The private sector plays a pivotal role

Ho Van Long – Deputy General Director and Director of Retail Banking VIB shared at the event on the morning of 05/08/2025.

|

Mr. Ho Van Long – Deputy General Director and Director of Retail Banking VIB stated that the private sector – in which SMEs account for 98% of the total number of enterprises – always plays a pivotal role in the socio-economic development of Vietnam. This sector currently contributes more than 50% of GDP, 30% of the state budget revenue, and creates more than 40 million jobs, equivalent to more than 82% of the country’s labor force.

The potential of this dynamic economic sector is not yet commensurate with its development capacity and the support of all sectors, including the banking industry, the information technology industry, the tax and customs management agencies, and other support to promote the private economy, especially SMEs.

However, to develop rapidly and sustainably in both scale and quality, the SME community still faces many difficulties and challenges, especially in accessing capital, improving governance, and digital transformation.

First, more than 42% of businesses face difficulties in accessing credit; having a stable source of capital at a reasonable cost, and accessing capital for businesses is currently very challenging.

Second, in the trend of digital transformation, competitive ability in the digital field is the core capacity that private enterprises and SMEs are facing.

Third, in the context of limited capital and a strong desire to develop business, financial management capacity and mechanisms for managing spending and cash flow after business are not optimized.

Although there are many challenges, the current economy also offers many opportunities for SMEs with the support of the State in promoting the development of the private sector, new tax policies in the domestic market, or value-added tax refund policies. On March 25, 2025, the Prime Minister also issued Directive No. 10/CT-TTg on promoting the development of SMEs. Accordingly, by 2030, there will be at least 1 million new enterprises, while promoting supportive infrastructure, improving access to finance, credit, and human resources for SMEs.

The current picture of SMEs

Speakers shared at the event

|

Mr. Gareth Parrington – Senior Director of Visa assessed that Vietnam is undergoing a significant transformation in its payment ecosystem, with an increasing number of digital transactions. Key developments include the rise of contactless payments. By the end of 2020, more than 75% of face-to-face transactions on Visa cards in Vietnam were contactless, and e-wallets were widely used by over 80% of consumers. This reflects users’ preference for cashless payment methods.

In addition, it is worth mentioning the government’s policy of promoting digitization. The government is implementing a policy to encourage cashless payments and financial inclusion, aiming for 80% of the population aged 15 and over to have a bank account by 2025.

Economic trends that will affect SMEs this year. First, outstanding economic growth, with GDP expected to grow by 6.5% in 2025, driven by strong domestic demand and increased foreign direct investment. E-commerce is predicted to reach 32 billion USD by 2025, benefiting SMEs through online channels. This trend will also affect SMEs this year.

Second, improvements in payment technology. The adoption of real-time payments (API open banking) and the development of embedded payments in platforms such as accounting and billing systems benefit SMEs in transaction management.

Third, focusing on financial inclusion, such as pilot programs for unbanked population groups, and access to digital services also expands the potential customer base for SMEs. Card payments are also being introduced with security for businesses.

Common challenges when businesses approach financial solutions

According to a nationwide survey by Visa of 600 micro, small, and medium-sized enterprises aged 26-55. The results show the main challenges facing SMEs. First is the limitation in accessing finance, creating a barrier to growth. Finance is the second biggest challenge after business operations. Time-consuming processes and procedures create bottlenecks in payment and credit procedures.

In addition, there are also challenges in payments, such as the lack of separation between personal and business expenses. While most SMEs use cards as a means of payment, they lack the tools to manage and separate them. The card usage rate will increase if SMEs are offered programs with better credit terms, foreign exchange support, and cost management tools.

Most micro, small, and medium-sized enterprises still rely on credit to develop but face barriers due to complicated procedures and documentation, although digital platforms for credit extension have emerged, most still follow traditional methods.

The rate of adoption of digital payment acceptance is high. More than 40% of SMEs accept card payments from customers, and more than two-thirds of businesses recognize the positive impact of digital payments, such as increased revenue, simpler management, and higher security. Therefore, SMEs also want simple, safe, and secure payment acceptance solutions.

Mr. Ho Van Long shared that, understanding the pivotal role of SMEs in the Vietnamese economy and the challenges in accessing and managing finances, VIB has also designed a comprehensive financial solution to accompany and bring optimal benefits to the SME community. The solution offers three products that meet the needs of capital, cost management, and payment for businesses: VIB Business Card credit card, VIB Business Loan supplemental working capital loan package, and VIB Business digital banking.

With the demand for working capital loans from businesses, the maximum loan limit is up to VND 150 billion, competitive interest rate from 6.7%/year, loan ratio up to 90% of the value of collateral. Timely and abundant capital sources help businesses take the initiative in production and business activities and seize opportunities to expand the market.

– 15:45 05/08/2025

“HDBank Records Over VND 5,350 Billion in Q1 Profit, Launching Vietnam’s Premier Financial Banking Group”

HDBank, listed on the Ho Chi Minh City Stock Exchange (HOSE: HDB), has announced impressive first-quarter results for 2025, solidifying its position as one of the top-performing banks in the industry.

“Vĩnh Phúc’s Economic Surge: Surpassing 11.6 Trillion VND in State Budget Revenue”

Amidst a volatile international economic landscape, Vinh Phuc province has achieved a remarkable feat by surpassing the 11.6 trillion VND mark in state budget revenue within the first four months of 2025. This outstanding outcome is a testament to the provincial leadership’s relentless, agile, and innovative governance, heralding a promising path toward sustainable growth.

Digital Transformation for All: A Comprehensive Initiative for Thanh Hoa Province

The “Digital Literacy for All” movement, initiated by Thanh Hoa, aims to bridge the digital divide by empowering all citizens with essential digital skills and knowledge. This ambitious initiative strives to foster a comprehensive digital society, ensuring that no one is left behind in the digital era.

The Art of Trimming: How UOB’s Deputy Chairman Envisions the Bank’s Strategy Through the Lens of a Bonsai Gardener

“The Art of Bonsai: Nurturing Slow, Steady, and Sustainable Growth”

This ancient art form, with its meticulous attention to detail and long-term vision, reflects UOB’s commitment to Vietnam. Like the careful cultivation of a bonsai tree, UOB’s approach to investment in the country is one of patience, precision, and a dedication to enduring success.

Mr. Wee Ee Cheong, Deputy Chairman, and CEO of UOB, encapsulates this philosophy, emphasizing the bank’s belief in a steady and sustainable future for Vietnam.

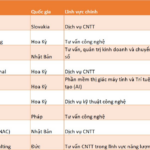

A String of FPT’s Overseas M&A Deals: Nearly Half are US-Based Companies

Since its inaugural deal in 2014, FPT has been relentlessly extending its reach, engaging in a series of strategic investments and acquisitions. Through these ventures, the company has bolstered its global presence and enhanced its competitive edge on an international scale.