**HoSE Cancels Competitive Sale of DMC Shares as No Investors Show Interest**

The Ho Chi Minh City Stock Exchange (HoSE) recently announced the cancellation of a competitive sale of shares in Domesco Health Import-Export Joint Stock Company (code: DMC) owned by the State Capital Investment Corporation (SCIC).

Specifically, by 4:00 PM on April 29, 2025, the deadline for registration and deposit submission for the competitive sale, HoSE’s competitive sale system recorded no registered investors. As per regulations, the competitive sale did not meet the conditions to be organized and was thus considered unsuccessful.

SCIC had planned to publicly auction nearly 12.1 million DMC shares, equivalent to 34.71% of Domesco’s charter capital, with a starting price of nearly VND 1,531.5 billion per lot of shares, equivalent to approximately VND 127,046 per share.

This is the third time that DMC shares have failed to attract bidders. The most recent auction failure was in February 2025 due to a lack of participants, with a starting price of around VND 127,046 per share. In 2019, SCIC also failed to sell the entire 34.71% stake in the pharmaceutical company due to a lack of interest. The starting price per share was VND 119,600, corresponding to a total value of over VND 1,440 billion for the lot. The starting price was also significantly higher than DMC’s market price at that time.

In the stock market, DMC shares have been trading sideways around the VND 62,000 level after a recovery from the beginning of April 2025. Currently, the market price is at VND 62,300 per share, which means that the starting price for this auction is double the market value.

Domesco, established in May 1989, specializes in researching, developing, manufacturing, marketing, and trading pharmaceutical products, medicines derived from medicinal materials, functional foods, pure water, and beverages made from medicinal materials, among other things. Additionally, the company engages in the import and export of medicines, raw materials for pharmaceuticals, food and dietary supplements, medical equipment, and hospital equipment for the healthcare sector.

Domesco presently has a charter capital of over VND 347 billion and a market capitalization of VND 2,160 billion. Aside from the state-owned stake, Abbott Laboratories holds a controlling interest of more than 51% in the company. Given the current situation, the American “giant” is the most likely participant in the auction. However, the exorbitant price could be an impediment to this transaction.

In terms of financial performance for the first quarter of 2025, Domesco recorded net revenue of over VND 469 billion, up 12% year-on-year. After deducting expenses, the company’s post-tax profit exceeded VND 47 billion, a 15% increase compared to the first quarter of 2024.

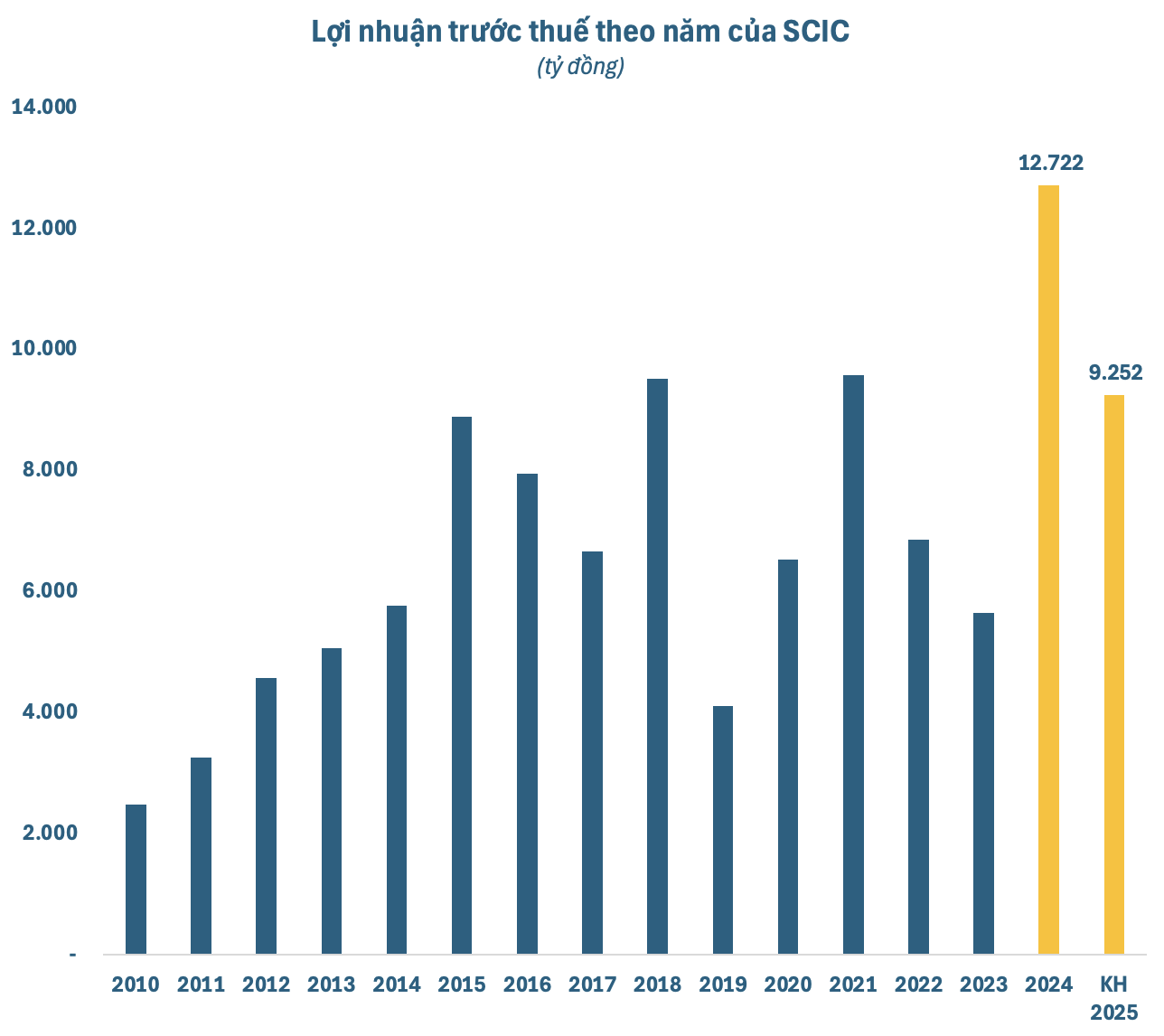

As for SCIC, according to the audited consolidated financial statements for 2024, the corporation achieved a pre-tax profit of over VND 12,700 billion, twice that of the previous year, and exceeded the annual plan. This is SCIC’s highest profit since its inception. The results for 2024 contributed to achieving 5 out of 6 business targets, including revenue, profit, state budget contributions, ROE, and ROA, as per the 2021-2025 Production and Business Plan and Investment Development of SCIC.

The Business Highlights of SCIC’s 2025 Annual General Meeting

The government’s ambitious 8% GDP growth target sets a challenging yet achievable goal for businesses in a year of anticipated economic hurdles. The determination to strive towards this target was evident in the recent round of shareholder meetings, with enterprises partially or wholly owned by the State Capital Investment Corporation (SCIC) leading the charge.

The Elusive Pivot: VN-Index Retreats Amid Cash Crunch

The VIC’s sharp decline has poured cold water on yesterday’s enthusiasm. Despite standouts like FPT and LPB, particularly the latter’s strong performance, its limited market cap prevents it from being considered a pillar, weakening the overall market support. Additionally, the money flow has turned notably cautious, with the breadth tilting towards the red and liquidity declining by 13%.

The Market Wary of Tariff Talks: Foreign Investors Turn Net Sellers

This morning, the market witnessed a significant cautious sentiment as preliminary and unofficial news regarding the first meeting on tariff issues was circulated. Despite an impressive surge in VIC, the second-largest market cap stock, the VN-Index fluctuated and posted a modest gain amid declining liquidity and a strong net sell-off by foreign investors.

“Sabeco Finalizes Dividend Payout for 2024: A Generous Treat for Shareholders”

“Shareholders of the Saigon Beer, Alcohol, and Beverage Joint Stock Company (Sabeco) will have until June 30th to trade their shares without entitlement to the remaining 2024 cash dividend. This key date was announced on the Ho Chi Minh City Stock Exchange (HoSE), where Sabeco is listed under the ticker symbol ‘SAB’.”