Central Bank Rate Continues to Fall as VietinBank Raises USD Buying Price

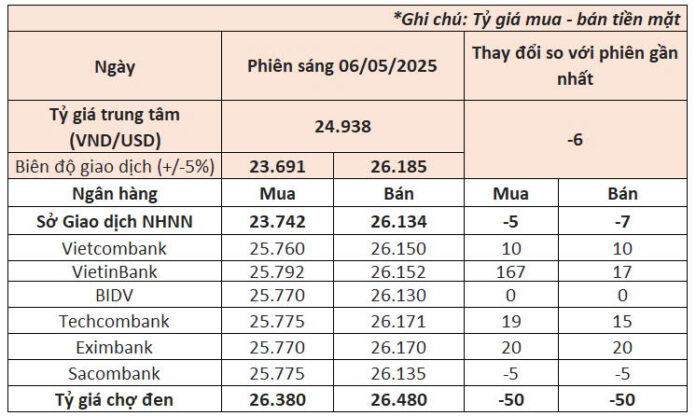

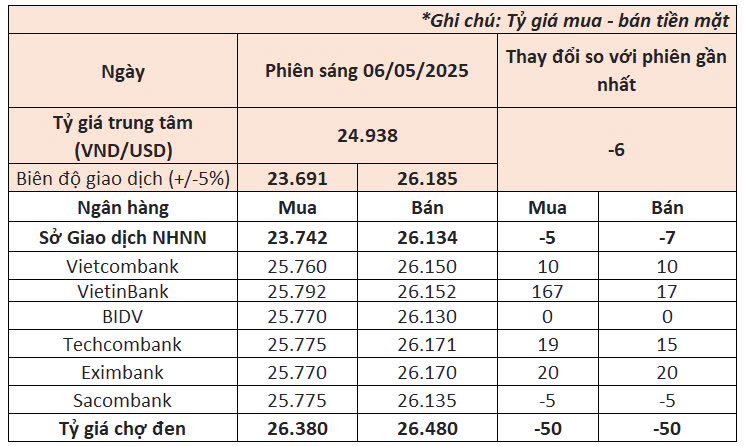

Today (May 6), the State Bank of Vietnam set the central exchange rate at 24,938 VND/USD, a decrease of 6 VND from yesterday’s rate, marking the second consecutive decline since the holiday period. Since the beginning of the week, the central rate has dropped by a total of 18 VND.

With a 5% fluctuation band, the trading rate for commercial banks is currently between 23,691 and 26,185 VND/USD.

The State Bank of Vietnam’s trading center also lowered the buying and selling rates to 23,742 and 26,134 VND/USD, respectively.

This morning, USD rates at commercial banks showed an upward trend after a significant drop yesterday.

At 10:00 AM, Vietcombank, the largest foreign currency trader in the system, set its USD buying and selling rates at 25,760 and 26,150 VND/USD, respectively, a 10 VND increase from yesterday’s closing rates.

VietinBank raised its buying and selling rates by 167 and 17 VND, respectively, to 25,792-26,152 VND/USD. Meanwhile, BIDV maintained its rates from the previous day.

Among private banks, the majority also witnessed rate increases. Specifically, Techcombank raised its buying and selling rates by 19 and 15 VND, respectively, while Eximbank increased both rates by 20 VND. In contrast, Sacombank decreased its buying and selling rates by 5 VND.

In the interbank market, the exchange rate ended at 25,953 VND/USD on May 5, a significant drop of 49 VND from the previous session on April 29.

In the black market, as of 10:00 AM today, the USD was traded at 26,380-26,480 VND/USD, with both buying and selling rates decreasing by 50 VND compared to yesterday.

Internationally, the US Dollar Index (DXY), which measures the strength of the greenback against a basket of major currencies, dipped slightly to 99.86 after rebounding above 100 earlier in the morning.

Since the beginning of May, the US dollar has strengthened against a range of currencies as investors grew more optimistic about potential trade deals between the US and its partners.

Finance Minister Scott Bessent and White House economic advisor Kevin Hassett expressed hope for easing trade tensions. Mr. Hassett told CNBC that there had been preliminary discussions on tariffs, and China’s recent move to reduce taxes on some US goods was a sign of progress.

On Wednesday, President Donald Trump stated that viable trade agreements with India, South Korea, and Japan are in the works, and there is a high likelihood of reaching a deal with China.

Additionally, the US economy has demonstrated resilience amidst global trade uncertainties. While the first-quarter GDP contraction (-0.3%) was largely attributed to a widening trade deficit as importers stocked up on goods ahead of new tariffs, a positive sign was the growth in consumer spending, a crucial driver of the world’s largest economy. Although it slowed to +1.8% in the first quarter of 2025, it still expanded.

The April US labor market remained generally positive, seemingly unaffected by the rising trade tensions. Job creation remained stable, with an average of 155,000 jobs added in the past three months, slightly lower than the 2024 average of 168,000 jobs.

Gold Prices Surge in the Morning Session of May 6

At the opening of the morning session today, gold bars and gold jewelry prices at major gold shops surged simultaneously. Specifically, gold bar prices at Bao Tin Minh Chau, PNJ, SJC, and DOJI were adjusted to 120.8 – 122.8 million VND/tael (buying – selling), a significant increase of 3 million VND per tael in both buying and selling prices compared to the closing session yesterday. This is also a new record high for gold bar prices.

Gold jewelry prices also recorded impressive gains. Bao Tin Minh Chau, PNJ, SJC, and DOJI simultaneously raised gold jewelry prices by about 2.5 – 3 million VND per tael. Currently, gold jewelry prices at SJC, PNJ, and DOJI are listed at 115.5 – 118 million VND/tael, while Bao Tin Minh Chau’s prices are at 117.5 – 120.5 million VND/tael.

In the global market, the spot gold price is currently trading around $3,360 per ounce, up $26 from the previous session’s close, following a more than 2% gain in the overnight session.

According to Kitco News, gold staged an impressive recovery during Monday’s trading session, erasing last week’s losses as investors bought the dip ahead of the crucial interest rate announcement from the US Federal Reserve.

The Golden Crash: When World Gold Prices Plummet and Bitcoin, Stocks Soar.

The gold price took a significant dip following US President Donald Trump’s announcement of a trade deal with the UK, sparking hopes of similar breakthroughs with other nations. Global stock markets, cryptocurrencies, and oil prices rebounded, indicating a shift towards a more positive investor sentiment.

“Gold Prices Surge as the Dollar Weakens: SPDR Gold Trust Sells Over 6 Tons of Gold This Week”

Global gold prices rose on Friday, May 9, trading above the $3,300/oz mark after a brief dip below this level earlier in the session.