According to the new land price table

Ms. T.H. (from Cu Chi district) stated that on October 25, 2024, she went to the Department of Reception and Return of the People’s Committee of Cu Chi district to submit a dossier for changing the purpose of using more than 50sqm of agricultural land to residential land. The expected result date was November 11, 2024. When the due date arrived, she was shocked to receive a notice to pay land use fees amounting to over VND 2.6 billion.

She sent a petition to the People’s Committee of Cu Chi district and the Cu Chi District Tax Department (now the Cu Chi District Tax Team), requesting to consider applying Decision 02 instead of Decision 79, as she had submitted her dossier before Decision 79 took effect. However, the authorities responded that the time for calculating land use fees is determined from the time the tax agency receives the dossier for collection. The amount to be paid was too high, and she was worried that if she did not pay in full within 30 days, she would be charged a late payment interest rate of 0.03%/day, so Ms. T.H. had to request to cancel the decision to change the purpose of using the above-mentioned land.

In a similar situation, Mr. N.K. (from Tan Thanh Dong commune, Cu Chi district) heard about the new land price table and on October 30, 2024, he submitted a dossier to convert nearly 960sqm of agricultural land to residential land. His dossier was received by the Department of Reception and Return of the People’s Committee of Cu Chi district, and he was given a receipt for November 14, 2024, to receive the results.

But it wasn’t until two months later that he received a notice to pay land use fees. According to the new land price table, he had to pay more than VND 4.3 billion, while according to his calculations based on the old price table, he would only have to pay less than VND 500 million. Believing that the determination of the time point for financial obligations was unreasonable, Mr. N.K. decided to leave the dossier and filed a complaint.

Recorded in some other localities, there were also cases of people withdrawing their dossiers because the amount of money to be paid was too high. Mr. Lai Phu Cuong, Head of the Natural Resources and Environment Office of Binh Tan District, said that since the application of the new land price table, the district has received about 100 dossiers for changing the purpose of land use. However, about 10 cases withdrew their dossiers because the land use fee increased compared to the initial expectation of the people. Most of the cases that withdrew the dossier for changing the purpose of land use had large land areas and high amounts of money to be paid.

Mr. Vo Phan Le Nguyen, Vice Chairman of the People’s Committee of Nha Be district, said that from October 31, 2024, to now, the district has received 28 dossiers for changing the purpose of land use, of which 3 dossiers requested cancellation because they were unable to pay the land use fee.

“The tax agency cannot do otherwise”

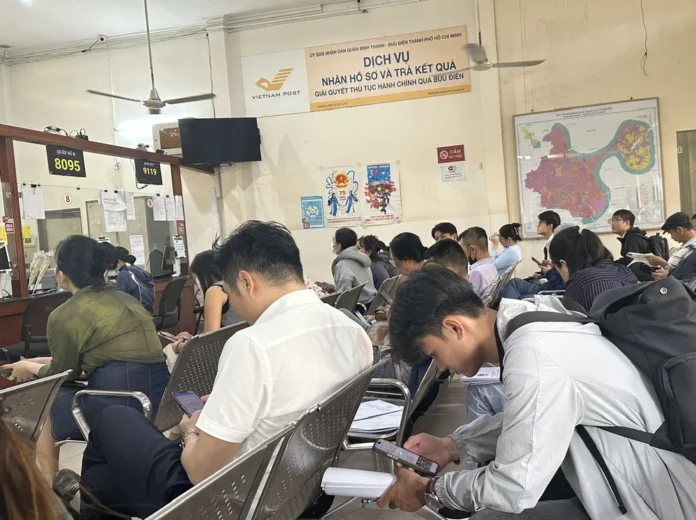

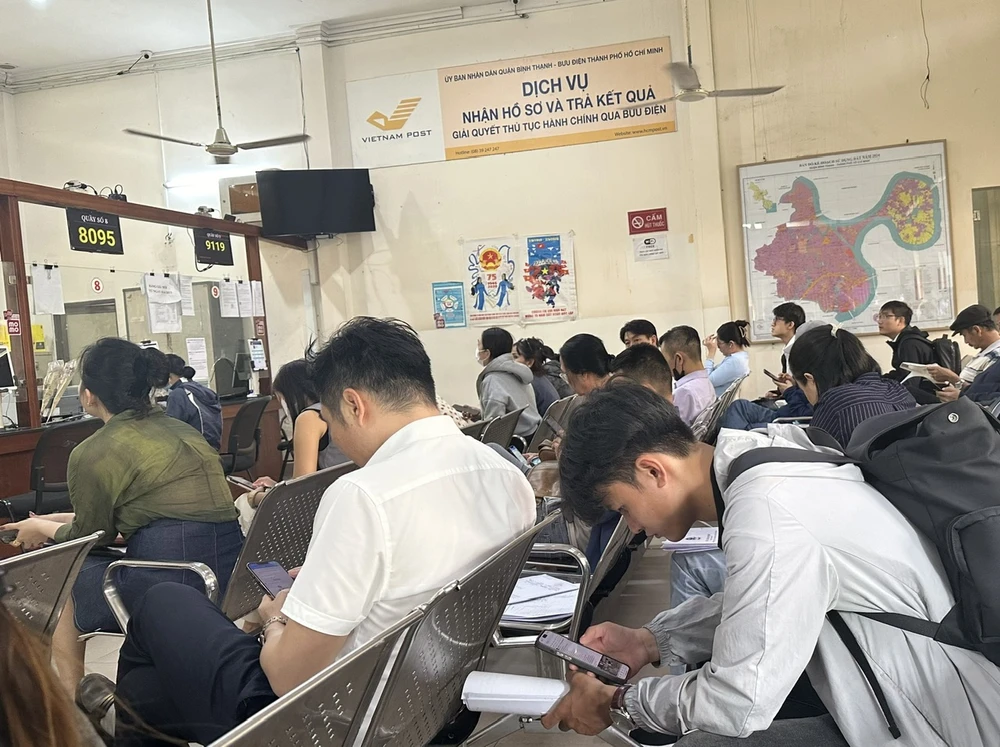

Recorded in Cu Chi district, there were more than 60 cases of people submitting reflections, suggestions, and complaints related to the application of the new land price table when calculating land use fees. On February 21, the leader of Ho Chi Minh City Tax Department (now Branch Tax Office II) chaired a direct dialogue with the people in Cu Chi district.

To avoid generating more complaints, the People’s Committee of Cu Chi district has proposed to the People’s Committee of Ho Chi Minh City and the Department of Natural Resources and Environment to guide the application of Clause 3, Decision No. 79 for dossiers for changing the purpose of land use that have been fully and properly received by the People’s Committee before October 31, 2024.

Talking to Saigon Liberation Newspaper reporter, a representative of the Department of Natural Resources and Environment said that Clause 3, Article 155 of the 2024 Land Law stipulates the time to calculate land use fees is the time when the State allows the conversion of land use purposes. Thus, for dossiers for changing the purpose of land use before October 31, 2024, the time to determine the calculation of land use fees is the time of receiving the dossier for collection, not the time of submitting the dossier for changing the purpose of land use.

Similarly, Ho Chi Minh City Tax Department also cited information about the time to calculate land use fees, which must be based on the time of the decision to change the purpose of land use, according to Clause 3, Article 155 of the Land Law. For dossiers that people submitted before October 31, 2024, but the decision to change the purpose of land use was issued after this date, the tax agency must base on the time of this decision to calculate the money.

“The tax agency cannot do otherwise because doing otherwise would be against the law,” said a leader of the Ho Chi Minh City Tax Department.

On October 28, 2024, the tax departments (now the tax teams in the districts) were directed to lock the electronic inter-sectoral connection system at the end of October 30, 2024, print a list of the number of dossiers eligible for receipt on that day, and sign confirmation with the Department of Natural Resources and Environment.

According to the record, among the localities, Cu Chi district had the most complicated cases. The complicated cases were all related to changing the purpose of land use, while other land-related dossiers, such as land-use right certificates, proceeded smoothly.

The Art of Optimizing Land Use: A Study on Adjusting Land Allocation Post-Merger

Deputy Prime Minister Tran Hong Ha has instructed the Ministry of Natural Resources and Environment to take the lead and collaborate with other relevant ministries, sectors, and local authorities to finalize a plan for adjusting land-use targets. This includes calculating the transitional phase for the implementation of land-use planning and plans when excluding the district level.

Why Dong Nai Proposed to Reduce Over 27,000 Ha of Agricultural Land

With a focus on economic and social development, Dong Nai province has proposed a reduction of 27,200 hectares of agricultural land to make way for a much-needed increase in industrial, transportation, residential, and technical infrastructure areas. This bold move showcases the province’s commitment to fostering a thriving and diverse economy, one that strikes a delicate balance between traditional agricultural strengths and the demands of a modern, industrializing nation.