Market liquidity increased compared to the previous trading session, with the matched trading volume of VN-Index reaching over 562 million shares, equivalent to a value of more than 13.1 trillion dong; HNX-Index reached over 40.8 million shares, equivalent to a value of more than 655 billion dong.

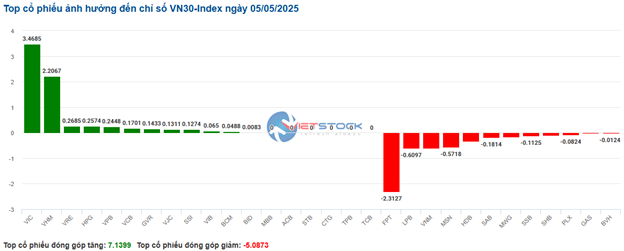

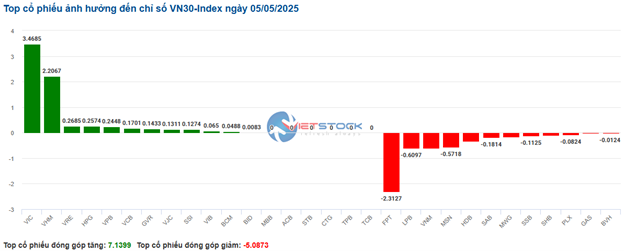

| Top 10 stocks with the strongest impact on VN-Index on May 5, 2025 |

VN-Index opened the afternoon session with buyers gradually regaining the upper hand, helping the index continue to break through and close in positive territory. In terms of impact, VHM, VIC, GVR, and VRE were the most positive influences on the VN-Index, contributing over 6.2 points. On the other hand, VCB, VNM, LPB, and FPT were still under selling pressure and took away more than 1.2 points from the overall index.

Similarly, the HNX-Index also had an optimistic performance, positively impacted by IDC (+3.59%), PVS (+1.56%), NTP (+1.79%), PLC (+6.69%), etc.

|

Source: VietstockFinance

|

The real estate industry was the group with the strongest growth, up 2.71%, mainly driven by VIC (+2.94%), VHM (+4.28%), BCM (+4.55%), and VRE (+5.29%). This was followed by the materials and industrial sectors, which increased by 1.89% and 0.97%, respectively. On the other hand, the information technology sector saw the biggest decline in the market, falling by 0.56%, mainly due to FPT (-0.73%).

In terms of foreign trading, foreigners net bought over 90 billion dong on the HOSE exchange, focusing on VRE (92.21 billion), MSN (40.77 billion), NLG (39.68 billion), and MWG (33.93 billion). On the HNX exchange, foreigners net sold more than 22 billion dong, focusing on PVS (13.02 billion), IDC (4.83 billion), CEO (2.74 billion), and TNG (1.32 billion).

| Foreign Trading Net Buying and Selling |

Morning Session: Caution Persists, Foreigners Dump FPT

The new KRX system has not yet brought much excitement to the market. By lunchtime, the VN-Index continued to fluctuate around the 1,230-point threshold, while the HNX-Index turned red, settling at 211.8 points. The market breadth was relatively balanced, with 320 gainers and 293 losers.

Liquidity remained low, with the matched trading value in the morning session reaching just over 5.3 trillion dong on the HOSE and 291 billion dong on the HNX, similar to the subdued levels before the holiday.

The green territory was mainly supported by a few large-cap stocks. VHM, VIC, and GVR were the top three contributors, adding more than 5 points to the VN-Index. On the other hand, FPT was the most significant drag on the index, taking away more than half a point.

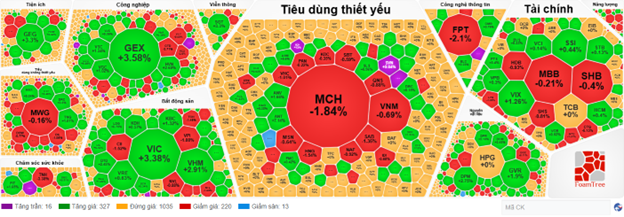

The market showed clear signs of differentiation, with most sector indices fluctuating within a narrow range, except for the standout performance of the real estate group (+2.16%) thanks to the strong momentum of the Vingroup trio, including VIC (+3.38%), VHM (+4.11%), and VRE (+2.33%). In contrast, the information technology sector lagged with a decline of 1.27% due to substantial pressure from its leader, FPT (-1.37%).

Foreign investors also reduced their trading activity, with net selling pressure mainly coming from FPT (235 billion dong), while VHM was the most actively bought stock, but with a modest net purchase of only 47 billion dong.

| Top 10 stocks with the strongest foreign net buying and selling in the morning session of May 5, 2025 |

10:30 AM: Market Fluctuates as MCH Sees Large Block Trade

Investor caution was evident as the main indices, which had started the day with strong gains, turned to fluctuate around the reference level. As of 10:30 AM, the VN-Index rose slightly by 4 points, trading around 1,230 points. The HNX-Index gained 0.38 points, trading around 212 points.

Stocks in the VN30 basket showed strong differentiation, but buyers slightly outpaced sellers. Specifically, VIC, VHM, VRE, and HPG contributed 3.47 points, 2.21 points, 0.27 points, and 0.26 points to the overall index, respectively. Conversely, FPT, LPB, VNM, and MSN faced selling pressure and took away more than 4.1 points from the VN30-Index.

Source: VietstockFinance

|

The real estate group was the best-performing sector in the market, although some differentiation was still evident. Notable gainers included VIC (+3.24%), VHM (+2.57%), VRE (+1.06%), and BCM (+1.27%) … Meanwhile, stocks such as SSH, PDR, NVL, and KSF were still under selling pressure, but the declines were not significant.

The telecommunications sector also witnessed differentiation, with sellers slightly outpacing buyers. VGI rose by 1.18%, SGT gained 3.6%, and YEG increased by 0.43% … On the downside, stocks such as CTR, ELC, FOC, and others turned red, but the declines were not substantial.

In contrast, the information technology sector saw a less positive performance as its leader, FPT, faced selling pressure, which weighed on the group. However, other stocks in the sector, such as ITD (+6.94%), CMG (+0.95%), SMT (+6.96%), and HPT (+8.49%), posted gains.

Additionally, the essential consumer goods sector saw red territory, with declines in large-cap stocks such as VNM (-0.69%), MSN (-0.64%), and SAB (-1.66%) … Notably, the stock MCH fell by 1.84% and saw a large block trade worth over 2,800 billion dong as of 10:25 AM.

Compared to the opening, buyers continued to hold the upper hand. There were 327 gainers and 220 losers.

Source: VietstockFinance

|

Opening: KRX System Goes Live, Green Across Most Sectors

At the start of the May 5 session, the VN-Index rose sharply by more than 5 points to 1,232.14 points. The HNX-Index also edged higher, reaching 212.79 points.

The new KRX system officially went live on May 5, 2025, marking a significant turning point for the Vietnamese stock market. The operation of the KRX system will enhance the market’s processing capacity and liquidity and pave the way for the introduction of new products such as intraday trading (T+0), short selling, and new derivatives.

As of 9:30 AM, green territory prevailed in the VN30 basket, with 10 decliners, 16 advancers, and 4 stocks trading unchanged. Among the decliners, PLX, FPT, LPB, and SAB posted the most significant losses. On the other hand, GVR, SSI, BCM, and VHM were the top gainers.

Industrial stocks continued their stable growth in the market, with most stocks maintaining their upward momentum. Notable gainers included HVN (+4.27%), GMD (+2.45%), HAH (+2.65%), VTP (+1.82%), HBC (+1.59%), HHV (+1.27%), and others.

The telecommunications services sector also contributed positively to the market’s performance this morning, with a growth rate of 1.13%. Standout performers included VGI (+1.48%), CTR (+1.3%), YEG (+0.85%), and SGT (+0.9%), among others.

|

Changes with the KRX System

|

“Vietstock Daily: Caution Prevails Ahead of Long Weekend”

The VN-Index witnessed a slight dip with trading volumes remaining below the 20-day average, indicating a continued cautious sentiment among investors. The recent peak formed in mid-April 2025 (approximately 1,230 – 1,245 points) now acts as a short-term resistance level for the index.

Market Beat: VHM Sees Foreign Sell-Off of $5 Million, VN-Index in a Tug-of-War

The market closed with the VN-Index down 2.43 points (-0.2%), settling at 1,226.8 points. The HNX-Index also witnessed a decline of 0.27 points (-0.13%), ending the day at 211.45. The market breadth tilted slightly towards the bullish side, with 396 gainers outweighing 353 losers. Within the VN30 basket, bulls held a slight edge, as evidenced by 15 advancing stocks, 13 declining stocks, and 2 stocks remaining unchanged.

Market Beat: VN-Index Recovers from 70-Point Loss to Close Down Just Under 10 Points

The market seemed poised for a major correction at the start of the afternoon session, but buyers quickly stepped in as the index touched the strong support level of 1,140 points. This swift response from buyers fueled a continuous recovery for the remainder of the trading day.

Stock Market Update for April 28-29, 2025: The Tug-of-War Continues

The VN-Index ended the week with a slight decline, maintaining a tug-of-war stance as alternating weeks of gains and losses have been prevalent in recent times. This reflects the unstable sentiment of investors following the sharp decline at the end of March 2025. At present, the index is struggling to surpass the crucial resistance level at the 200-week SMA. If this condition persists, the prospect of the VN-Index establishing an upward trend in the coming period will face further challenges.