|

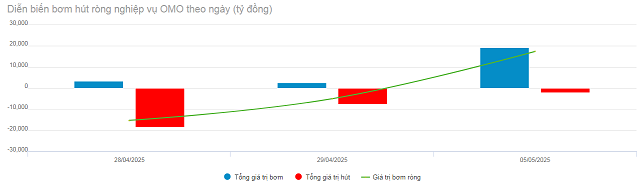

OMO net pumping evolution in the past week (04/28-05/05/2025). Unit: Billion VND

Source: VietstockFinance

|

Specifically, the State Bank of Vietnam (SBV) injected VND 25,283 billion into the market through the term purchase channel, with terms of 7 days, 14 days, and 35 days, at a common interest rate of 4%/year. During the week, VND 28,273 billion also matured, causing the SBV to net drain VND 2,990 billion from the system. The total circulation volume in the term purchase channel reached VND 103,080 billion.

|

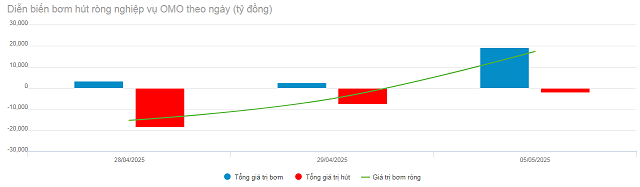

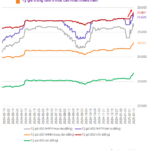

Evolution of overnight interbank interest rates since the beginning of 2025. Unit: %/year

Source: VietstockFinance

|

The overnight interbank interest rate rose slightly by 7 basis points to 2.54%/year at the end of the 04/28 session. However, this remains the lowest level in a year, since 04/09/2024. The overnight transaction volume in the interbank market increased by 37% compared to the previous week.

|

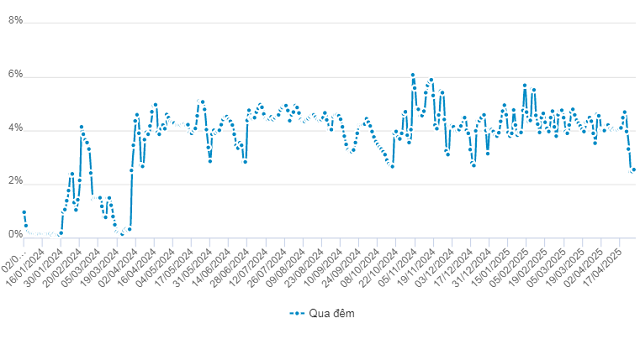

DXY performance in the past 3 years

Source: marketwatch

|

In the international market, the USD-Index (DXY) in the week of 04/28-05/02 increased by 0.45 points compared to the previous week, reaching 100.04 points. This development reflects investors’ expectations of a potential Fed rate cut in June diminishing, following the release of positive US employment reports.

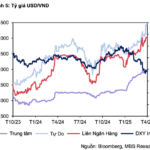

USD/VND exchange rate at Vietcombank closed at VND 25,790/USD (buying) and VND 26,180/USD (selling) on 04/29, both down VND 15 from the previous week’s close.

– 13:58 05/06/2025

Why is the US Dollar Weakening Globally Yet Appreciating Against the VND?

According to MBS, the increase in foreign currency purchases by the State Treasury, coupled with heightened foreign currency demands from businesses amid global trade uncertainties and a significant negative shift in VND-USD interest rate differentials, contributed to the appreciation of the USD/VND exchange rate in April, despite the greenback’s weakness in the international market.

The Greenback’s Pre-Lunar New Year Surprise

The US dollar continues its downward trajectory, with commercial bank rates reflecting the cooling off of the greenback on the international market.

The Exchange Rate Conundrum: Why It Remains a Challenge in 2025

Although there have been signs of cooling off since the beginning of the year, the USD/VND exchange rate remains one of the most unpredictable factors of 2025. What key elements could influence the foreign exchange market this year?