Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 693 million shares, equivalent to a value of more than 15.8 trillion dong; HNX-Index reached over 59.8 million shares, equivalent to a value of more than 827 billion dong.

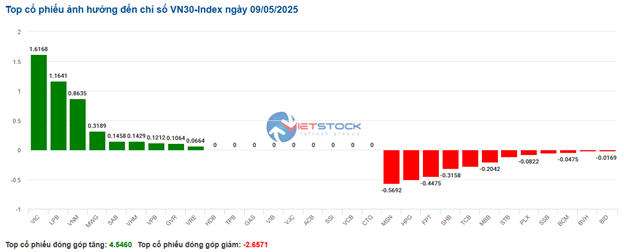

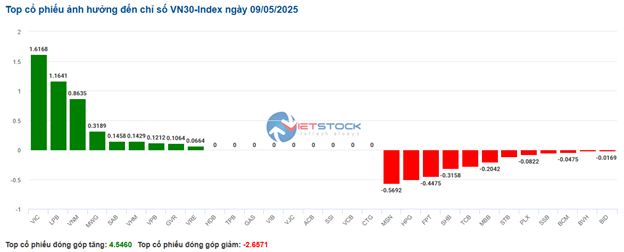

VN-Index opened the afternoon session with a prolonged tug-of-war and the sellers slightly outperformed, causing the index to fail to recover and close in the red. In terms of impact, VIC, VCB, BID, and GAS were the most negative influences on the VN-Index, with a decrease of 3.5 points. On the other hand, LPB, FPT, TCB, and PNJ remained in the green and contributed more than 2.2 points to the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on May 09, 2025 |

Similarly, the HNX-Index also had a rather pessimistic performance, with the index negatively impacted by BAB (-2.65%), DTK (-3.13%), KSF (-1.24%), and PVS (-1.48%)…

|

Source: VietstockFinance

|

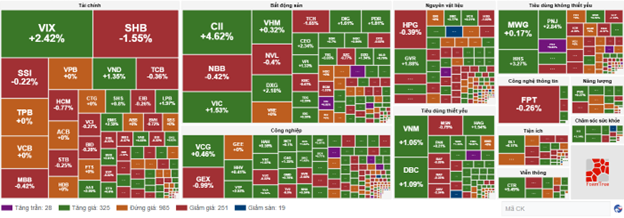

The real estate industry was the group with the sharpest decline in the market, falling by 0.97%, mainly due to VIC (-2.55%), BCM (-0.83%), SSH (-1.24%), and KDH (-1.22%). This was followed by the utilities and financial sectors, which decreased by 0.22% and 0.15%, respectively. On the other hand, the information technology industry maintained its positive performance with a 1.4% increase, mainly driven by FPT (+1.49%) and ITD (+1.85%).

In terms of foreign trading, they returned to net selling with more than 89 billion dong on the HOSE exchange, focusing on VCB (184.35 billion), VHM (133.67 billion), NVL (91.44 billion), and VCG (67.22 billion). On the HNX exchange, foreign investors net sold more than 390 million dong, focusing on PVS (15.76 billion), TNG (2.63 billion), BVS (1.8 billion), and AAV (1.07 billion).

| Foreign trading net buying and selling |

Morning Session: Foreigners returned to net selling, with VCB being the most heavily sold stock

The market fluctuated and turned red towards the end of the morning session. By lunchtime, the VN-Index stood just below the reference level at 1,269.75 points. The HNX-Index decreased by 0.28% to 214.6 points. The market breadth was balanced, with 334 gainers and 334 losers.

VIC, LPB, and VNM are actively supporting the indices, contributing more than 1.5 points to the increase. Meanwhile, although the number of declining stocks increased, the extent was not overly concerning. The most significant negative impacts came from HVN, BID, and VCB, causing the VN-Index to lose more than 1 point.

Considering the sector performance, except for the telecommunications group, which recorded a significant increase of nearly 1% with the main contributions coming from the two large-cap stocks in the industry, VGI (+1%) and CTR (+3.81%), the other sectors fluctuated within a narrow range.

Typically, the real estate group is trying to hold on to the green with efforts from VIC, VHM, DXG, PDR, CEO, QCG, etc. However, adjustment pressure is present in many stocks after a good upward momentum previously, with BCM, KBC, NVL, TCH, HDG, IJC, etc., all declining by more than 1%.

The financial sector was somewhat more negative, with the red dominating the industry’s landscape. Only a few bright spots of green were visible, such as LPB (+2.12%), VAB (+4.55%), VIX (+1.21%), and VND (+1.01%).

Foreigners returned to net selling in the morning after four consecutive sessions of net buying, with a total net selling value of more than 350 billion dong on all three exchanges. VCB was the stock that foreigners dumped the most heavily, with a value of over 104 billion dong, far exceeding the second-ranked stock, SSI, at 62 billion dong. Meanwhile, the value of the top net buying stocks was modest, with VIX and PNJ leading at 35 billion dong and 31 billion dong, respectively.

| Top 10 stocks that foreigners bought and sold the most in the morning session of May 09, 2025 |

10:40 AM: Transitioned to a tug-of-war state

Selling pressure intensified compared to the beginning of the session, pushing the major indices below the reference level and transitioning to a tug-of-war state. As of 10:30 AM, the VN-Index slightly increased by 1.83 points, trading around 1,271 points. The HNX-Index gained 0.39 points, trading around 215 points.

The breadth of the stocks in the VN30 basket was highly divergent, with the buying side slightly outperforming. Specifically, VIC, LPB, VNM, and MWG remained in the green and supported the VN30-Index with more than 4.1 points. Conversely, MSN, HPG, FPT, and SHB took away 0.57 points, 0.50 points, 0.45 points, and 0.32 points from the overall index, respectively.

Source: VietstockFinance

|

The information technology industry recorded a sharp decline in the market. Notably, FPT fell by 0.35%, CMG dropped by 0.3%, CMT decreased by 2.17%, and POT slid by 2.52%…

Following this was the energy sector, which exhibited a highly divergent performance with selling pressure dominating. Specifically, PVS declined by 0.37%, TMB fell by 1.41%, NBC dropped by 1%, and MGC decreased by 4.35%…

On the other hand, the essential consumer goods industry was among the groups with the most robust recovery, with green hues concentrated in large-cap stocks such as MCH, which rose by 2.39%, SAB increased by 1.44%, and VNM advanced by 1.22%… However, a few stocks remained under selling pressure, including MSN, which fell by 0.79%, KDC decreased by 0.36%, SBT dropped by 1.15%, and BAF slid by 0.88%…

Compared to the beginning of the session, the divergent performance persisted, with over 980 stocks unchanged and the buying side slightly outperforming. There were 325 gainers and 251 losers.

Source: VietstockFinance

|

Opening: Positive start

At the beginning of the May 09 session, as of 9:30 AM, the VN-Index started in the green, reaching 1,274.13 points. Meanwhile, the HNX-Index slightly increased, maintaining 215.48 points.

U.S. stocks rose on Thursday (May 08) after U.S. President Donald Trump announced a trade agreement between the U.S. and the U.K., the first significant trade deal since the U.S. imposed tariffs on most global nations early this year. At the close of the May 08 session, the Dow Jones index rose 254.48 points (equivalent to 0.62%) to 41,368.45 points. The S&P 500 index added 0.58% to 5,663.94 points. The Nasdaq Composite index advanced 1.07% to 17,928.14 points.

The green hue temporarily dominated the VN30 basket, with 10 decliners, 15 gainers, and 5 unchanged stocks. Among them, BCM, VJC, BVH, and PLX were the stocks with the sharpest declines. Conversely, VNM, LPB, GVR, and VIC were the stocks with the strongest gains.

Telecommunication services stocks were among the most prominent industries at the beginning of the morning session. Stocks in this sector rose positively from the start, such as VGI, increasing by 1.58%, CTR surging by 3.02%, FOX climbing by 0.11%, FOC rising by 2.25%, SGT advancing by 1.12%,…

Following this was the industrial sector, where most stocks contributed positively to the market’s performance this morning. Notably, ACV rose by 0.94%, VTP climbed by 2.4%, VCG increased by 2.08%, GMD gained 0.57%, CII surged by 6.15%, HHV advanced by 2.88%,…

|

Changes to the KRX System

|

“VNDIRECT Research: Cautiously Awaiting the Outcome of Vietnam-US Trade Talks”

VNDIRECT Securities Analysis Unit (VNDIRECT Research) forecasts that the VN-Index will fluctuate between 1,230 and 1,520 points by the end of 2025, depending on three main scenarios. The outcome will hinge on the trade negotiations between the US and Vietnam, the number of Fed rate cuts, the State Bank’s interest rate management, and the results of the FTSE’s market classification review in September.

HNX Liquidity Surges 38% in April

In April 2025, the HNX-listed stock market closed at 211.94 points, a 10% decrease from the previous month. Despite this decline, the market witnessed a significant surge in liquidity, with a remarkable 38% increase, resulting in a robust 89.4 million shares traded per session.

Stock Market Week May 5-9, 2025: Powerful Breakthrough

The VN-Index concluded a highly positive week of trading, recording gains in 4 out of 5 consecutive sessions and surpassing the 200-day SMA. The resumption of net foreign buying was a key factor in supporting this upward momentum. If this trend persists into the next week, coupled with stronger market participation, the VN-Index is poised to further consolidate and extend its gains.

The Top Stocks to Watch at the Start of the 09/05 Session

The stock market is a dynamic and ever-changing landscape, and keeping up with the biggest gainers and losers is crucial for investors. Vietstock’s statistical insights offer a glimpse into the rising and falling stocks, providing valuable information for strategic financial decisions.