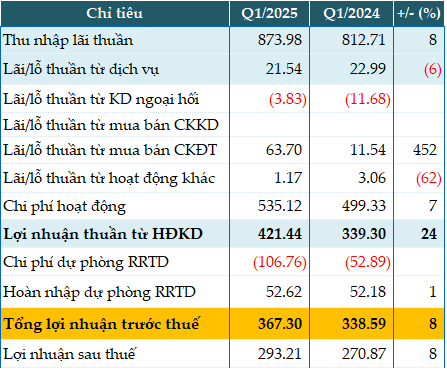

Bac A Bank reported nearly VND 874 billion in net interest income for the first quarter, an 8% increase year-on-year.

On the flip side, most non-interest income sources witnessed a decline, including a 6% decrease in service fees, a nearly VND 4 billion loss in foreign exchange trading, and a 62% drop in other operating income. Notably, investment securities trading yielded nearly VND 64 billion in profits, a five-fold increase compared to the same period last year.

Consequently, the bank’s net income from operating activities surpassed VND 421 billion, marking a 24% rise. During the quarter, Bac A Bank set aside nearly VND 107 billion in credit risk provisions but reversed almost VND 53 billion, resulting in a pre-tax profit of over VND 367 billion, an 8% increase year-on-year.

With an annual pre-tax profit target of VND 1,300 billion, the bank has accomplished 28% of its goal in the first three months.

|

Bac A Bank’s Q1/2025 Financial Results in billions of VND. BAB. Unit: VND trillion

Source: VietstockFinance

|

As of the quarter’s end, total assets stood at VND 175.365 trillion, reflecting a 6% growth since the beginning of the year. Customer loans witnessed a modest 1% increase (VND 111.173 trillion), while customer deposits climbed by 2% (VND 124.794 trillion).

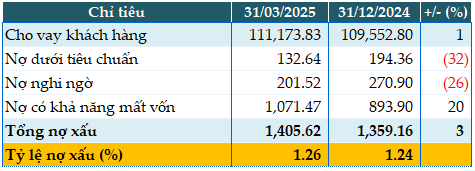

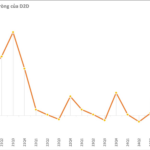

Non-performing loans as of March 31, 2025, totaled nearly VND 1.406 trillion, a 3% increase from the start of the year. Consequently, the non-performing loan ratio inched up from 1.24% to 1.26%.

|

Loan Quality of BAB as of 31/03/2025. Unit: VND billion

Source: VietstockFinance

|

– 15:58 29/04/2025

A Surprising Spike in Other Income, BIDV’s Pre-Tax Profit Stagnates in Q1 2025

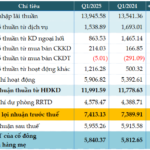

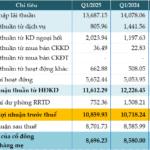

The consolidated financial statements for Q1 2025 reveal that the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) posted a pre-tax profit of over VND 7.413 trillion, remaining flat compared to the same period last year.

“VietinBank Reports Over VND 2,000 Billion in Other Operating Income, Boosting Q1 2025 Pre-Tax Profit by 10%”

In the recently released consolidated financial statements for the first quarter of 2025, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank, HOSE: CTG) reported a remarkable performance with a profit before tax of over VND 6,823 billion, reflecting a 10% increase compared to the same period last year.

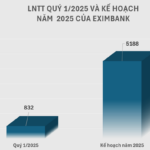

“A Profitable Quarter: Eximbank’s Pre-Tax Profits Soar by 26% in Q1 2025”

The first quarter of 2025 painted a diverse picture of profits in the banking industry, with a notable performance gap between private and large banks. While the big players maintained their steady growth trajectory, a few private banks, including Eximbank, stood out with impressive double-digit profit increases. This development underscores the evolving landscape of the banking sector, where smaller institutions are making their mark and challenging the traditional dominance of industry giants.

“Vietcombank Reports Flat Profit in Q1 2025 Despite Significant Cut in Provisions”

In the first quarter of 2025, the Joint Stock Commercial Bank for Foreign Trade of Vietnam, known as Vietcombank (HOSE: VCB), reported a slight increase in pre-tax profits, reaching nearly VND 10,860 billion, a 1% rise compared to the same period last year. This positive result is attributed to a significant reduction in provision for risks.