Source: HNX

|

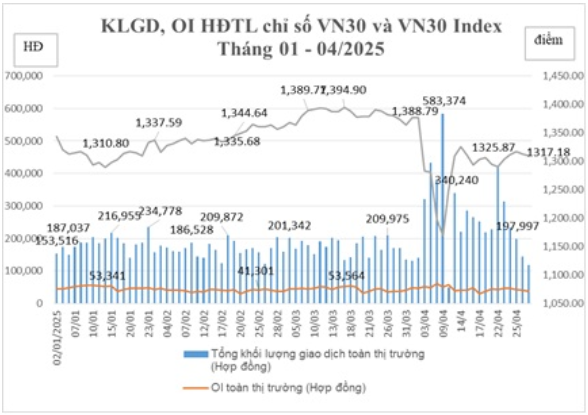

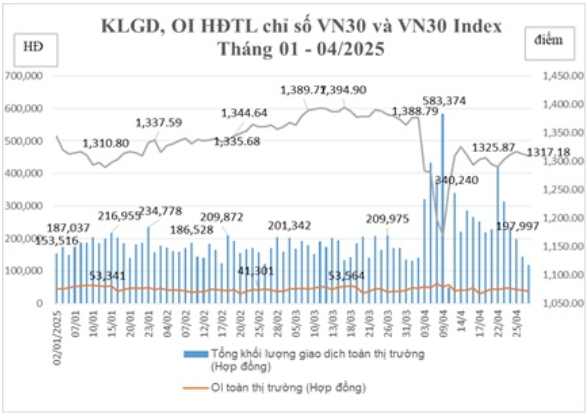

The average trading volume of the VN30 index futures contract reached 263,995 contracts per session, a 51% increase. This corresponded to an average trading value of VND 33,700 billion per session (in notional contract value), a 40% rise compared to the previous month. Notably, the trading session on April 9 witnessed the highest trading volume of the month with 583,374 contracts, 2.8 times higher than the highest volume in March and the highest since 2023.

Open interest stood at 37,707 contracts in the last trading session of the month, a 9% decrease from the previous month.

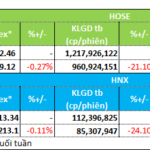

In terms of investor composition, proprietary trading of securities derivatives by securities companies accounted for 2.4% of the total market, slightly up from 2.3% in March 2025. Meanwhile, foreign investors’ trading volume decreased slightly, accounting for 2.7% of the total trading volume in the market.

|

Summary of VN30 Index Futures Contracts

Source: HNX

|

There were no transactions in the government bond futures contracts during April 2025.

The number of securities derivatives trading accounts continued to grow in April 2025, surpassing 2 million accounts at the end of the month, a 2.5% increase compared to the end of March 2025.

– 10:06 05/08/2025

The Big Money Rush: Stocks Soar as VN-Index Recovers from Tariff Trauma

The lethargic morning trading pace took an unexpected turn within the first 15 minutes of the afternoon session. Leading stocks, notably FPT, witnessed a dramatic surge in volume, swiftly triggering a frenzied buying spree. HoSE’s afternoon matching volume skyrocketed by 66% compared to the morning session, with the VN-Index closing at its strongest gain in 16 sessions.

The Cautious Sentiment Returns

The VN-Index witnessed a significant decline, with trading volume dipping below the 20-day average, reflecting investors’ extremely cautious sentiment. The index is currently retesting the old peak from November 2024 (1,195-1,215 points), which also coincides with the bottom established at the beginning of 2025. If the index sustains these levels, the outlook remains relatively optimistic. Additionally, the MACD indicator is poised to generate a buy signal as the gap with the signal line narrows. Confirmation of this buy signal would alleviate short-term downside risks.

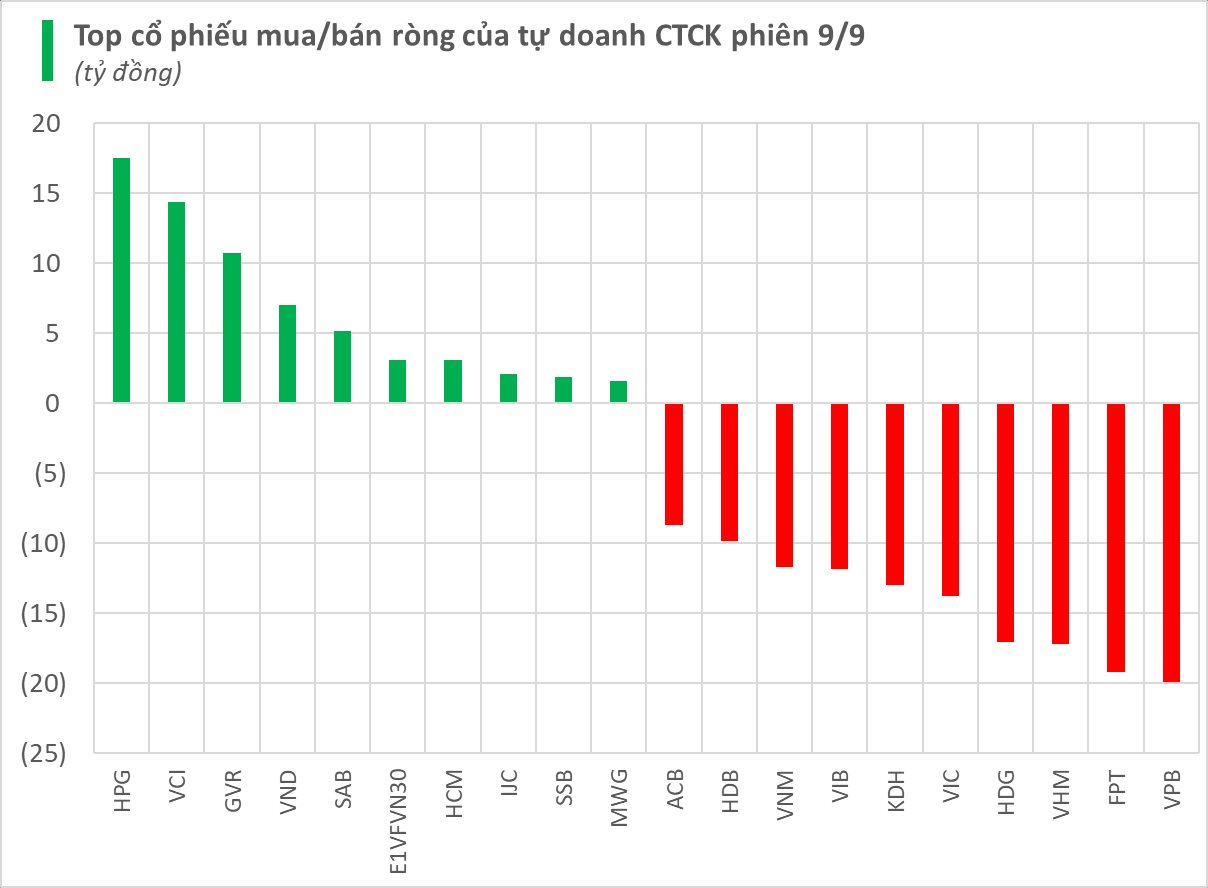

The Cash Flow Conundrum: Unraveling the Capital Retreat in Real Estate Stocks

Last week saw a notable decline in transactions, with a significant outflow of funds from the real estate sector. Smaller and mid-cap stocks also suffered a similar fate, experiencing a withdrawal of investment funds.