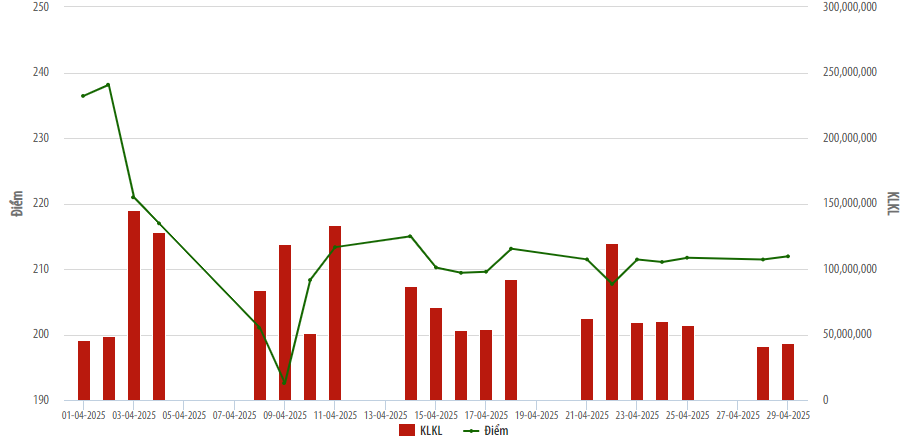

The HNX listed stock market experienced a significant decline on April 3, 2025, following news of a 46% tariff imposed by the US on Vietnamese goods. Subsequently, the market witnessed mild recovery sessions and maintained a narrow trading range until the month’s end. The HNX Index closed at 211.94 points, a 10% decrease from the previous month.

However, market liquidity surged with average trading volume reaching 89.4 million shares per session, marking a 38% increase from the prior month. This was accompanied by a 1,350 billion VND average monthly trading value in April 2025, representing an 18% rise. Notably, the trading session on April 3, 2025, witnessed the highest trading volume and value for the month, with 162.6 million shares changing hands, equivalent to a trading value of 2.6 trillion VND.

|

Matched trading volume and index performance of the HNX listed market in April 2025

Source: HNX

|

The HNX30 group of stocks accounted for a total trading volume of over 1,161 million shares, corresponding to a trading value of more than 20.5 trillion VND. This represented a 65% share in volume and a 76% share in value of the overall market.

In terms of liquidity, SHS remained the market leader. Compared to March 2024, SHS witnessed a substantial increase in trading volume, surging by 31% to exceed 391 million shares and capturing a 21% market share. Following closely was CEO with a trading volume of over 165 million shares, accounting for a 9% market share. PVS occupied the third spot with a trading volume of 112.4 million shares, contributing to a 6% market share.

Regarding stock price performance, NFC emerged as the top gainer, with its closing price surging by 55% to reach 42,400 VND per share. SMT claimed second place with a 35% increase to 11,500 VND per share. THS and KHS followed suit with gains of 35% and 34%, respectively, closing at 12,800 VND and 19,300 VND per share.

Foreign investors recorded net selling of over 439 billion VND, with a buying value of more than 1,211 billion VND and a selling value of over 1,651 billion VND. The total trading value rose by 23% from the previous month. SHS remained the top choice for foreign investors, with a buying volume of over 12.1 million shares. CEO secured the second position with a trading volume of over 8.8 million shares. On the selling side, IDC and PVS led the market, with trading volumes of 16.6 million and over 13.9 million shares, respectively.

Proprietary trading activities of member securities companies witnessed a 69% decline from the previous month, with a trading value of over 267 billion VND (accounting for a 1.1% market share). This resulted in net selling of nearly 202 billion VND.

During April 2025, the HNX listed stock market accommodated a total of 311 listed companies, with a total listing value of over 166.8 trillion VND. The market capitalization at the end of the month’s final trading session stood at more than 345.7 trillion VND, indicating an 8% decrease from the previous month.

– 10:24, May 8, 2025

Why Navigate Without a Compass?

Investing in the stock market is easy, but are you truly equipped for it? Opening an account takes just 5 minutes, and buying stocks, a mere 10 seconds. But no one asks if you’ve ever been taught how to invest. There’s no formal education, no exams to pass, and no one arms you with a map to navigate the pitfalls, risks, and temptations of this challenging terrain.

The Billionaire Chairman: A 76-Year-Old’s $160 Million Bet on the Property Market

Introducing the sole investor, Mr. Phạm Thu, who has exclusively signed up for the private placement of stocks.

Stock Market Insights: Unleashing the Power Within

The market witnessed a surprising turnaround in the afternoon session, triggered by a price surge in FPT. Convincingly, the session saw strong buying power and a significant reversal in foreign investors’ net buying position compared to the morning session. The matched liquidity of the two floors rose to a healthy VND 19.3k billion.

The Market Tug-of-War: Heavyweight Stocks Hold the Line, Foreign Investors Surprise with Strong Buying

The VN-Index struggled to maintain its highs this morning as blue-chip stocks continued to diverge and weaken. Only 5 out of the top 10 largest capitalization codes increased, fortunately including VIC and GAS. Trading volume decreased by 10% compared to yesterday morning, with a balanced breadth confirming a tug-of-war state. A bright spot was that foreign investors unexpectedly net bought 367 billion VND after 16 consecutive net selling sessions.