According to the report by the Governor of the State Bank of Vietnam to the National Assembly at the 9th session of the 15th National Assembly, this year will see the fundamental resolution of weak and underperforming banks and credit institutions, with a particular focus on preventing the emergence of any new weak banks.

The State Bank has issued mandatory transfer decisions for four banks: OceanBank, CB, GPBank, and Dong A Bank. This marks a significant step forward in the restructuring process of weak banking systems. As a result, the stability and safety of credit institutions have been maintained, and the legitimate rights of depositors have been protected.

The report also mentions that, based on the restructuring plan for SCB submitted by investors, the State Bank has submitted a report to the Government on the restructuring plan for this bank.

On April 18, the State Bank submitted a report to the Prime Minister, providing explanations regarding the opinions of Government members. Following Government Resolution 25, dated April 29, the State Bank is in the process of finalizing the SCB restructuring plan for submission to the competent authority for approval.

SCB has been under the control of the State Bank since the middle of October 2022.

In October 2022, the State Bank announced its decision to place SCB under special control to stabilize the bank’s operations. This is a professional measure in accordance with legal regulations, aiming to tightly control and limit negative impacts on the credit institution and the banking system as a whole.

As a result of this decision, SCB’s operations are now carried out under the supervision of the State Bank. Experienced and capable professionals from state-owned commercial banks (Vietcombank, BIDV, VietinBank, and Agribank) have been appointed by the State Bank to manage and operate SCB.

The report also states that joint-stock commercial banks are actively implementing restructuring plans approved by competent authorities. These banks are primarily focusing on comprehensive consolidation and rectification in terms of finance, governance, and operations to improve business efficiency and competitiveness.

The banks have been actively growing, expanding their scale, promoting credit and capital mobilization, and improving their repayment capacity and financial safety indicators. At the same time, they are also making efforts to address bad debts, enhance risk management, and improve loan quality, especially in high-risk areas.

Additionally, many banks are expanding their payment services, non-credit services, retail and consumer credit services, and diversifying their banking services.

As of February 2025, the bad debt ratio in the credit institution system (excluding five banks: MBV, GPBank, NCB Neo, Vikki Bank, and SCB) stood at 1.88%.

At the press conference on the banking sector’s performance in the first quarter, the Permanent Deputy Governor of the State Bank, Dao Minh Tu, shared insights regarding the restructuring solutions for SCB and the weak banks that were subject to mandatory transfers.

Mr. Tu stated that the State Bank is working on solutions, policies, and legal frameworks to intervene and ensure stability, first for weak banks, and then for the entire commercial banking system, as well as to maintain social order and security.

“SCB is one of the large-scale banks with significant total assets. Therefore, the solutions for its restructuring and handling require adequate capital. We are still working on a roadmap to restructure this bank step by step and are urgently studying solutions and mechanisms to facilitate its stabilization and recovery,” said the Deputy Governor.

Inter-Bank Shareholding: Circumventing Regulations Through Nominee Holders

The State Bank of Vietnam has highlighted the challenges in regulating cross-ownership among banks. The problem arises when shareholders and related parties deliberately conceal their ownership by nominating individuals or organizations to hold shares on their behalf, thereby circumventing the law.

“Post-AGM and Q1 Results: Navigating Investment Strategies Amid Tariff Turbulence”

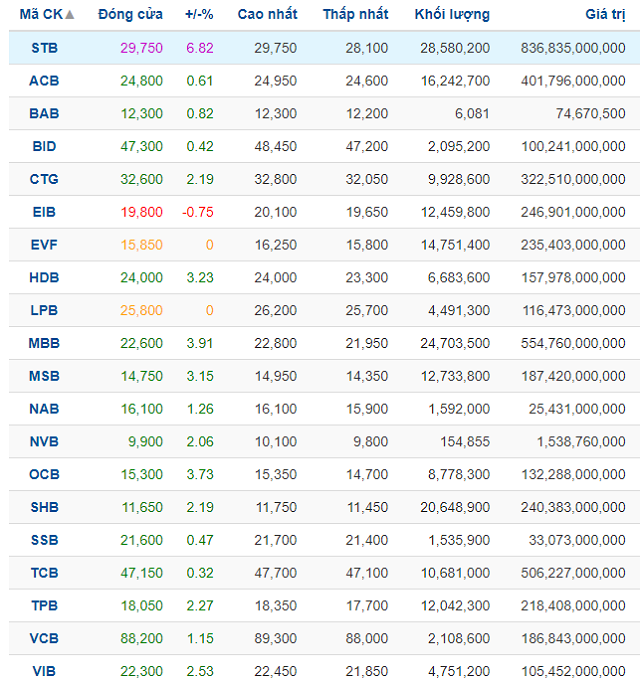

“As the AGM season and Q1 earnings reports draw to a close, investors have cause for optimism. Despite ongoing tariff tensions, Le Duc Tien, a Shinhan Vietnam Securities analyst, suggests that investors consider taking profits and monitoring policy developments on tariffs, rather than solely focusing on corporate news. This strategic shift is advised as expectations have been met and further policy moves may impact the market dynamic.”

The Challenges Faced by the State Bank of Vietnam in Addressing Cross-Ownership Issues

The challenges faced by the State Bank Governor in addressing cross-ownership and manipulative ownership in credit institutions are significant.