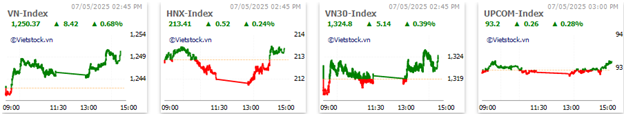

Liquidity in the market decreased compared to the previous trading session, with the VN-Index matching volume reaching over 696 million shares, equivalent to a value of more than 15.4 trillion dong; HNX-Index reached over 58.9 million shares, equivalent to a value of more than 932 billion dong.

VN-Index opened the afternoon session with buyers gradually regaining momentum, helping the index continue to break through and close in positive territory. In terms of impact, VIC, VHM, BSR, and HVN were the most positive influences on the VN-Index, contributing over 5.4 points. On the other hand, MBB, MSN, HDB, and CTG were still under selling pressure, taking away more than 1.2 points from the overall index.

| Stocks with the biggest impact on the VN-Index |

Similarly, the HNX-Index also witnessed a rather optimistic performance, with the index positively influenced by DTK (+7.44%), HUT (+2.4%), IDC (+2.18%), KSF (+1.25%), among others.

Source: VietstockFinance

|

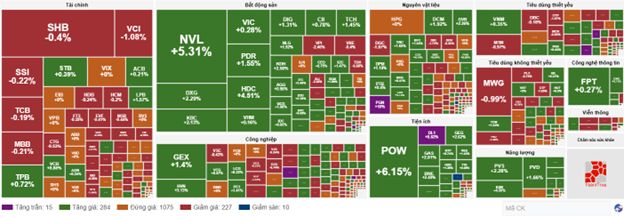

At the close, the market was up 0.51%. The energy sector led the gains with a 4.71% increase, mainly driven by PVS (+1.14%), PVD (+1.11%), PVC (+2.25%), and PVB (+1.54%). This was followed by the real estate and utilities sectors, which rose 2.41% and 1.04%, respectively. On the other hand, the telecommunications sector witnessed the biggest decline, falling by 0.66%, mainly due to losses in VGI (-0.57%), FOX (-1.42%), CTR (-0.9%), and SGT (-1.94%).

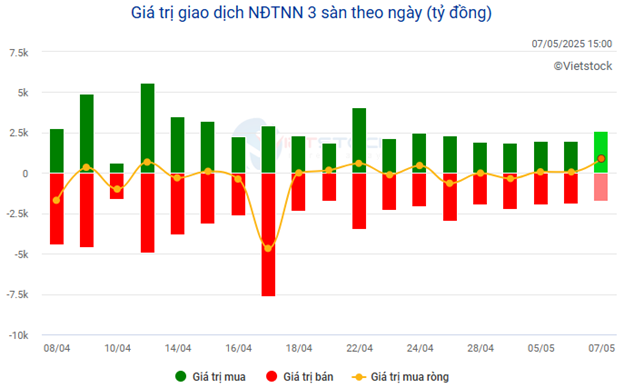

In terms of foreign trading activities, foreign investors continued to be net buyers on the HOSE exchange, focusing on DXG (104.77 billion dong), NLG (102.09 billion dong), GEX (99.54 billion dong), and VIC (90.72 billion dong). On the HNX exchange, foreign investors net bought over 4 billion dong, mainly investing in IDC (12.04 billion dong), VFS (3.41 billion dong), SHS (3.3 billion dong), and VTZ (1.41 billion dong).

12:00 PM: Foreign investors increased net buying

The market continued to fluctuate during the late morning session. At the midday break, the VN-Index narrowed its gain to 0.29%, closing at 1,245.57 points. Meanwhile, the HNX-Index turned red, falling to 211.98 points, a loss of 0.43%. The market breadth was negative, with 322 declining stocks versus 286 advancing stocks.

VIC, HVN, and BSR were the top contributors to the VN-Index, adding more than 2.5 points to the index. On the flip side, CTG, BID, and MWF were the biggest drags on the index, taking away nearly 1.5 points.

The energy sector remained the top performer, rising over 3% thanks to strong gains in BSR (+4.55%), PVS (+1.14%), PVD (+0.55%), PVC (+2.25%), and PVB (+1.54%). The real estate and utilities sectors also stood out, with notable performances from VIC (+2.13%), NVL (+2.86%), PDR (+2.79%), KDH (+2.95%), DXG (+1.96%); POW (+5.74%), GAS (+1.34%), BWE (+2.49%), and NT2 (+3.03%).

In contrast, declines in CTR (-2.02%), VGI (-1%), FOX (-1.53%), ELC (-1.57%), and other stocks weighed on the telecommunications sector, causing it to end the morning session with a loss of over 1%. The remaining sectors were mostly mixed.

The financial sector, which has the largest market capitalization, traded rather sluggishly. Specifically, the “king stocks” recorded small losses and mostly traded below the reference price. Securities stocks were more negative, with many stocks falling over 1%, including SSI, VCI, MBS, FTS, SHS, and CTS. The only bright spots in the sector were BVH (+2.63%) and PGI (+3.93%) in the insurance industry.

On a positive note, foreign investors increased net buying, providing a boost to the market. They net bought nearly 365 billion dong across all three exchanges in the morning session. The top stocks attracting buying interest were GEX (75 billion dong), NVL (49 billion dong), and NLG (46 billion dong).

| Foreign Buying and Selling Activities |

10:30 AM: Investor sentiment remains cautious

Investor caution continued to dominate the market, causing the main indices to fluctuate around the reference level after a positive start. As of 10:30 AM, the VN-Index rose 5.98 points to trade around 1,247 points, while the HNX-Index edged up 0.01 points to 213 points.

The breadth among the VN30 stocks was mixed, with a slight bias towards the upside. Specifically, FPT, VNM, LPB, and VIC contributed 0.79 points, 0.74 points, 0.62 points, and 0.49 points to the index, respectively. On the other hand, MSN, MWG, VJC, and VHM faced selling pressure, taking away 1.6 points from the VN30-Index.

The energy sector was the top performer, rising 3.74%. While there was some divergence within the sector, the majority of stocks traded in positive territory. Notable gainers included PVS (+2.66%), PVD (+1.66%), PVC (+2.25%), and PVB (+1.93%) … Meanwhile, MGC declined by 0.49% but the loss was not significant.

The utilities sector also performed well, with GAS (+2.35%), REE (+1.29%), POW (+6.15%), and PGV (+2.12%) leading the gains. On the downside, HNA, TDM, SHP, and others traded in the red, but the losses were not substantial.

Additionally, the real estate sector, despite posting a modest gain, attracted strong interest. Standout performers included NVL (+5.31%), DXG (+2.61%), KBC (+2.34%), and HDC (+4.51%) …

In contrast, the telecommunications services sector witnessed a negative performance, with large caps such as VGI (-0.57%), CTR (-1.01%), SGT (-0.28%), and ELC (-0.67%) dragging down the sector. Only a few stocks managed to stay in positive territory, including YEG (+0.43%), TTN (+4.12%), and SBD (+1.43%) …

Compared to the opening, the market continued to be mixed, with over 1,000 stocks unchanged and buyers slightly outpacing sellers. There were 284 advancing stocks and 227 declining stocks.

Source: VietstockFinance

|

Opening: Market maintains a slight gain

On May 7, as of 9:30 AM, the VN-Index fluctuated around the reference level, reaching 1,245.85 points. Meanwhile, the HNX-Index edged up slightly to 213.05 points.

U.S. stocks continued their decline on Tuesday (May 6) after uncertain comments from President Donald Trump regarding global trade deals, dampening hopes for an early resolution to tariff issues. Investors also awaited the Federal Reserve’s policy decision. At the close of the May 6 session, the Dow Jones fell 389.83 points (or 0.95%) to 40,829 points. The S&P 500 lost 0.77% to 5,606.91 points, and the Nasdaq Composite fell 0.87% to 17,689.66 points. All three indices recorded their second consecutive daily loss.

As of 9:30 AM, the VN30 basket was mostly in negative territory, with 12 declining stocks, 15 advancing stocks, and 3 unchanged stocks. Among them, PLX, MWG, VJC, and BID were the top losers. On the upside, VIC, GAS, GVR, and TPB were the top gainers.

Energy stocks were among the most prominent sectors in the morning session. Notable gainers included PVS (+2.66%), PVD (+1.94%), PVC (+1.12%), and PVB (+2.32%) …

In contrast, the telecommunications services sector was the top loser, with declines in VGI (-0.71%), CTR (-1.12%), FOX (-0.44%), and ELC (-0.22%) …

The Market Momentum: Can the Uptrend Persist?

The VN-Index witnessed a significant surge, forming a bullish White Marubozu candlestick pattern and breaching the 200-day SMA. This strong performance reflects a buoyant investor sentiment. Should the index sustain these levels and witness a substantial uptick in volume, the outlook would brighten considerably. Notably, the MACD indicator continues to flash a buy signal, and a potential crossover above zero in upcoming sessions remains on the cards. If this materializes, the optimistic short-term sentiment is here to stay.

Deep Discounts, Stock Market Surges: 194,000 New Accounts Join the Fray.

As of April 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, according to Vietnam Securities Depository (VSDC). The country’s stock market boasted over 9.88 million accounts, reflecting an increase of 194,023 accounts since March. This remarkable growth marks the highest increase in the past eight months.

“UPCoM Liquidity Surges 13% in April”

The UPCoM market in April 2025 mirrored the listed stock market, plunging early in the month, then staging a mild recovery and trading sideways for the remainder of the period. Average trading volume rose 13% from March, reaching nearly 61.4 million shares per session, while average trading value climbed 11%, surpassing VND 803 billion per session.