Source: VietstockFinance

|

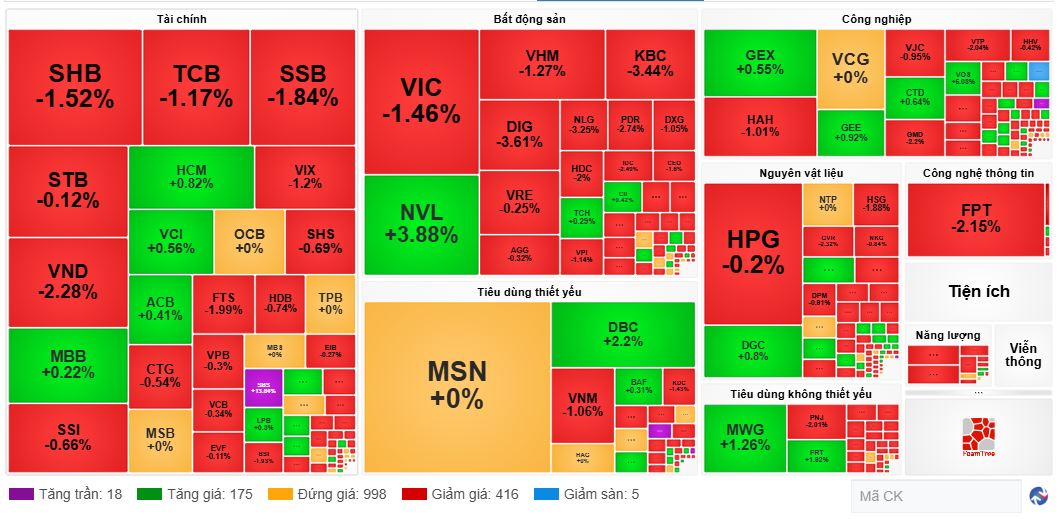

At the close on April 22nd, the VN-Index experienced a “rebirth” as it narrowed its loss to 9.94 points, or 0.82%, closing at 1,197.13. Similarly, the HNX-Index and UPCoM-Index also trimmed their losses, ending the day at 207.71 and 89.67, respectively.

In reality, bottom-fishing demand was not widespread across the market, as 679 stocks still declined, including 36 that hit their daily limit downs, while only 197 stocks advanced, and the remaining 736 remained unchanged. This was further evidenced by the VN30-Index, which only fell by 3.91 points, or 0.3%.

The market landscape witnessed more green on the screen compared to an hour earlier. In the banking group, STB rose 0.49%, MBB gained 0.65%, SSB climbed 0.79%, VCB increased 0.52%, and LPB went up by 0.61%. In the securities sector, HCM added 0.82%, VCI rose 0.28%, VFS surged 5.33%, and APG advanced 2.91%. Turning to the real estate industry, NVL jumped 3.4%, while VHM and VRE climbed 4.55% and 0.98%, respectively, contrasting with their sibling VIC, which fell 4.07%.

Additionally, several large-cap stocks from various sectors also ended in positive territory, including MSN from the food industry, HPG from the steel sector, and MWG and FRT from the retail industry.

Looking at the top 10 stocks with the most positive impact on the VN-Index today, VHM took the lead by contributing nearly 2.6 points, followed by HVN with almost 0.8 points and MWG with over 0.6 points. On the opposite side, VIC had the most negative impact, taking away more than 2.2 points, followed by GVR with nearly 1.3 points and TCB with almost 1 point.

| Stocks with the biggest impact on the VN-Index on April 22nd |

|

|

The market witnessed active trading in the afternoon session, resulting in a total trading value of over 36,899 billion VND. Foreign investors also joined the buying side, with a net buy value of more than 601 billion VND. Their net buying focused on HPG, MWG, and STB, while FPT and KBC were among the top stocks on the selling side.

Market Beat for April 22nd: Bottom-fishing Demand Appeared at the 1,140-point Level

After a sharp drop at the beginning of the afternoon session, accompanied by high trading volume, the VN-Index witnessed bottom-fishing demand at the 1,140-point level, helping to narrow its loss significantly.

Source: VietstockFinance

|

As of 2:00 PM, the VN-Index recovered to 1,163.75 points, a decrease of 43.32 points. Meanwhile, the HNX-Index and UPCoM-Index fell 9.29 points and 2.69 points, closing at 202.18 and 88.21, respectively.

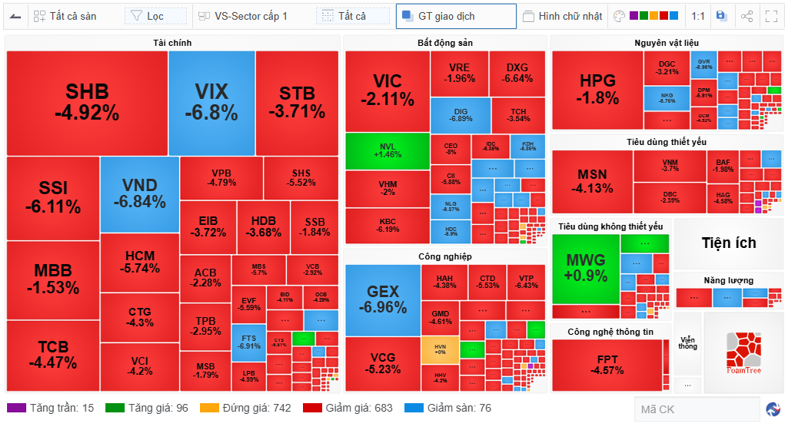

Looking at the market landscape, red and light green colors were prevalent across all stock sectors, notably in the large-cap banking, securities, real estate, materials, and consumer industries.

In total, the market had 759 declining stocks, including 76 hitting their daily limit downs, while only 111 stocks advanced, with 15 of them reaching their daily limit ups. However, some bright spots emerged, including NVL, SBS, MWG, and VOS.

|

Red and light green colors dominated the market

Source: VietstockFinance

|

The sharp decline after the recent recovery phase seemed to be somewhat anticipated by investors. At the “Vietnam and its Indices” event held on April 21st, Mr. Nguyen Viet Duc, Director of Digital Banking at VPBank, shared that looking back at the sharp declines in the stock market, once the VN-Index falls below the MA200, all recovery attempts have been strongly resisted by the MA200, which corresponds to the 1,260-1,280 range. In reality, selling pressure reappeared at the 1,242 level, even before the index touched the MA200.

Mr. Duc emphasized that when the index falls below the MA200, it often retests the bottom. According to this scenario, a strong support level like 1,140 points presents a buying opportunity if one hasn’t built a sufficient position yet.

Although Vietnam experienced a sharp decline, it was not an isolated case. Overnight, U.S. stocks also fell sharply as President Donald Trump intensified his criticism of Fed Chairman Jerome Powell, raising doubts about the independence of the central bank, while investors saw little progress in global trade negotiations.

1:20 PM: Sudden Plunge, VN-Index Lost Nearly 70 Points

At the beginning of the afternoon session, selling pressure suddenly spread across the market, causing the main index on the HOSE to plunge. As of 1:22 PM, the VN-Index had lost nearly 70 points.

At the morning close, the VN-Index stood at 1,189 points, down 18 points. Meanwhile, the HNX-Index fell 4 points to just above 207.4.

After the lunch break, the downward trend continued. By 1:15 PM, the VN-Index had dropped 40 points, while the HNX-Index lost 8 points. Red dominated the market, with over 680 declining stocks, including 66 at their daily limit downs.

Sectors such as energy, telecommunications, financial services, and software all fell by 5-6%.

At 1:20 PM, the VN-Index continued its free fall, losing 63 points to 1,143.7 points. The number of stocks hitting their daily limit downs increased to 78.

10:30 AM: Trading Momentum Shows Signs of Weakening

The downward trend extended further from the early session, and by 10:20 AM, the VN-Index had lost nearly 10 points, falling to 1,197.4 points. Meanwhile, the HNX-Index dropped 1.6 points to 209.85 points.

Trading momentum showed signs of weakening, as the total trading value for the first half of the morning session was 5.4 trillion VND, lower than the same period yesterday. Red dominated the market in sectors such as real estate, information technology, materials, and energy. On the other hand, the financial and consumer sectors were mixed.

Market performance as of 10:20 AM. Source: VietstockFinance

|

At that time, the Vingroup trio, comprising VIC, VHM, and FPT, along with GVR, were exerting significant downward pressure on the index. Conversely, NVL, FRT, and VOS were providing some support, although their impact was not sufficient to counter the decline.

NVL surged nearly 4% this morning, leading the trading volume on the HOSE with a matched volume of over 14.1 million shares. This was the third consecutive gaining session for this stock. Yesterday, it hit its daily limit up with a trading volume of over 24.3 million shares.

VIC stock was in a tug-of-war as it fluctuated around the reference price. After two consecutive daily limit downs, investors seemed hesitant about this stock.

Opening: Red Continues to Dominate

Red remained the dominant color in the stock market. At the opening of the April 22nd session, the VN-Index fell more than 6 points, dropping below the 1,200 level. The market breadth was negative, with nearly 290 declining stocks compared to 100 advancing ones.

GAS, VHM, TCB, and CTG were among the stocks with the most negative impact on the VN-Index. Additionally, several large-cap securities stocks also traded negatively, with SSI, VND, and HCM among the top decliners.

On the positive side, VIC, ACB, and STB were providing some support to the market, although their gains were not significant.

Despite the overall negative sentiment, some stocks managed to buck the trend, with NVL, DGC, and DBC rising by 2-3%.

Green still appeared in major sectors. In the financial sector, ACB, MSB, EVF, VCB, and LPB remained in positive territory. Notably, SBS even hit its daily limit up. In the materials sector, the situation looked more favorable, with many stocks maintaining their gains, including DGC, NTP, DCM, BFC, KSV, PLC, and LAS.

– 4:10 PM, April 22nd, 2025

The Market Mind: Caution Still Lingers

The VN-Index pared its gains, forming an Inverted Hammer candlestick pattern and failing to breach the previous peak established in mid-April 2025 (1,230-1,245 points). The cautious sentiment among investors was further reflected in the trading volume, which remained below the 20-day average. To sustain its upward trajectory, the index needs to surpass this threshold in the upcoming sessions. Nonetheless, the MACD and Stochastic Oscillator indicators remain upward-pointing and have generated buy signals. If this status quo persists, the short-term optimistic outlook is likely to extend.

Market Beat: VN-Index Turns to Late Session Tug-of-War, Holding on to Green Tint.

The market closed with positive gains as the VN-Index rose by 5.88 points (+0.48%), settling at 1,229.23. Similarly, the HNX-Index witnessed an increase of 0.65 points (+0.31%), ending the day at 211.72. The market breadth tilted towards the bulls with 404 gainers versus 323 decliners. The VN30 basket also painted a positive picture, with 15 gainers outperforming the 13 losers, while 2 stocks remained unchanged, tilting the basket towards the green.

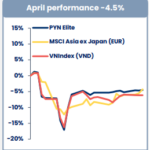

Shark PYN Elite: Deep-Value Adjustments Offer Golden Opportunity to Accumulate Quality Stocks

In PYN Elite’s April 2025 investment report, the large-scale foreign fund with approximately VND 22,000 billion in assets views the recent sell-off in the Vietnamese stock market as an opportunity to accumulate high-quality stocks at attractive discounts.

Stock Market Outlook for April 21-25, 2025: Returning to an Optimistic Mindset

The VN-Index concluded the week on a positive note, with a significant rise in trading volume, surpassing the 20-week average. This indicates a sustained influx of capital into the market. Moreover, foreign investors’ net buying, following an extended period of net selling, serves as a notable supportive signal, boosting investor sentiment and enhancing the short-term positive outlook.

Market Beat: Afternoon Euphoria Sends VN-Index Soaring by 20 Points

The VN-Index defied the morning’s tug-of-war, surging in the afternoon session to close at 1,269.8 points on May 8, a substantial gain of 19.43 points. Mirroring this positive trend, the HNX-Index climbed 1.8 points to 215.21, while the UPCoM-Index inched up 0.06 points to 92.98. Trading value accelerated, surpassing 20,718 billion VND.