Global fertilizer demand is projected to continue growing, while supply tightens

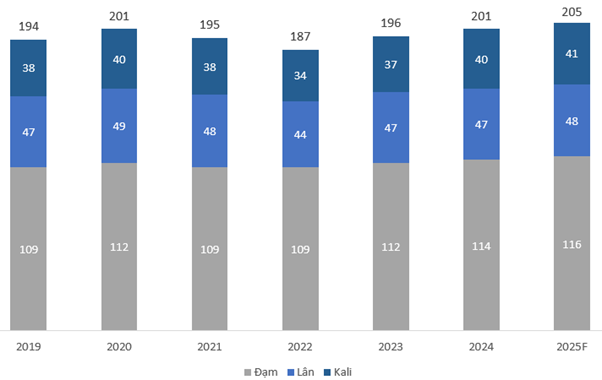

Forecasts by the International Fertilizer Association (IFA) indicate that global fertilizer consumption is expected to increase by 2.5% in 2024 and 2.2% in 2025. Total consumption is projected to reach 205 million tons in 2025, significantly higher than the previous record of 201.5 million tons in 2020.

Global Fertilizer Consumption in the 2019-2025F

(Unit: Million Tons)

Source: IFA

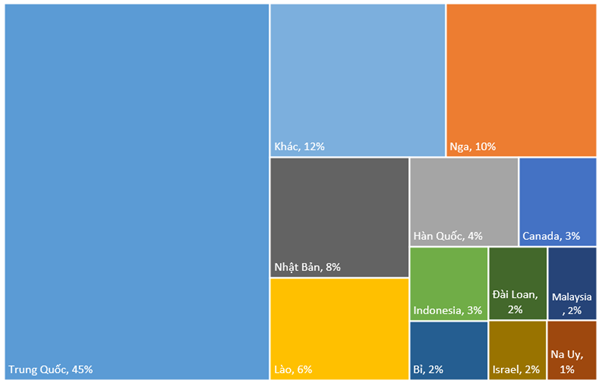

In addition, the global fertilizer supply continues to tighten as China and Russia maintain their export restrictions. This also presents an opportunity for domestic fertilizer producers to expand their export markets, leveraging their production capabilities to increase value and assert their position in the international market.

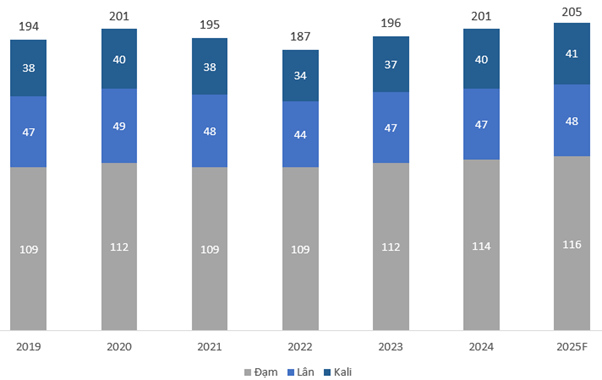

Fertilizer Export Market Share by Country in 2024

(Unit: Percent)

Source: VITIC

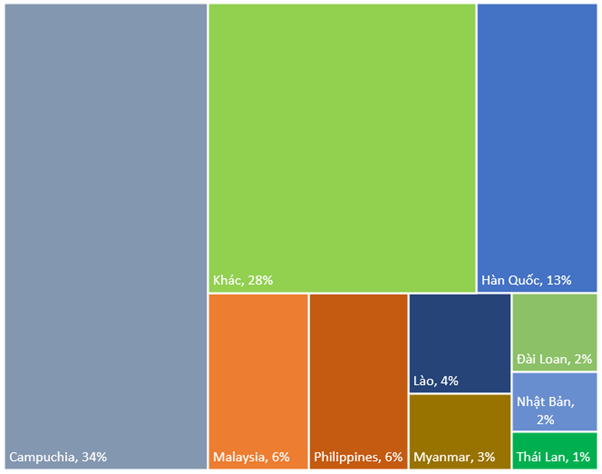

Fertilizer Import Market Share by Country in 2024

(Unit: Percent)

Source: VITIC

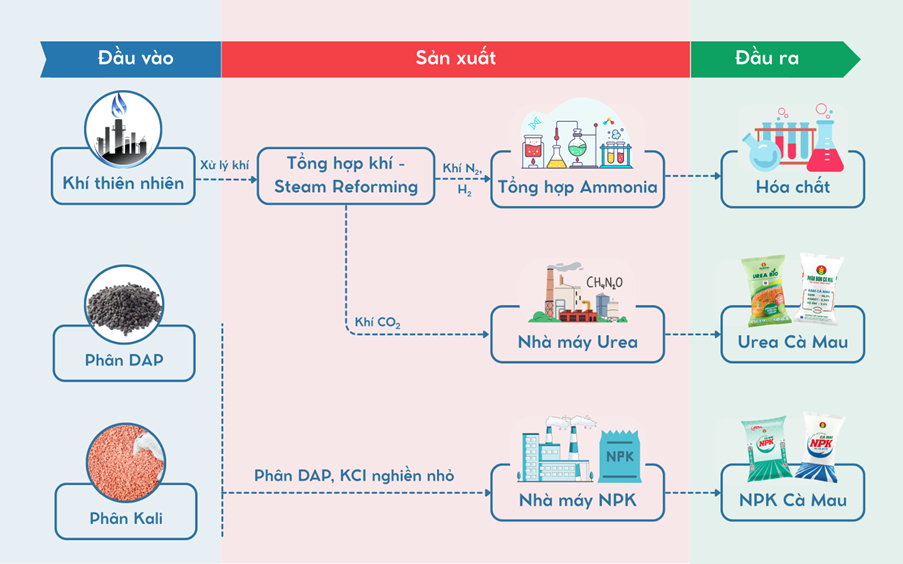

Value Chain of the Vietnam Fertilizer Industry

Source: Vietstock

Low raw material prices reduce production costs

Urea and natural gas prices have fallen significantly since their peak in 2022 and have remained low since the beginning of 2024. This has considerably reduced production costs, especially for businesses with a high proportion of raw material costs such as DCM. This helps control costs while the recovery of the fertilizer industry and increasing domestic consumption also create additional growth momentum for the business in 2025.

Urea Price Movement in the 2021-02/2025 period

(Unit: USD/Ton)

Source: Tradingview

Natural Gas Price Movement in the 2021-02/2025 period

(Unit: USD/MMBtu)

Source: Tradingview

The Lot B – O Mon project is a driving force in ensuring a gas supply for DCM

The Lot B – O Mon project is one of the key offshore natural gas exploitation projects in Vietnam, aiming to provide gas to power plants in the O Mon area (Can Tho) and industrial consumers, including DCM. Against the backdrop of declining reserves from the PM3-CAA mine, Lot B – O Mon is expected to ensure a stable supply for DCM, helping the company maintain production and reduce the risk of long-term raw material shortages.

Currently, the project has not yet reached a final investment decision (FID) due to some legal and policy issues. However, given the project’s importance to national energy security, the involved parties have flexibly implemented several critical packages of the project chain even before the FID. This not only reflects their determination to accelerate progress but also sets the stage for DCM to stabilize its raw material sources, expand production, and increase exports in the future.

Source: Vietnam Energy

Enterprise Analysis Department, Vietstock Consulting

– 08:40 24/04/2025