On July 1st, Vietnam’s leading beverage company, Sabeco (code: SAB), will finalize its shareholder list to distribute a 30% cash dividend for the year 2024 (VND 3,000 per share). The payment is expected to be made by July 31st, 2025. With approximately 1.3 billion shares outstanding, Sabeco is set to pay out over VND 3,900 billion in this dividend round.

Vietnam Beverage, a member of Thai billionaire Charoen Sirivadhanabhakdi’s Thaibev, holds a 53.59% stake in Sabeco and will receive nearly VND 2,100 billion in dividends. The State Capital Investment Corporation (SCIC), with a 36% stake, is also set to collect nearly VND 1,400 billion.

Earlier in January 2025, Sabeco had paid an interim cash dividend for the first phase of 2024 with a rate of 20%. With these two dividend payments, the total dividend for 2024 reached 50%, fulfilling the plan approved at the 2025 Annual General Meeting of Shareholders.

In terms of business plans, Sabeco aims to maintain a 50% dividend payout ratio for 2025 and has set financial targets of VND 44,819.1 billion in revenue, a 9% increase, and VND 4,835 billion in after-tax profit, an 8% rise compared to the previous year.

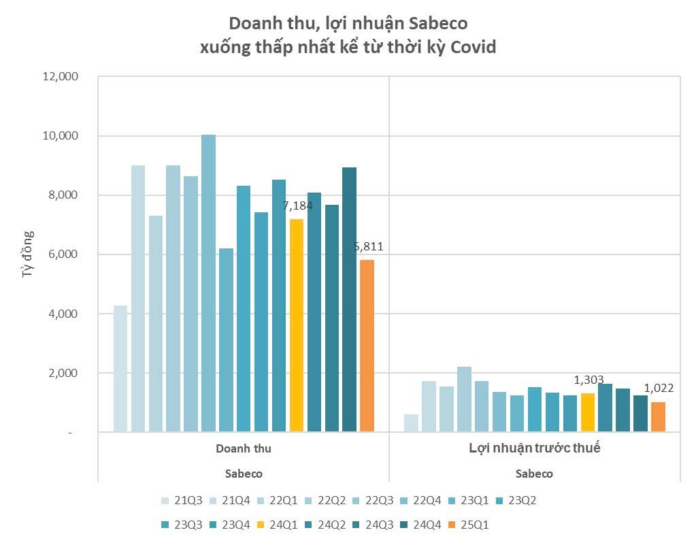

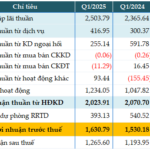

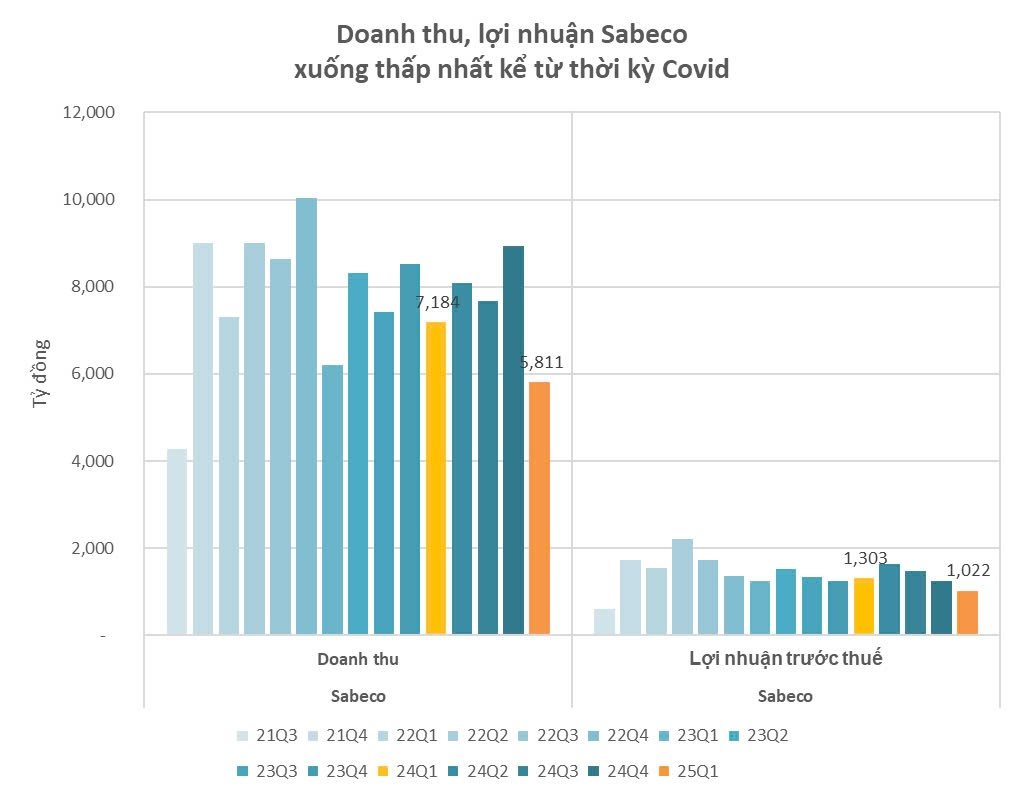

For the first quarter of 2025, Sabeco reported a 19% year-on-year decrease in net revenue to VND 5,811 billion. Despite an improved gross profit margin of 32.2% (up from 29.2% in Q1/2024) and a slight 5% reduction in sales expenses, the most significant cost for Sabeco, the substantial decline in net revenue led to a 22% drop in pre-tax profit to VND 1,022 billion. Net profit also fell by 20% to VND 793 billion. Both revenue and profit reached their lowest levels since Q4/2021.

Attributing the decline in numbers, Sabeco cited lower revenue compared to the previous year due to decreased output resulting from intensified competition and the impact of Decree 168 on traffic order and safety violations.

Additionally, the consolidation of Bia Binh Tay Group as a subsidiary since January 3, 2025, instead of an associate as in 2024, influenced the lower revenue in Q1/2025, as it incurred special consumption tax for the group.

The financial results were also impacted by reduced interest income and increased financial expenses related to the acquisition of Bia Binh Tay Group (VND 85 billion), along with higher administrative expenses, partially offset by improved results from joint ventures and decreased sales expenses.

As of March 31, 2025, Sabeco’s total assets slightly decreased from the beginning of the year to VND 31,619 billion. Cash and cash equivalents, including short-term deposits, accounted for nearly 2/3 of the total, amounting to nearly VND 20,300 billion. As of the end of the first quarter, accumulated undistributed profit after tax stood at nearly VND 9,980 billion.

In the stock market, SAB shares closed at VND 47,850 per share on May 6th, 2025.

Unlocking Profitability: MSB’s Strategic Cost-Cutting Measures Yield Fruitful Results, with Q1 Pre-Tax Profits Soaring to VND 1,631 Billion, a 7% Increase

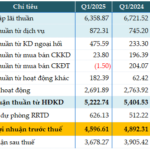

In the recently released consolidated financial statements for the first quarter of 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) reported a remarkable performance with a pre-tax profit of nearly VND 1,631 billion, reflecting a 7% increase compared to the same period last year. This impressive growth can be attributed to the bank’s effective management of credit risk provisions.

“Vĩnh Phúc’s Economic Surge: Surpassing 11.6 Trillion VND in State Budget Revenue”

Amidst a volatile international economic landscape, Vinh Phuc province has achieved a remarkable feat by surpassing the 11.6 trillion VND mark in state budget revenue within the first four months of 2025. This outstanding outcome is a testament to the provincial leadership’s relentless, agile, and innovative governance, heralding a promising path toward sustainable growth.

The Business Highlights of SCIC’s 2025 Annual General Meeting

The government’s ambitious 8% GDP growth target sets a challenging yet achievable goal for businesses in a year of anticipated economic hurdles. The determination to strive towards this target was evident in the recent round of shareholder meetings, with enterprises partially or wholly owned by the State Capital Investment Corporation (SCIC) leading the charge.