|

Source: VietstockFinance

|

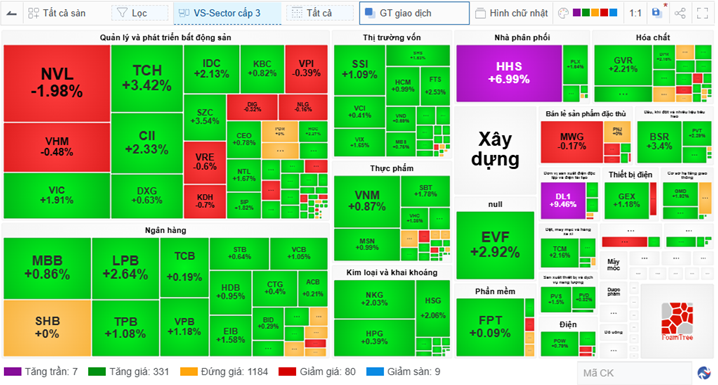

The market closed on May 8 with 502 codes in the green, including 29 ceiling codes, while only 266 codes were in the red, and 842 codes remained unchanged.

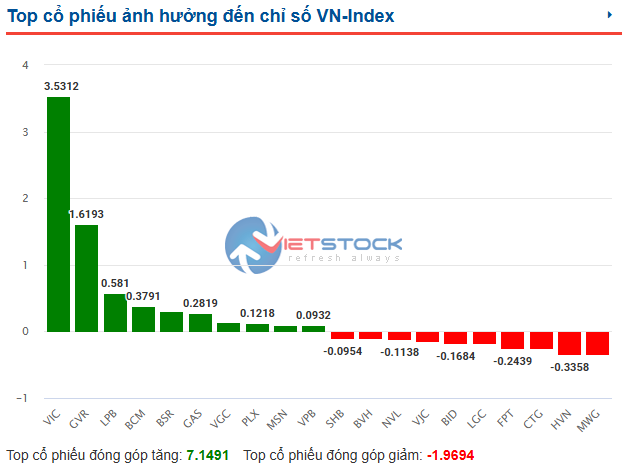

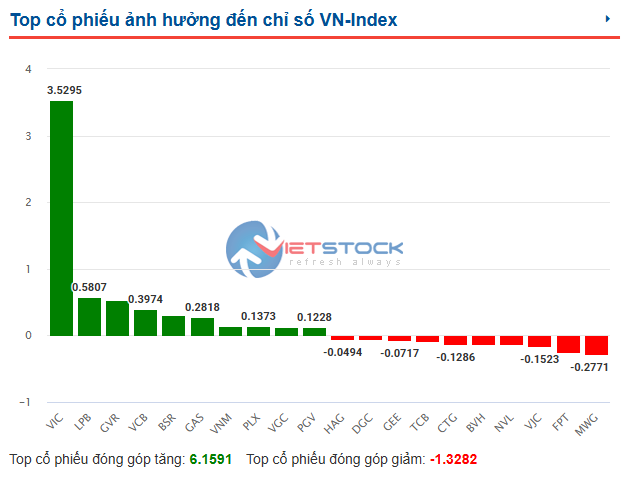

The two most notable gainers today were real estate giant VIC and GVR from the chemicals group. These two stocks also directly contributed the most points to the VN-Index today, with more than 4.9 points and over 1.7 points, respectively. In addition, FPT also rose by 4.19%, bringing in nearly 1.7 points to the index.

The number of declining industries was narrowed from 10 at the end of the morning session to just 2 at the close, with household goods and personal care down 0.02% and consumer services down 0.78%, both very minor drops.

Meanwhile, the market witnessed 20 rising industries, led by software up 4.05%, real estate up 2.61%, and specialized and commercial services up 2.57%. There were also 8 other industries that rose by more than 1%.

The market also saw other large-cap industries post positive gains, thus contributing significantly to the market’s upward momentum, including banking with SHB up 2.38%, STB up 1.67%, TCB up 1.48%, MBB up 1.29%… securities with SSI up 1.09%, HCM up 3.16%, VIX up 2.06%, VCI up 1.24%… and food with MSN up 3.45%, and steel with HPG up 1.18%.

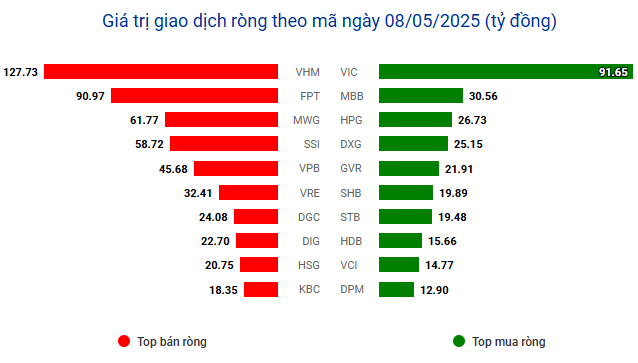

Riding on this excitement, foreign investors also reversed their actions, from net selling nearly VND 495 billion in the morning session to net buying over VND 255 billion at the close, led by three large-cap stocks, namely VIC with more than VND 145 billion, MBB with nearly VND 120 billion, and HPG with nearly VND 103 billion.

Although VIC was heavily bought, other members of the same family were among the top net sold, including VHM with more than VND 282 billion and VRE with over VND 48 billion.

The excitement in the afternoon session was believed to be driven by rumors about the progress of trade negotiations between the US and Vietnam. However, investors should note that the outcome of the negotiations has not been verified.

Morning Session: Big Caps Support VN-Index

Amid mounting pressures, the VN-Index‘s gains narrowed from nearly 9 points to just over 3 points by 11 am, before recovering slightly to close the morning session at 1,255.66, up 5.29 points. Meanwhile, the HNX-Index rose 0.74 points to 214.15 and the UPCoM-Index climbed 0.04 points to 92.96.

VIC was the most prominent stock in the morning session, contributing over 3.5 points to the VN-Index. The stock of this real estate giant also rose more than 5%, continuing the positive momentum from recent sessions. In fact, since the beginning of 2025, VIC has surged by 90%.

|

VIC up over 90% since the beginning of 2025

Source: VietstockFinance

|

In addition to VIC, another stock that is “shouldering” the index is GVR, contributing more than 1.6 points after rising over 6%.

It is evident that the contributions of VIC and GVR, along with numerous other large-cap stocks, have helped prevent the VN-Index from losing more points during the morning session.

Source: VietstockFinance

|

The pressure was also more evident when looking at the market breadth, with 327 gainers and 276 losers, a narrowing gap compared to the beginning of the morning session.

By industry, the market recorded 10 declining sectors, led by consumer services down 0.79% and software down 0.64%. This number was not much lower than the 12 rising sectors, led by specialized and commercial services up 3.12% and entertainment and media up 2.29%. The only sector that stood unchanged was semiconductors.

After three consecutive net buying sessions, foreign investors resumed net selling today, with a net sell value of nearly VND 495 billion. The net selling pressure was concentrated in VHM, with nearly VND 128 billion, and FPT, with nearly VND 91 billion. In contrast, VIC led the net buying with nearly VND 92 billion.

Source: VietstockFinance

|

10:40 am: Entering a tug-of-war, VIC surges 5%

After an initial excitement, the VN-Index entered a tug-of-war. The most notable stock at this time was VIC, which rose more than 5% and directly contributed more than 3.5 points to the VN-Index.

The indices generally maintained their upward momentum, with the VN-Index up 6.09 points to 1,256.46, the HNX-Index up 0.9 points to 214.31, and the UPCoM-Index up 0.15 points to 93.07. The green side still dominated with 344 gainers, but it was no longer overwhelmingly superior to the red side, which now stood at 221 losers.

Many big names were in the red, including NVL down 1.98%, TCB down 0.19%, CTG down 0.13%, MWG down 1.5%, and FPT down 0.55%…

Another notable point was that the top 10 stocks with the most positive impact on the VN-Index brought in 6.2 points, higher than the index’s gain. VIC led with more than 3.5 points, after the stock surged 5.31%. It is clear that VIC has made a significant contribution to the index so far.

Source: VietstockFinance

|

The pressure also partly came from the actions of foreign investors, who were net selling by more than VND 340 billion, mainly due to net selling pressure in VHM of over VND 76 billion, FPT of over VND 52 billion, MWG of over VND 47 billion, and VPB of over VND 45 billion.

Opening: Green Dominates

On May 8, Vietnam’s stock market opened positively, with the VN-Index up 8.21 points to 1,258.58, the HNX-Index up 1.63 points to 215.04, and the UPCoM-Index up 0.24 points to 93.16. Green dominated many sectors, notably real estate, banking, and securities.

Looking at the market map, stocks in the real estate management and development group occupied a large area, with many names surging, such as VIC up 1.91%, TCH up 3.42%, CII up 2.33%, IDC up 2.13%, and SZC up 3.54%… However, a certain number of codes in this group were also in the red, including NVL down 1.98%, VHM down 0.48%, VRE down 0.6%, and KDH down 0.7%…

Banking stocks also performed positively, with notable gainers including LPB up 2.64%, TPB up 1.08%, VPB up 1.18%, EIB up 1.58%, and VCB up 1.05%…

With the positive developments in these two large-cap sectors, VIC, VCB, and LPB occupied the top three positions in the ranking of stocks with the most positive impact on the VN-Index, with VIC and VCB each contributing more than 1 point.

In addition, other sectors such as securities, food, metals, and mining also witnessed a widespread sea of green.

The market recorded 338 gainers, including 7 ceiling codes, notably HHS and DL1. In contrast, only 89 codes were in the red, and 1,184 codes were unchanged. Market liquidity was nearly 88.3 million shares, corresponding to a value of nearly VND 1,666 billion, slightly higher than the 5-session average.

|

Green dominates the market at the start of the morning session

Source: VietstockFinance

|

Asian markets also opened positively, with Hang Seng up 0.51%, Nikkei 225 up 0.03%, and Shanghai Composite up 0.64%…

Last night, US stocks also rose. At the close of the trading session on May 7, the S&P 500 rose 0.43%, the Nasdaq Composite gained 0.27%, and the Dow Jones climbed 0.70%. The Dow Jones index was supported by Disney’s nearly 11% surge after the company reported better-than-expected second-quarter financial results and a surge in streaming service subscriptions.

As expected, the FOMC kept interest rates unchanged in the range of 4.25 – 4.5%, a level that has been maintained since December 2024.

“The Committee is attentive to inflation risks to its dual mandate goals and assesses that the risk of high unemployment and inflation have increased.” – the statement after the meeting said.

The Fed’s statement on Wednesday coincided with growing concerns that the global trade war could lead to higher inflation, complicating the central bank’s path toward its 2% inflation target.

Fed Chairman Jerome Powell said at a press conference following the decision that if “tariff rates rise significantly” from current levels, they could lead to slower economic growth, higher long-term inflation, and higher unemployment.

Source: VietstockFinance

|

The market is painted green with more than 310 gainers, far outpacing the 110 losers. The information technology, oil and gas, and real estate groups are performing positively across the board.

In the real estate group, NVL hit the ceiling in the morning session. CEO, DIG, and PDR also rose between 3% and 4%.

In the information technology group, FPT rose more than 1%, CMG climbed nearly 4%, and ELC gained nearly 2%. Notably, ITD hit the ceiling.

In the oil and gas group, green dominated. PVD, PVS, BSR, PVB, and others rose.

Mild differentiation appeared in the essential consumer goods group, with VNM, VHC, BAF, and DBC in the green, while MSN, ANV, HAG, and VLC were in the red.

|

Changes to the KRX System

|

Market Beat: Energy & Real Estate Sectors Surge, VN-Index Rallies Further

The market closed with positive gains, seeing the VN-Index rise by 8.42 points (+0.68%), settling at 1,250.37. Likewise, the HNX-Index witnessed an increase of 0.52 points (+0.24%), ending the day at 213.41. The market breadth tilted in favor of the bulls, with 402 gainers versus 337 losers. The VN30 basket saw a similar trend, with 14 gainers outperforming 11 losers, while 5 stocks remained unchanged, adding a slight tilt to the bullish sentiment.

The Market Momentum: Can the Uptrend Persist?

The VN-Index witnessed a significant surge, forming a bullish White Marubozu candlestick pattern and breaching the 200-day SMA. This strong performance reflects a buoyant investor sentiment. Should the index sustain these levels and witness a substantial uptick in volume, the outlook would brighten considerably. Notably, the MACD indicator continues to flash a buy signal, and a potential crossover above zero in upcoming sessions remains on the cards. If this materializes, the optimistic short-term sentiment is here to stay.

Deep Discounts, Stock Market Surges: 194,000 New Accounts Join the Fray.

As of April 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, according to Vietnam Securities Depository (VSDC). The country’s stock market boasted over 9.88 million accounts, reflecting an increase of 194,023 accounts since March. This remarkable growth marks the highest increase in the past eight months.