Gold prices witnessed a notable decline on Thursday, as global economic uncertainties and ongoing trade tensions between the US and foreign nations continued to drive its safe-haven demand. The market sentiment took a hit after the Trump administration imposed tariffs on foreign goods, sparking concerns about potential retaliation from other countries.

However, the market mood improved following a successful trade agreement between the US and the UK, instilling optimism about the upcoming US-China trade negotiations scheduled for later this week.

Gold prices take a dip. (Illustrative image: Cong Hieu)

According to analysts, the biggest short-term risk to gold stems from the potential resolution of the US-China trade war, as negotiations between the two countries get underway. The talks, held in Switzerland, come on the heels of the US-UK trade deal, which maintains import tariffs on most British goods while reducing taxes on strategic industries such as automobiles and steel.

While the deal has been announced, it is not yet finalized. Market participants remain cautious as they await further developments.

Gold Price Movements:

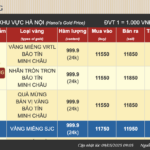

+ Domestic Gold Prices:

As of 6:00 am on May 11th, gold bar and SJC gold prices were listed at VND 120 – 122 million/tael (buying – selling), marking an increase of VND 500,000/tael in both directions from the previous day.

Meanwhile, Doji listed gold ring prices at VND 114.5 – 117 million/tael (buying – selling), also reflecting a VND 500,000/tael increase.

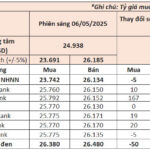

+ International Gold Prices:

International gold prices, as listed on Kitco, stood at $3,323.30 per ounce, reflecting a $13.37 increase per ounce from the previous day. Gold futures last traded at $3,325.30 per ounce.

Gold Price Forecasts:

James Stanley, Senior Market Strategist at Forex.com, anticipated gold prices to remain elevated, even amid capped upside momentum.

Gold price movements remained relatively neutral last week after the US Federal Reserve reaffirmed its stance on interest rates, citing a stable economy and persistent inflationary risks. While a rate cut is still expected during the summer, analysts suggest that gold’s upward trajectory has shifted to a “wait-and-see” mode.

Naeem Aslam, Chief Investment Officer at Zaye Capital Markets, noted that in the short term, he foresees a path of least resistance for gold to the downside. However, he added that he expects gold to continue being purchased on price dips.

Grace Peters, Global Investment Strategist at JPMorgan, emphasized the importance of geographic and currency diversification in navigating today’s markets. She predicted gold to reach $4,000 per ounce in a base case scenario, given an upward trajectory in US and global GDP over the next 12 months.

David Meger, Director of Metal Trading at High Ridge Futures, attributed the ongoing tariff-related uncertainties as a key factor supporting gold prices. However, he also cautioned that the market could enter a period of consolidation or corrective decline in the near term.

The Golden Rush: When Gold Prices Tumble

The gold market witnessed a dramatic turnaround on May 6th, with bullion prices plummeting by a staggering 1.1 million VND per tael during the afternoon session, following a sharp surge in the morning. This sudden reversal caught investors off guard, as the buy-sell spread widened significantly. However, gold jewelry prices remained resilient, showing no signs of fluctuation and maintaining their stability throughout the day’s volatile trading session.

SSI Research: Positive Trade Negotiation Developments to Spur Market Recovery

The SSI Securities Analysis Department’s strategic report highlights the need for positive developments in trade negotiations to sustain the market’s recovery momentum. The current blended P/E ratio remains low, and the estimated one-year market yield is attractive compared to deposit interest rates.

The Golden Opportunity: Navigating the Dip in Gold Prices

In the past 24 hours, domestic gold bar prices have plummeted by over VND 3 million per tael, while gold ring prices have dropped by VND 2.5 million per tael.