## NHH Share Price Movement from the Beginning of 2024 to the Session on May 8, 2025

| NHH share price movement from the beginning of 2024 to the session on May 8, 2025 |

Specifically, NHH will offer more than 36.44 million shares at a price of VND 10,000/share, which is 11% lower than the market price of VND 11,250/share at the end of the morning session on May 8. The entitlement ratio is 2:1 (for every 2 shares held, shareholders are entitled to buy 1 new share). The newly issued shares will be freely transferable, and the subscription and payment period will take place from June 2 to July 2.

The minimum successful offering rate is 70%. In case this rate is not achieved, even after redistributing the remaining shares to other objects, NHH plans to use its own capital, bank loans, or seek additional funding to ensure the success of the share offering.

The entire proceeds of more than VND 364 billion are expected to be contributed as additional capital to its direct subsidiary, An Trung Industries Co., Ltd. (ATI) in Q2 2025. The goal is to increase ATI’s charter capital from VND 341 billion to VND 705.4 billion.

The additional capital will be invested by ATI in a project to build a factory for manufacturing molds and producing high-tech plastic components in An Phat 1 Industrial Park (Hai Duong). The investment items include the purchase of machinery and equipment, installation of water and electricity systems, advance payment of workshop rent, repayment of loans, and supplementary working capital.

In terms of business plan for 2025, NHH targets a slight increase of 4% in revenue compared to the performance in 2024, reaching VND 2,190 billion, while the expected profit after tax is VND 62 billion, a decrease of 29%.

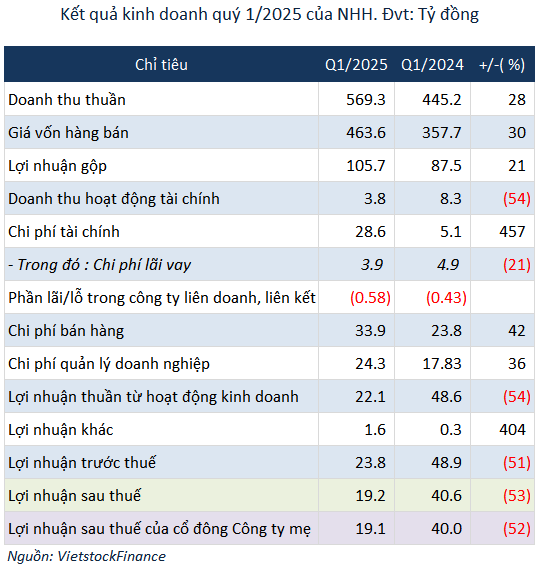

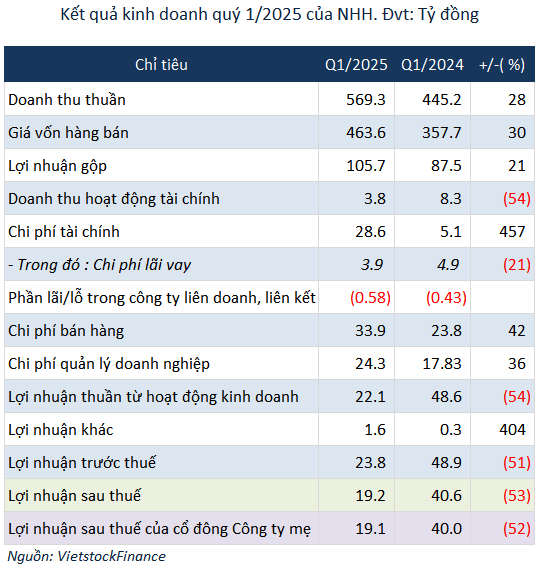

In Q1 2025, NHH recorded more than VND 569 billion in net revenue, up 28% over the same period last year. However, due to a sharp increase in cost of goods sold (30%), gross profit increased by only 21% to nearly VND 106 billion. At the same time, financial revenue decreased by 54%, and selling expenses and management expenses increased, causing net profit to decrease by 52%, reaching over VND 19 billion, equivalent to 31% of the yearly plan.

According to the Company’s explanation, the main reason for the profit decrease was a loss incurred from the recovery of an investment.

– 13:25 05/08/2025

“D2D Announces 2024 Cash Dividend Payout: A Whopping 84% Yield”

Industrial Urban Development Joint Stock Company (HOSE: D2D) is pleased to announce its latest cash dividend offering to shareholders. On May 22nd, the company declared an 84% dividend yield, equivalent to VND 8,400 per share, with the payment expected to be made on June 10th. This announcement marks an exciting opportunity for investors, showcasing the company’s commitment to returning value to its shareholders.

“Investors Express Interest in Long-Term Partnership with BIG Post-Annual General Meeting”

The 2025 Annual General Meeting of Big Invest Group JSC (UPCoM: BIG) was arguably the most memorable event for shareholders since its listing on the stock exchange in early 2022. Aside from record-breaking growth figures, BIG garnered expressions of long-term commitment from numerous professional investors.