Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 786 million shares, equivalent to a value of more than 17.1 trillion dong; HNX-Index reached over 59.8 million shares, equivalent to a value of more than 911 billion dong.

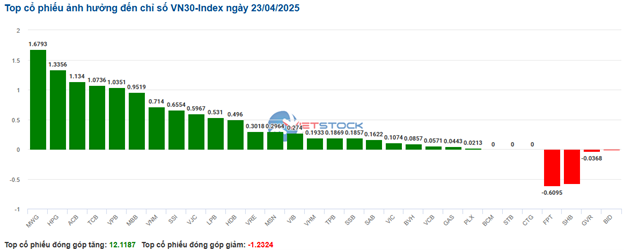

VN-Index opened the afternoon session continuing the tug-of-war with the advantage tilting towards the buying side until the end of the session. In terms of impact, TCB, VHM, GVR, and BCM were the codes that had the most positive impact on the VN-Index, with an increase of more than 4.2 points. On the contrary, VCB, SSB, VIC, and HVN were still under selling pressure and took away more than 2 points from the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on April 23, 2025 |

Similarly, the HNX-Index also had an optimistic performance, with the index positively impacted by the codes KSF (+6.17%), IDC (+3.74%), NTP (+4.12%), and BAB (+3.74%)…

|

Source: VietstockFinance

|

At the close, green covered all sectors. Telecommunications was the group with the strongest increase of 7.83%, mainly contributed by VGI (+9.93%), CTR (+6.91%), VNZ (+3.26%), and FOX (+1.78%). This was followed by the materials and industrial sectors, with increases of 2.5% and 2.3%, respectively.

In terms of foreign trading, foreigners net sold more than 81 billion dong on the HOSE exchange, focusing on FPT (142.41 billion), MBB (103.54 billion), SHB (57.17 billion), and GMD (31.53 billion). On the HNX exchange, foreigners net sold more than 15 billion dong, focusing on SHS (14.87 billion), CEO (6.88 billion), PVS (6.14 billion), and MBS (4.84 billion).

| Foreign trading net buying and selling |

Morning session: Liquidity has not broken out, foreigners net sell again

The green color was maintained until the end of the morning session, but the trading slowed down significantly. At the midday break, the VN-Index increased by 1.04%, reaching 1,209.63 points; HNX-Index stood at 211.06 points, up 1.61%. The market breadth recorded 552 gainers and 138 losers.

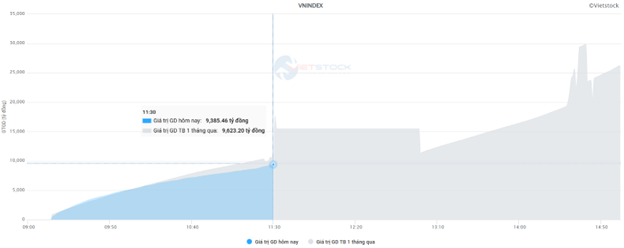

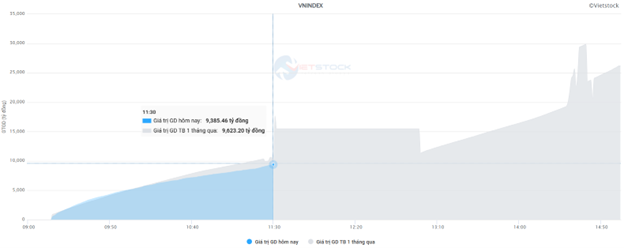

The initial excitement raised expectations for a strong breakout, but the actual liquidity was not really commensurate. The total matching value this morning reached nearly 9.4 trillion dong on the HOSE and about 500 billion dong on the HNX, an improvement from the same period in the previous session but still below the 1-month average. This shows that investors’ psychology is positive but still cautious in terms of strong disbursement, especially after the unexpected volatility yesterday.

Source: VietstockFinance

|

However, the morning gain still occurred on a large scale and did not depend too much on large-cap stocks. HPG, VRE, and MWG are the stocks that contributed the most positively, helping the VN-Index increase by nearly 2 points. Meanwhile, there were no codes that had too much impact on the opposite side, helping the overall index maintain a stable green color.

The telecommunications group is leading the market with the strongest increase of 6.72%, mainly contributed by VGI (+8.96%), CTR (+6.91%), and YEG (+5.91%). Most other sectors also recorded good increases in the range of 1-3%. Only the information technology sector was under adjustment pressure with FPT down slightly by 0.63%, VTB lost 2.51%, and SMT fell to the floor price.

Foreign trading was a minus point that significantly affected the market this morning. Despite the positive market rebound, foreigners net sold more than 321 billion dong on all three exchanges after recent net buying sessions. FPT was the stock under the strongest selling pressure with a net selling value of 137 billion dong, far exceeding the rest.

| Top 10 stocks with the strongest net buying and selling in the morning session of April 23, 2025 |

10:30: Investor sentiment divided

Investor sentiment continued to be divided, causing the main indices to fluctuate around the reference level after a positive opening. As of 10:30, the VN-Index increased by 8.24 points, trading around 1,205 points. The HNX-Index increased by 3.26 points, trading around 210 points.

The breadth of the VN30 basket was tilted to the upside, with 28 gainers and 2 losers. Specifically, HPG, MWG, MBB, and VPB contributed 1.68 points, 1.33 points, 1.13 points, and 1.07 points to the overall index, respectively. On the other hand, only a few codes such as FPT, SHB, GVR, and BID were under selling pressure, taking away more than 1.2 points from the VN30-Index.

Source: VietstockFinance

|

The telecommunications group is leading the market with the strongest increase of 7.17%, thanks to the contribution of VGI (+8.79%), CTR (+6.79%), and YEG (+5.45%)… The remaining codes such as SGT, ELC, BST, and EID are still under selling pressure, but the decrease is not significant.

Following is the energy sector, which also recorded a good increase, with PVD (+2.07%), PVB (+0.8%), PVC (+3.49%), and AAH (+2.78%)… On the downside, codes such as CST, NBC, THT… are in the red, but the decrease is not significant.

On the contrary, information technology was the only sector that did not perform well, as the large-cap stock FPT continued to decrease by 0.82%, putting significant pressure on the group, while only a few remaining codes such as HPT (+10.38%), CMG (+2.28%), and ITD (+0.43%) managed to stay in the green.

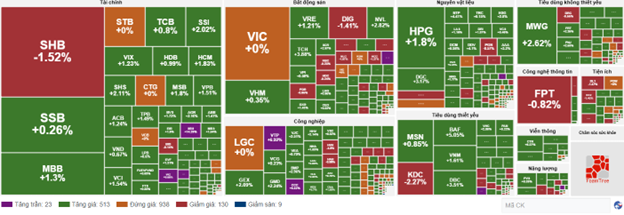

Compared to the beginning of the session, the buying side still dominated. There were 513 gainers and 130 losers.

Source: VietstockFinance

|

Opening: Continuing the recovery, green covered most sectors

On April 23, as of 9:30 am, the VN-Index turned green right from the beginning of the session and increased by more than 13 points, reaching 1,210.26 points. Meanwhile, the HNX-Index slightly increased, reaching 210.89 points.

U.S. stocks rebounded on Tuesday (April 22) as hopes for an easing of U.S.-China trade tensions grew, helping investors recover from a sharp decline in the previous session. At the close of the trading session on April 22, the Dow Jones index increased by 1,016.57 points (equivalent to 2.66%) to 39,186.98 points. The S&P 500 index added 2.51% to 5,287.76 points, while the Nasdaq Composite index advanced 2.71% to 16,300.42 points.

The green color temporarily dominated the VN30 basket, with 2 losers and 28 gainers. Among them, FPT and SHB were the stocks with the strongest decline. On the other hand, BVH, BCM, SSI, and VJC were the stocks with the strongest increase.

Telecommunications service stocks were one of the most prominent sectors at the beginning of the morning session, with stocks increasing positively from the beginning of the session, such as YEG (+1.82%), VGI (+3.09%), CTR (+2.3%), and FOX (+2.56%)…

Along with that, energy stocks also contributed positively to the market this morning. Specifically, codes such as PVD (+1.78%), PVS (+1.89%), PVC (+4.65%), PVB (+2.4%), and NBC (+2.02%)…

– 15:20 23/04/2025

Market Beat: Energy & Real Estate Sectors Surge, VN-Index Rallies Further

The market closed with positive gains, seeing the VN-Index rise by 8.42 points (+0.68%), settling at 1,250.37. Likewise, the HNX-Index witnessed an increase of 0.52 points (+0.24%), ending the day at 213.41. The market breadth tilted in favor of the bulls, with 402 gainers versus 337 losers. The VN30 basket saw a similar trend, with 14 gainers outperforming 11 losers, while 5 stocks remained unchanged, adding a slight tilt to the bullish sentiment.

The Market Momentum: Can the Uptrend Persist?

The VN-Index witnessed a significant surge, forming a bullish White Marubozu candlestick pattern and breaching the 200-day SMA. This strong performance reflects a buoyant investor sentiment. Should the index sustain these levels and witness a substantial uptick in volume, the outlook would brighten considerably. Notably, the MACD indicator continues to flash a buy signal, and a potential crossover above zero in upcoming sessions remains on the cards. If this materializes, the optimistic short-term sentiment is here to stay.

Deep Discounts, Stock Market Surges: 194,000 New Accounts Join the Fray.

As of April 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, according to Vietnam Securities Depository (VSDC). The country’s stock market boasted over 9.88 million accounts, reflecting an increase of 194,023 accounts since March. This remarkable growth marks the highest increase in the past eight months.