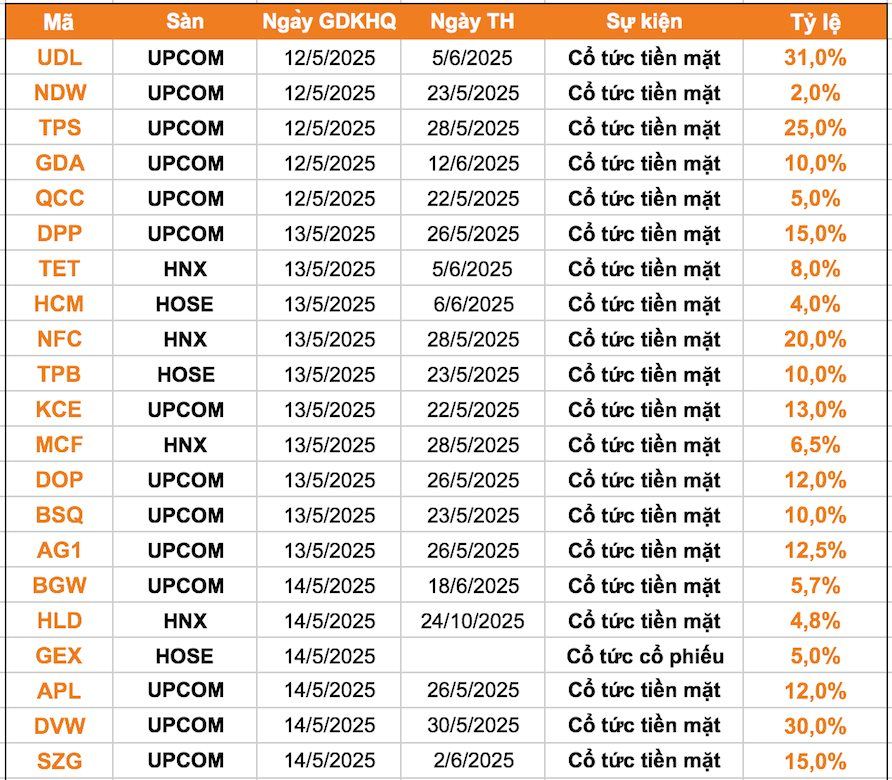

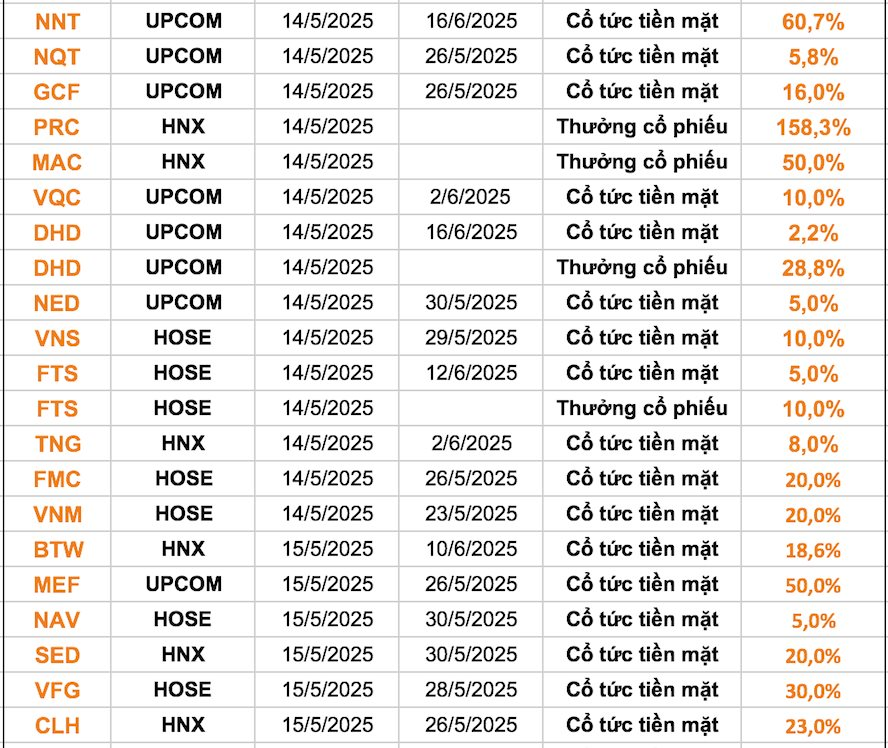

According to statistics, 51 companies announced dividend lock-in during the week of May 12-16, with 46 companies paying dividends in cash. The highest dividend rate was nearly 61%, while the lowest was 2%.

Additionally, two companies paid dividends in stocks, three offered bonus shares, and one distributed a mixed dividend.

Sunburst with sectors representing the distribution of dividend payout ratios among the 51 companies. The majority fall within the range of 2-10%.

Bar chart illustrating the dividend payout ratios of the top 10 companies. TPBank stands out with a high dividend rate of 57.14%.

Table listing the companies offering the highest dividend rates, with TPBank at the top, followed by Vinamilk and FPT Securities.

On May 14th, Tien Phong Commercial Joint Stock Bank (TPBank, code: TPB) will finalize its list of shareholders to distribute dividends from undistributed profits after establishing funds up to December 31, 2024.

TPBank plans to pay a 10% cash dividend, meaning that for each share owned, shareholders will receive VND 1,000. The ex-rights date is set for May 13th, and dividend payment is expected to be made on May 23rd. TPBank estimates to disburse approximately VND 2,642 billion for this dividend payout.

Vinamilk (code: VNM) also announced the record date for the first part of its 2024 cash dividend. On May 15, 2025, Vinamilk will finalize its shareholder list to distribute a 20% dividend, equivalent to VND 2,000 per share.

The expected payment date is May 23, 2025. With nearly 2.09 billion shares in circulation, Vinamilk is projected to disburse approximately VND 4,180 billion for this payout.

On May 15th, FPT Securities Joint Stock Company (code: FTS) will finalize its shareholder list for the 2024 dividend payout and issue bonus shares to increase capital from owner equity.

The company will distribute a 5% cash dividend, which means that for each share owned, shareholders will receive VND 500. With approximately 306 million listed and circulating shares, FPT Securities will disburse roughly VND 153 billion in dividends to its existing shareholders. The expected dividend payment date is June 12th.

Simultaneously, the company plans to issue approximately 30.6 million bonus shares at a ratio of 10:1, meaning that for every 10 shares owned, shareholders will receive one new share. The capital source for this issuance is the undistributed post-tax profit as of December 31, 2024, as stated in the audited 2024 financial statements.

Hai Phong Funeral Service Joint Stock Company (stock code CPH) has announced that May 16, 2025, is the ex-rights date for its 2024 cash dividend payout. The payout ratio is set at 19.6% (equivalent to VND 1,960 per share). With CPH’s market price hovering around VND 300 per share, this dividend payout is remarkably higher than the stock’s market price.

With 4.4 million shares in circulation, the company estimates to disburse nearly VND 8.6 billion for this dividend.

Vietnam Disinfection Joint Stock Company (code: VFG) announced that May 16th is the record date for the final 2024 cash dividend payout, with a payout ratio of 30% (VND 3,000 per share). This is also the highest dividend payout in the company’s history if calculated per period. The expected payment date is May 28, 2025.

Including the previous two dividend payouts, VFG shareholders will receive a total dividend ratio of 50% for 2024, equivalent to VND 5,000 per share, which is unprecedented in the company’s operational history.

With over 41.7 million circulating shares, VFG estimates to disburse approximately VND 125 billion for this dividend payout.

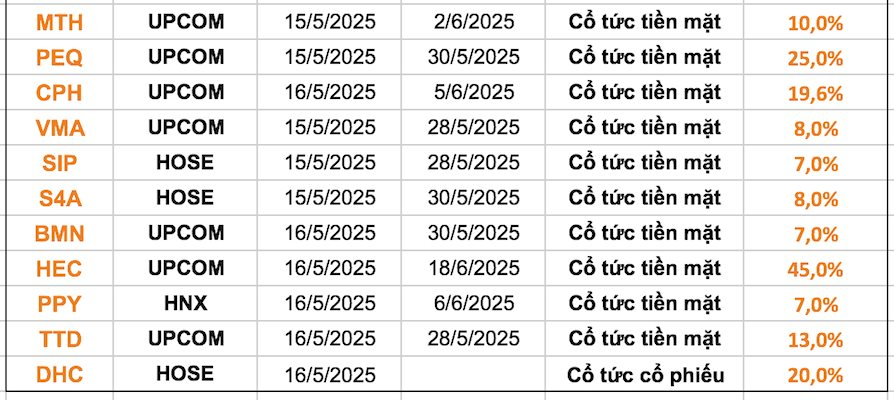

Water Resources Construction Consulting Joint Stock Company No. 2 (code: HEC) will finalize its shareholder list on May 19th to distribute 2024 dividends in cash. The payout ratio is set at 45%, meaning that for each share owned, shareholders will receive VND 4,500. The expected payment date is June 18, 2025.

With 6 million circulating shares, Water Resources Construction Consulting Joint Stock Company No. 2 plans to disburse approximately VND 27 billion for this interim dividend payout to its shareholders.

“A Company is About to Pay a Jaw-Dropping 65-Bagger Dividend in Cash”

In 2025, the company forecasts a revenue of 120 billion, with a projected 9,000 cremations and 50 burials.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)