Financial Sector Leads Q1 Growth

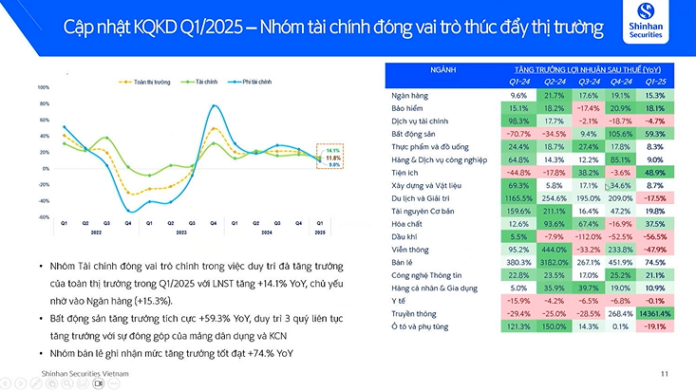

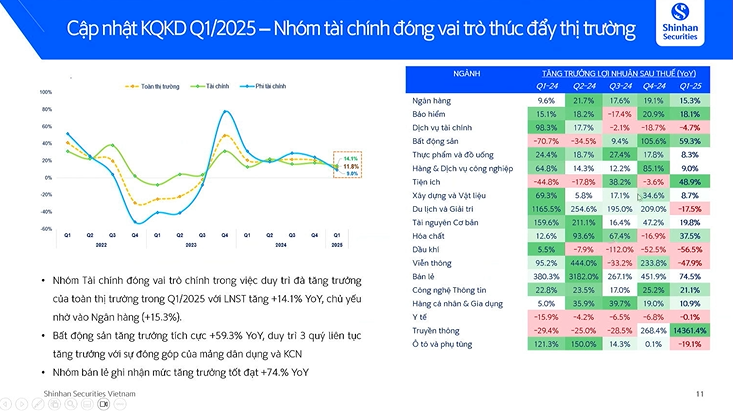

At the Vietstock LIVE program, while reviewing the Q1/2025 business results of listed companies, Mr. Tien noted that one of the critical sectors driving the market and the economy was finance. While the overall market grew by 11.8% year-on-year, the finance group recorded a 14.1% growth rate, mainly driven by banks’ performance.

Some other sectors maintained stable growth, such as real estate, which has been on an upward trend for three consecutive quarters. After the implementation of policies related to three laws – the Real Estate Business Law, the Land Law, and the Housing Law – the real estate market started to improve. The utilities sector also sustained growth due to a low comparison base in Q1/2024. The retail sector witnessed a remarkable 74% year-on-year growth.

|

There was a clear differentiation between private banks and the Big 4 in the banking sector, with private banks outperforming their larger counterparts. This was attributed to their ability to maintain stable net interest margins (NIMs) and sustainable credit growth, with some private banks significantly improving their consumer lending business.

In contrast, the Big 4 banks experienced only slight growth due to slow credit growth and declining interest rates, which narrowed their NIMs. Some banks even reported negative growth, mainly due to reduced NIMs and increased operating expenses.

A notable observation was the increase in non-performing loans (NPLs), particularly in the 3-5 category, compared to Q4/2024, with overall NPLs also on the rise. Meanwhile, loan loss provisions – the financial buffer against increasing NPLs or an economic downturn – only increased slightly. According to statistics from several banks, NPLs increased by approximately 17%, while provisions rose by just 5%. This discrepancy has raised concerns among investors about the banking sector.

However, NPL ratios have remained stable. Among the top 10 banks by market capitalization, the NPL ratio in Q1/2025 was higher than in Q4/2024 but lower than in Q1/2024, indicating a cyclical pattern.

One of the standout sectors recently has been securities, particularly related to the KRX system. The performance of companies in this sector varied significantly, mainly due to differences in proprietary trading and margin lending.

The market is anticipating an upgrade in September, which is expected to attract significant capital inflows into Vietnam, boosting liquidity and growth for securities firms. Currently, the main source of revenue for securities companies is margin lending, as the brokerage business faces intense competition due to zero-fee policies, impacting brokerage income. Therefore, margin lending is expected to become the primary growth driver.

Securities companies are actively increasing their lending, with outstanding loans steadily rising over the years. Companies with higher margin lending ratios will be the forerunners when the market is upgraded.

In the residential real estate sector, while there were variations in performance among companies, the industry has generally recovered well due to strong demand. Enterprises with projects launched this year have reported positive growth. This recovery is supported by the recently enacted three laws related to real estate, along with preferential loan packages from the government.

For industrial real estate, the primary growth drivers were the significant increase in FDI inflows during the first four months of the year and a slight rise in industrial land prices. However, only companies with large land banks have significant growth potential, while those with limited land banks have yet to demonstrate clear growth.

|

Regarding FDI inflows, Mr. Tien noted that the conflict between India and Pakistan could present an opportunity for Vietnam. Global businesses tend to avoid investing in countries with high geopolitical risks. For instance, Apple, one of the largest corporations, is gradually moving its production out of China and has planned to shift to India and Vietnam. However, if India continues to face instability, Apple and other corporations are more likely to prioritize Vietnam.

Therefore, if the trend of FDI diversion from China persists, Vietnam could emerge as an ideal alternative destination instead of India. This is a crucial opportunity for Vietnam to enhance its competitive advantage and attract additional FDI from international partners.

Sector Outlook: Differentiation Ahead, Opportunities Aren’t Universal

Mr. Tien selected several sectors that are less affected or unaffected by the trade war for investors’ consideration.

A prime example is the domestic consumer sector, which is relatively insulated from export market fluctuations. Other sectors include logistics, especially major port clusters, which could become a link between China and the US; the banking sector, with an expected growth rate of around 30-40% for banks; and the steel industry, specifically companies serving the domestic market.

The unaffected sectors include essential industries such as electricity, which has potential due to new policies like the Power Development Plan VIII. Real estate continues to be promising due to preferential loan packages and the enactment of the three related laws. The public investment sector is also expected to thrive, with a projected 30% increase in disbursed capital this year, offering lucrative contract opportunities.

In contrast, some sectors are on the “blacklist” due to their heavy reliance on exports to the US. These include textiles, wood, and seafood.

Sell in May and Go Away?

According to Mr. Tien, a common saying in the investment community is “Sell in May and go away.” One factor contributing to this phenomenon is the information vacuum that occurs after companies hold their annual general meetings and release their Q1 financial results, as the market awaits new trends that will emerge from Q2 performance.

In addition to corporate information, investors should also pay close attention to tariff-related issues, as they significantly impact the market. Sometimes, a single tweet from President Trump is enough to cause market fluctuations the following day.

Therefore, at this juncture, investors who have achieved reasonable profits should consider taking profits and monitoring new developments in tariff policies rather than solely focusing on corporate news.

– 19:02 05/09/2025

The Ultimate Real Estate Launch: 15,000 Strong for HCMC’s Central Property Sensation

On May 9, 2025, in the heart of Ho Chi Minh City at the Saigon Exhibition and Convention Center, a prestigious real estate project, The Privé, made its highly anticipated debut. Developed by the renowned Dat Xanh Group, the project launch, aptly named The Privilege Show, captivated audiences with an artistic showcase, generating buzz and excitement even before its official opening on the night of May 8.

The Great Detached Home – Villa Conundrum: An Unexpected Twist

“David Jackson, CEO of Avison Young, recently shared his insights on the future supply of villas and townhouses in Ho Chi Minh City. He emphasized that the majority of upcoming developments in these segments will be concentrated in the city’s satellite towns. This centrifugal direction is set to be the leading trend, shaping the real estate market.”

The VN-Index Surges by 41 Points Post-Holiday Week

“For the week of May 5th to May 9th, the VN-Index witnessed a robust upward trend, with four out of five trading sessions ending in the green. On May 9th, the index witnessed a slight dip, closing at 1,267.3 points, which still marked a notable 41-point increase compared to the closing value on April 29th.”