| VN-Index Rebounds Strongly in the Afternoon Session |

|

Source: VietstockFinance

|

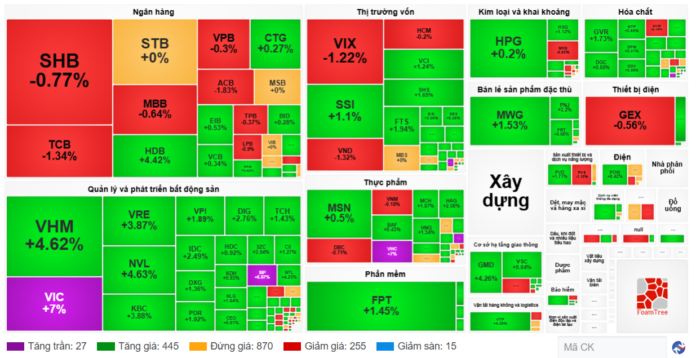

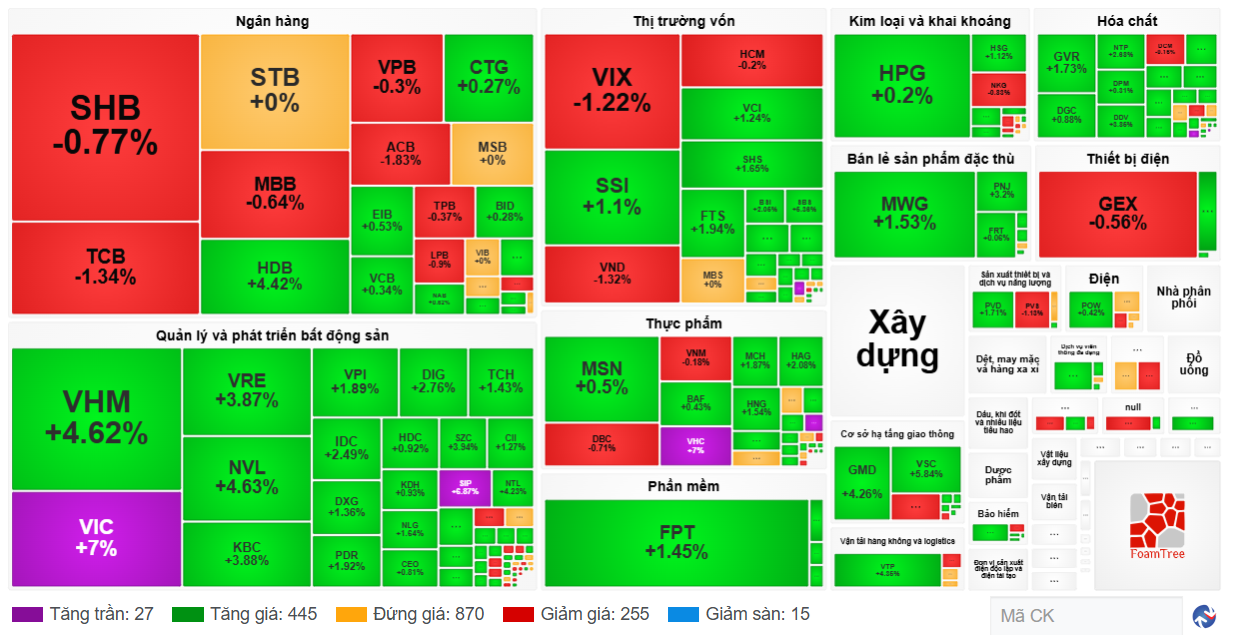

The money flow showed a broad-based recovery with 440 stocks gaining, spanning various sectors, especially real estate. Notably, 23 stocks hit the daily limit-up, including the “giant” VIC and industrial zone stocks like SIP.

Several sectors also witnessed a strong presence of green, including food and beverage, with MSN up 0.5%, BAF up 0.43%, MCH up 1.87%, HNG up 1.54%, and HAG up 2.08%; metals and mining, with HPG up 0.2% and HSG up 1.12%; and retail, with MWG up 1.53% and PNJ up 3.2%. In the ports sector, GMD rose 4.26% while VSC climbed 5.84%.

Financial stocks, including banks and securities, experienced more mixed performances. In the banking sector, while there were no shortages of gainers, a closer look at the market map revealed sizeable areas in red, with SHB down 0.77%, TCB down 1.34%, MBB down 0.64%, VPB down 0.3%, and ACB down 1.83%. In the securities sector, VIX fell 1.22%, VND lost 1.32%, and HCM dipped 0.2%.

Looking at the top 10 stocks with the most positive impact on the VN-Index today, VIC naturally took the lead, contributing nearly 4 points, followed by VHM with over 2.7 points and HDB with nearly 0.8 points. On the other hand, TCB took away the most points, deducting 0.6 points.

Source: VietstockFinance

|

The market closed higher as the annual general meeting (AGM) season entered its peak, with a series of business plans, dividend policies, capital increases, and other important matters for the year being officially approved. Notably, several prominent names held their AGMs today, including VIC, which approved its development strategy, business plan, expansion of business lines, and profit distribution plan; KDH, which set a revenue target of VND 3,800 billion and after-tax profit of VND 1,000 billion, along with announcing the handover of certificates to over 30% of customers at The Privia project and expecting to complete the process in Q3 2025; and VHC, which expressed a positive outlook for the US tra fish market…

In addition to the news surrounding the AGM season, the market also received another positive update: Ho Chi Minh City Stock Exchange (HOSE) announced the official launch of its new information technology system starting May 5, 2025.

This system lays the foundation to address key issues for the market’s upgrade from a frontier to an emerging market status, including central counterparty clearing (CCP) and enhanced infrastructure quality.

However, market liquidity was not exceptionally high today, with a trading value of over VND 19,412 billion.

Foreign investors returned to net buying today, with a net purchase value of nearly VND 418 billion, following net purchases of nearly VND 2,436 billion and net sales of over VND 2,019 billion.

The most net bought stocks today were HPG with over VND 139 billion, MWG with over VND 135 billion, and VHM with nearly VND 110 billion. Following them were other actively net bought stocks, such as STB, NVL, and SAB…

On the opposite side, the most net sold stocks were GEX with over VND 78 billion, MCH with nearly VND 78 billion, and SHB with over VND 74 billion.

Morning Session: VIC Supports VN-Index

Pressure from banking stocks is weighing down the market, while real estate stocks are trying to hold the fort. By the end of the morning session, the VN-Index had gained 3.0 points to close at 1,214.08, while the HNX-Index lost 0.3 points to 211.13, and the VN30-Index dipped 1.6 points.

| Top 10 Stocks with the Most Impact on VN-Index in the Morning Session of April 24, 2025 |

The market breadth remained in favor of gainers, with nearly 390 stocks rising versus 260 declining ones. Sector-wise, 17 out of 23 sectors were in the green, led by telecommunications and insurance. Real estate, energy, and industrial zones also performed well.

In the real estate sector, VIC surged over 4%, leading the index higher. Other members of the Vingroup family, VRE, gained 0.23%. NVL, KBC, and DIG also posted solid gains. Industrial zone stocks maintained their positive momentum throughout the morning session.

Foreign investors were net sellers in the morning session, with GEX and SHB being the most sold stocks, offloaded by VND 88 billion and VND 79 billion, respectively. The market’s trading value in the morning session stood at VND 8.5 trillion, relatively low compared to the previous session.

10:45 am: Large-cap Stocks Diverge, VN-Index Retreats to Reference Level

As of 10:45 am, the buying momentum persisted, but the divergence widened. The VN-Index trimmed its earlier gains and returned to near the reference level, while the VN30-Index dropped 3.5 points.

This dynamic suggests that large-cap stocks are facing pressure. VHM fell 1.3%, GEX dropped 4%, and HPG slipped nearly 1%. In the banking sector, SHB, STB, TCB, ACB, and CTG declined between 1% and 3%.

Some large-cap stocks remained in positive territory, including VIC, FPT, GVR, BSR, BCM, NVL, and VCB, supporting the index.

SHB led the market in terms of liquidity, with a trading volume of over 35 million shares. NVL followed closely with a volume of over 19.5 million shares.

Overall market liquidity was relatively weak. By 11 am, the market’s trading value stood at over VND 7 trillion.

Market Open: Real Estate, Industrial Zones, Seafood, and Textile Stocks Lead the Charge

The morning session of April 24 started on a positive note, with the market indices opening in the green. At 9:30 am, the VN-Index climbed over 7 points to 1,218, while the HNX-Index gained nearly 1 point to 212.4.

Buying pressure dominated, with nearly 400 stocks rising against only 100 declining ones. Several stocks even hit the daily limit-up, such as SIP, VHC, VTP, and NFC…

Telecommunications stocks broke out at the opening bell. CTR jumped nearly 6%, VGI surged 9%, and TTN climbed 8%.

In the seafood sector, stocks also performed strongly. VHC hit the daily limit-up, ANV rose 4.5%, FMC gained 5%, ASM advanced 4%, and IDI climbed 5%.

Textile stocks were also in high spirits. TCM rose 4%, TNG climbed 5.5%, MSH surged 6%, and GIL inched up nearly 2%…

In the real estate sector, industrial zone stocks took the lead. KBC gained nearly 4%, SZC rose 6.5%, IDC climbed 6.6%, SIP hit the daily limit-up, and BCM advanced 4%.

– 16:00, April 24, 2025

“VN-Index Extends Gains, Yet Liquidity Remains Constrained”

The VN-Index witnessed a robust surge, despite trading volume remaining below the 20-day average. This indicates cautious participation amidst the index’s approach towards the nearest resistance zone formed in mid-April 2025 (1,230-1,245 points). Should the positive momentum persist, coupled with a significant improvement in liquidity in upcoming sessions, a breakthrough from this zone is plausible. Notably, the MACD indicator continues to signal a buy, reinforcing the strengthening market trend.

The Billionaire’s Conglomerate: Unprecedented Milestone Achieved.

As of early 2025, Vingroup’s market capitalization has surged by VND 145 trillion, surpassing the VND 300 trillion mark for the first time in almost three years.