The Vietnamese stock market continued its positive upward trajectory. Vingroup’s stock portfolio acted as the main catalyst, propelling the main index higher. At the close of the May 7 session, the VN-Index rose 8.42 points to 1,250.37. Liquidity eased slightly from the previous session, with matched orders on the HoSE reaching approximately VND 15,400 billion.

In this context, foreign investors’ net buying remained a bright spot, with strong net purchases of nearly VND 892 billion across the market. Specifically:

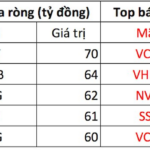

On HoSE, foreign investors net bought approximately VND 905 billion

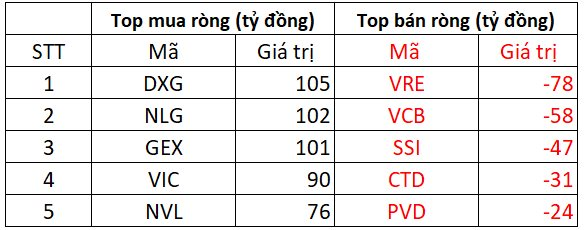

On the buying side, the real estate duo of DXG and NLG saw the strongest net buying in the market, with values of VND 105 billion and VND 102 billion, respectively, while GEX also witnessed net buying of VND 101 billion. Following closely, VCI and NVL were net bought in the range of VND 76-90 billion.

Conversely, VRE faced net selling pressure from foreign investors, with a net sell value of VND 78 billion, and VCB witnessed net selling of VND 58 billion. Other stocks that experienced net selling in the tens of billions of VND included SSI (-47 billion), CTD (-31 billion), and more.

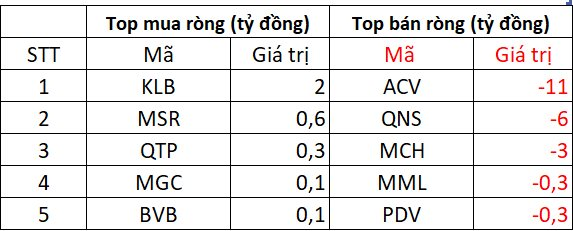

On HNX, foreign investors net bought approximately VND 4 billion

In terms of buying, IDC witnessed the strongest net buying of VND 12 billion. Following closely, VFS, SHS, VTZ, and VGS also experienced net buying in today’s session, albeit with values of just a few billion VND each.

On the opposite side, PVS, NTP, and CEO faced net selling pressure of VND 4-8 billion per stock. MBS and HJS also witnessed net selling, ranging from a few hundred million to VND 1 billion.

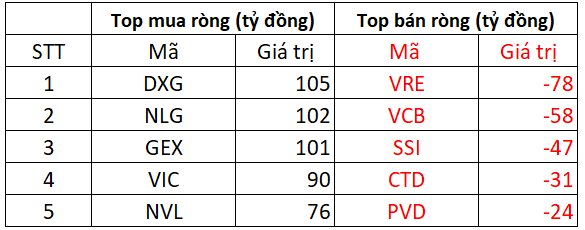

On UPCOM, foreign investors net sold over VND 17 billion

On the buying side, KLB witnessed net buying of approximately VND 2 billion, followed by light net buying in MSR, QTP, MGC, and BVB.

Conversely, ACV faced net selling pressure of VND 11 billion, while QNS and MCH experienced net selling of VND 6 billion and VND 3 billion, respectively. MML and PDV also witnessed net selling but to a lesser extent.

Stock Market Returns Are Much More Attractive Than Savings Accounts: Which Stock Groups Are Expected to Draw Investors in May?

The latest SSI Research reveals that the current blended P/E ratio is significantly lower than the 10-year average of 15.5 times.

The Smart Money Sells: Foreigners Dump Vietnamese Shares, Offloading Bank Stocks

The sell-off continued into the afternoon session, with VCB and VHM bearing the brunt of it. VCB witnessed a substantial sell-off, with approximately VND 184 billion changing hands, while VHM followed suit with a notable sell-off of VND 134 billion.