In Mirae Asset Securities’ newly released strategic report, the context of the global economy is still facing many uncertainties, mainly due to the unpredictable trade policies of the Trump administration. So far, the stock market has begun to show signs of stabilizing after the decision to temporarily delay reciprocal tariffs for 90 days and exempt taxes on important items such as electronics, semiconductors, and mobile phones, signaling a possible reduction in taxes on China.

In this volatile geopolitical landscape, Vietnam is assessed as one of the countries with the potential to reach an early tariff agreement with the United States, thanks to its consistent political stance and flexible diplomatic policies. According to a neutral scenario, Vietnam is expected to persuade the US to reduce tariff rates to 10-20% and achieve tax exemption for key export items such as electronic components, smartphones, textiles, and footwear.

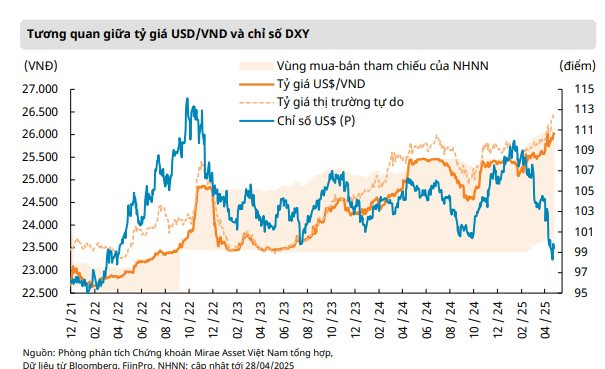

Domestically, the USD/VND exchange rate is under slight upward pressure, but this fluctuation remains manageable, partly due to the State Bank of Vietnam’s active support for interbank liquidity through the open market operation (RRP) instrument. The positive interest rate differential between VND and USD, reflected in the swap rate, returning to positive territory across most tenors, combined with the general expectation of the Fed cutting interest rates from the second half of 2025, has facilitated maintaining domestic interest rates at a low level, thereby promoting credit growth and economic activity.

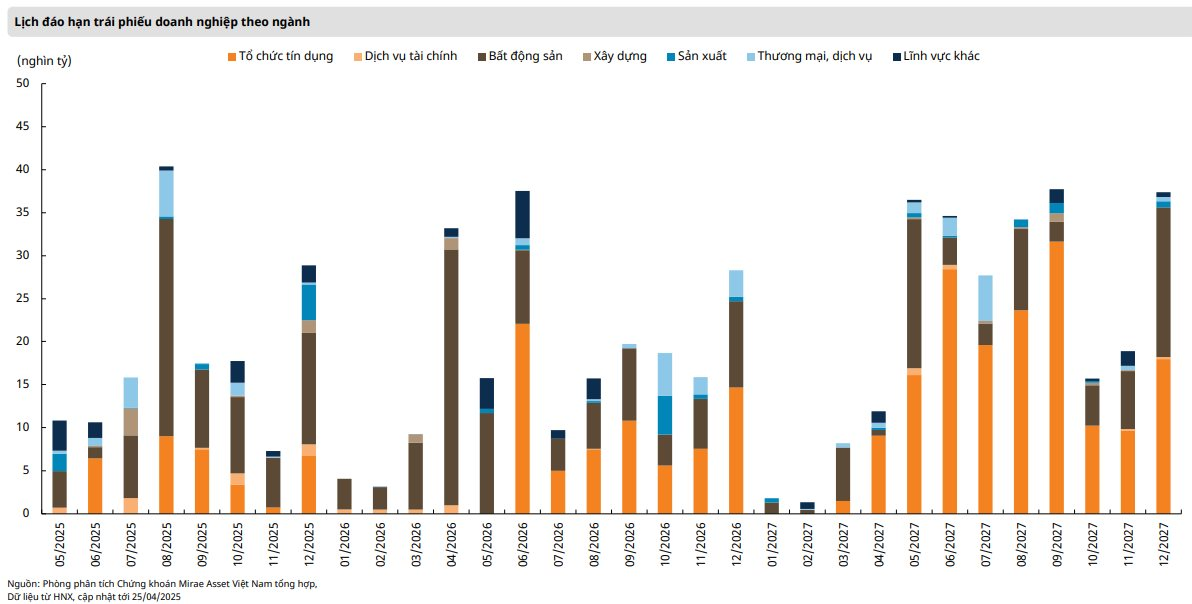

In the bond market, the State Treasury successfully mobilized VND 142,200 billion in the first four months, up 40% over the same period last year. However, the winning yield tended to inch up as investors reassessed risks amid trade tensions and Fed policy uncertainty. Secondary market yields followed a similar pattern, with increases across the yield curve. At the same time, the corporate bond market saw new issuance value surge to VND 27,300 billion (up 40%) in the period from March 4 to April 28. Early redemption amounted to VND 8,800 billion, while approximately VND 9,300 billion of bonds are expected to mature in May, with about VND 2,600 billion from the real estate sector.

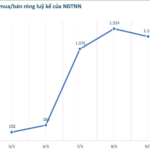

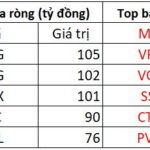

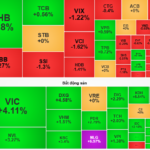

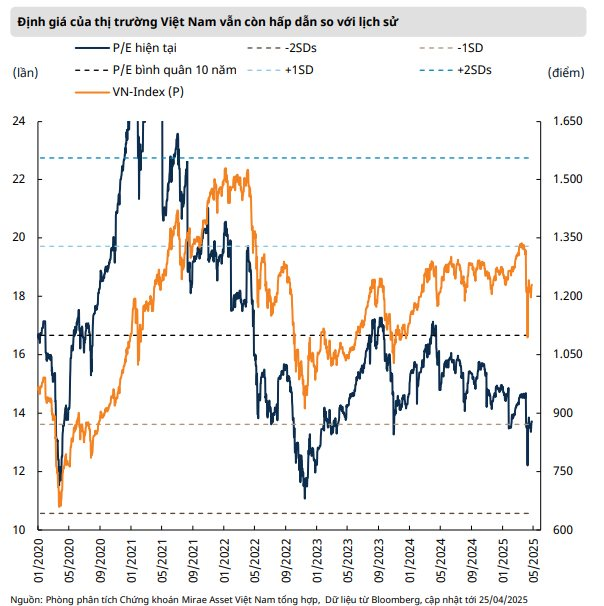

As for the stock market, the VN-Index recorded a sharp decline, which it quickly recovered, mainly due to internal factors, including attractive valuations and a relatively stable domestic macroeconomic context, with a focus on public investment and credit growth. This adjustment is considered a necessary consolidation after the VN-Index failed to conquer the resistance zone of 1,300-1,330 points. On the other hand, April’s trading activities showed the active and continuous participation of individual domestic investors, helping the average trading value per session increase by about 20% compared to the previous month to VND 21,800 billion.

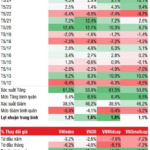

Looking into May, Mirae Asset believes that the outlook for the VN-Index is somewhat brighter, partly due to support from positive first-quarter earnings. According to statistics, the total net profit of listed companies on HoSE grew by 18% over the same period last year, led by sectors such as Real Estate (up 101%) and Retail (up 60%). The implementation and application of the KRX trading system from May 5 are also expected to be a positive factor for the market.

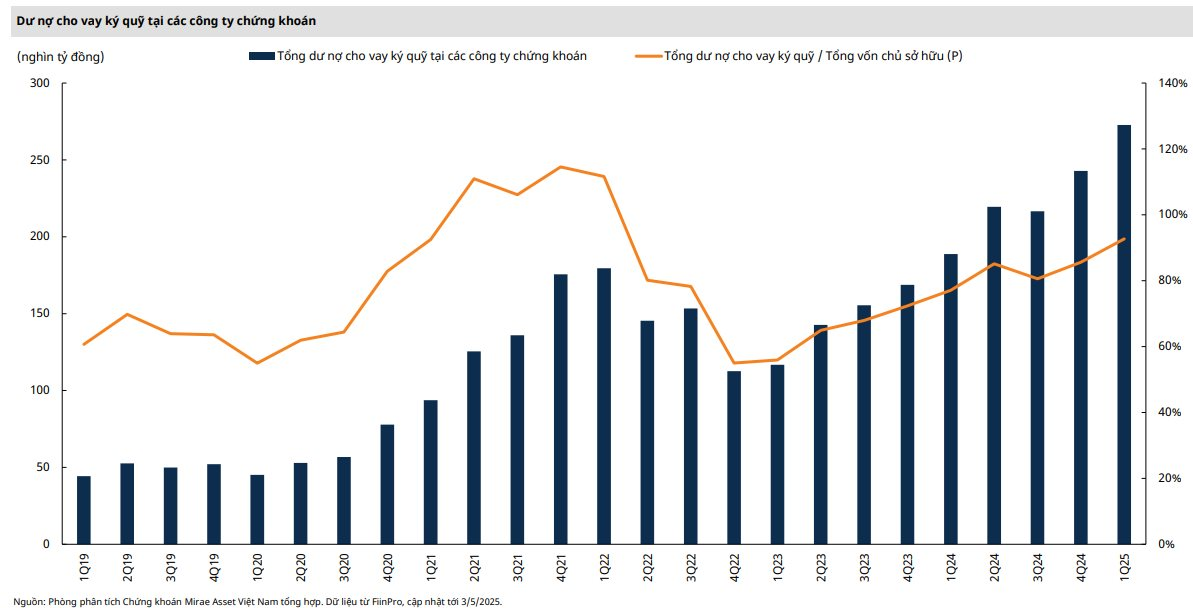

In another development, margin lending outstanding debt reached a high of VND 273,000 billion at the end of the first quarter of 2025, but this figure is only equivalent to 91% of the total equity of securities companies, much lower than the previous peak. This indicates that the system risk from forced selling is manageable, thanks to the market’s resilience and improved risk management by securities companies. However, the ongoing tariff negotiations remain an important variable to monitor. According to Mirae Asset, Vietnam’s optimal strategy is likely to prolong the negotiation process to minimize the impact of tariffs while actively diversifying trade relations through Free Trade Agreements (FTAs).

The report projects that the market will continue to fluctuate in May, with the possibility of testing the support zone of 1,180-1,200 points before the VN-Index continues its recovery trend towards the resistance zone of 1,280 points.

The Powerhouse Move: A $10 Billion Bet on Vietnam’s Stock Market This KRX Go-Live Week

The second week of 2025 witnessed a notable shift as this group emerged as net buyers of Vietnamese stocks.

Vietnam Stock Market Outlook: Consolidating the Uptrend for VN-Index

The Vietnamese stock market ended the trading session on May 7th with a notable gain, as the VN-Index rose by 8.4 points, or 0.68%, closing at the 1250-point level.