“A Rocky April for Vietnam’s Stock Market: Navigating Tariff Turbulence”

It’s important to note that the market experienced a turbulent April following tough statements on tariff policies by the Donald Trump administration, with Vietnam being one of the most prominent countries on the list facing taxes when exporting goods to the US.

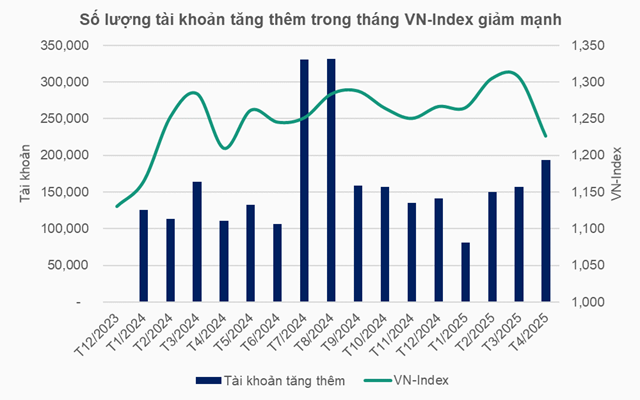

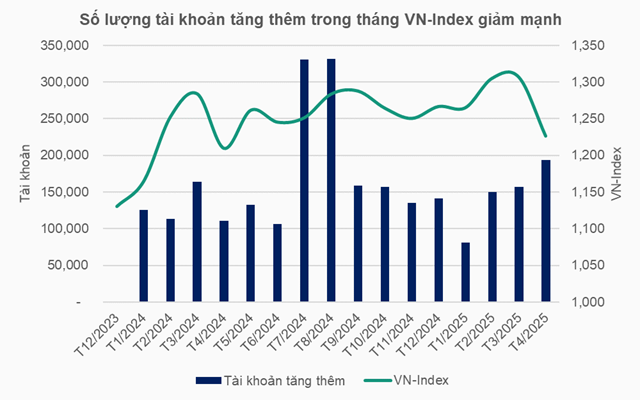

The VN-Index, which was trading above the 1,300-point threshold, suddenly lost the 1,100-point mark in just four sessions. More positive signals began to emerge in the latter half of April, allowing the market to close the month at 1,226.3 points.

With the market discounting to attractive valuation levels, it seemed that investors sensed an opportunity. A total of 194,023 new accounts were opened in April, surpassing the March figure of 157,380. When considering a longer time frame, the number of new accounts in April was the highest in the past eight months.

Source: VSDC, VietstockFinance, Author’s Compilation

|

The increase was predominantly driven by domestic individual investors, who opened 193,948 new accounts, while domestic institutional investors added 101 accounts.

In terms of foreign investors, there was a decrease of 26 accounts, resulting from a drop of 52 accounts held by individual investors. The last time foreign investor account numbers declined month-over-month was in September 2022.

During April, foreign investors recorded the strongest net selling since the beginning of 2025, totaling over VND 13.4 trillion, bringing the four-month cumulative net selling to nearly VND 39.3 trillion.

– 23:59 09/05/2025

Technical Analysis for May 9: Market Sentiment Turns Cautious

The VN-Index and HNX-Index both witnessed a decline in points, and with no significant improvement in liquidity during the morning session, it indicates that investors are exercising caution in their trading activities.

SSI Research: Positive Trade Negotiation Developments to Spur Market Recovery

The SSI Securities Analysis Department’s strategic report highlights the need for positive developments in trade negotiations to sustain the market’s recovery momentum. The current blended P/E ratio remains low, and the estimated one-year market yield is attractive compared to deposit interest rates.

Market Beat: VN-Index Sees Extended Tug-of-War as Caution Prevails

The market closed with the VN-Index down 2.5 points (-0.2%), settling at 1,267.3. The HNX-Index followed suit, dropping 1.08 points (-0.5%) to 214.13. The day’s trading saw a slight tilt towards decliners, with 396 stocks falling against 353 advancing. The VN30 basket mirrored this trend, showing a sea of red with 15 decliners, 8 gainers, and 7 stocks holding steady.

Stock Market Week May 5-9, 2025: Powerful Breakthrough

The VN-Index concluded a highly positive week of trading, recording gains in 4 out of 5 consecutive sessions and surpassing the 200-day SMA. The resumption of net foreign buying was a key factor in supporting this upward momentum. If this trend persists into the next week, coupled with stronger market participation, the VN-Index is poised to further consolidate and extend its gains.