Brent Crude Oil Price Outlook and Its Impact on DCM’s Input Costs

According to the U.S. Energy Information Administration (EIA), the average Brent crude oil price is expected to decrease by 8% to $74 per barrel in 2025 and further decline by 11% to $66 per barrel in 2026, due to the widening global supply and demand imbalance.

However, in early April 2025, the Trump administration unexpectedly imposed retaliatory tariffs on the U.S.’s trading partners, causing Brent crude oil prices to drop deeper than predicted, breaking below the November 2021 low (around $68.5-76 per barrel). This reflects heightened concerns about geopolitical and trade risks.

In this context, DCM may benefit as the company purchases its input gas from PVN, with prices referenced to Brent crude oil prices. Lower oil prices will help reduce production costs, improve profit margins, and enhance business efficiency.

Brent Crude Oil Price Movement in 2021-Q4 2025

(Unit: USD/barrel)

Source: Investing

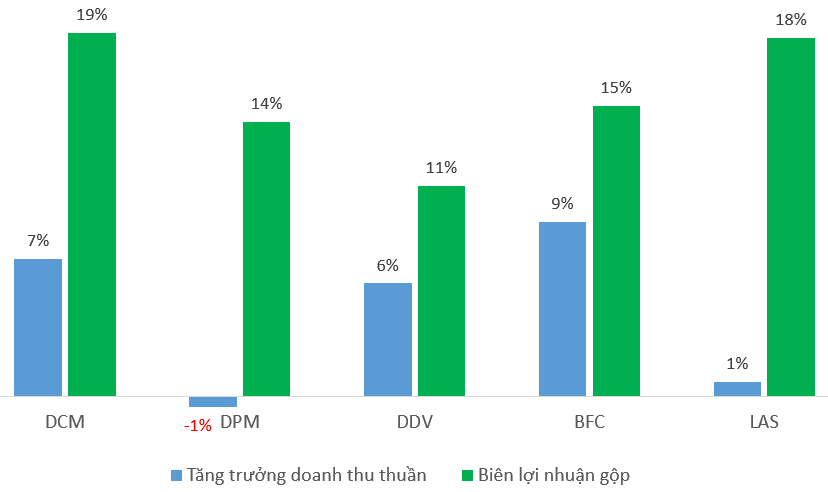

Demonstrating Superior Business Efficiency

As seen in the figure below, DCM boasts the highest gross profit margin at 19%, reflecting efficient business operations. Closely following is LAS with 18%, also indicating impressive profitability. BFC and DPM achieved gross profit margins of 15% and 14% respectively, both considered positive.

In terms of revenue growth, although LAS recorded only a slight 1% increase, it maintained a high gross profit margin, showcasing effective cost control. Meanwhile, DCM not only leads in profit margin but also achieved a 7% revenue growth, demonstrating balanced development in both scale and operational efficiency.

Revenue Growth and Gross Profit Margin of Fertilizer Companies in 2024

(Unit: Percentage)

Source: VietstockFinance

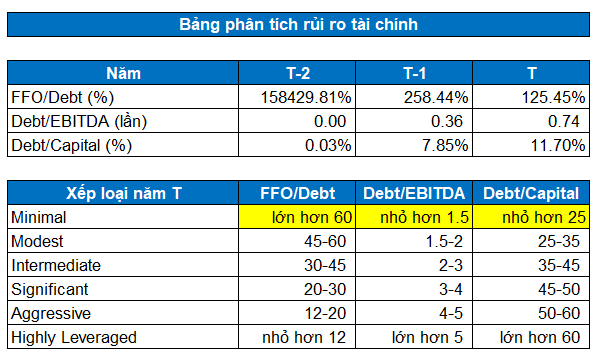

Financial Risk Remains Minimal

According to S&P’s financial risk assessment standards, DCM’s FFO/Debt, Debt/EBITDA, and Debt/Capital ratios, while gradually increasing, remain at a very low-risk level (Minimal). This reflects the company’s strong financial foundation and its ability to effectively manage leverage and cash flow, even amid rising debt.

The fact that these ratios remain within the safe range affirmed by S&P underscores DCM’s proactive and sustainable financial risk management capabilities.

Source: VietstockFinance

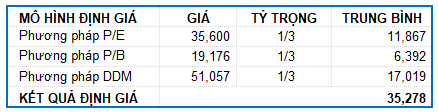

Stock Valuation

The author uses the Market Multiple Models (P/E, P/B) in conjunction with the DDM (Dividend Discount Model), giving equal weight to each. The fair value of DCM stock is determined to be 35,278 VND. Thus, the market price is quite attractive for long-term investment goals.

Enterprise Analysis Division, Vietstock Consulting

– 09:00 06/05/2025

Record-Breaking Profits for Rubber Group Since 2012

The rubber price surge in Q4 has led to impressive revenue and profit figures for the Vietnam Rubber Group (HOSE: GVR), with results showing the highest figures in over a decade.

The Shared Trait of Starch Sellers on the Stock Market

The resilient, multi-year upward trajectory of two cassava starch companies, APFCO (UPCoM: APF) and CAP (HNX: CAP), has been abruptly halted by regressive business results.

The Mighty Makeover: “Camau Protein’s Quarterly Profit Plunge: Hoarding a Staggering $9,000 Billion in Cash”

The explanation provided in the consolidated financial statements attributes the almost 63% increase in profit to the reduction in cost of goods sold, which outpaced the decrease in revenue. Additionally, this year’s revenue deductions were significantly lower than those of the previous year, contributing to the substantial growth in profit.