|

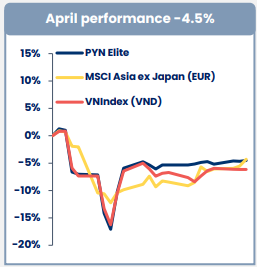

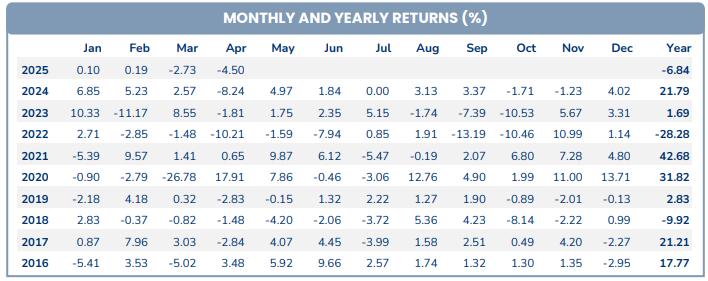

PYN Elite’s Performance vs. VN-Index

Source: PYN Elite Fund

|

PYN Elite, a prominent foreign fund with significant holdings in Vietnam, reported that the market experienced heightened volatility in April. Following a sharp 16.2% dip in the VN-Index, the index rebounded on news of tariff postponement and positive first-quarter earnings reports. Overall, the VN-Index declined by 6.2% for the month, while PYN Elite’s portfolio outperformed, dropping only 4.5%. This relative resilience was attributed to strong gains in key holdings such as HVN (+9.3%), STB (+2.1%), and MWG (+3.1%), which offset losses in VHC (-20.5%), SCS (-14.2%), and ASM (-14.2%).

|

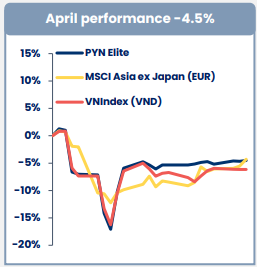

PYN Elite’s Investment Performance for 2016-2025

Source: PYN Elite Fund

|

“Notably, 96% of our portfolio is focused on domestic sectors, which are less directly impacted by tariffs. The recent correction has presented opportunities to increase our exposure to high-quality stocks at attractive valuations. Most listed companies maintain their growth targets, reflecting their confidence in the resilience of the Vietnamese economy,” PYN Elite emphasized.

The fund also highlighted recent positive developments: Vietnam commenced trade negotiations with the U.S. on May 7, and the KRX trading system was officially launched on May 5, marking a significant step forward in market modernization. This upgrade paves the way for features such as central counterparty clearing (CCP) and intraday trading (T+0), enhancing liquidity and transparency.

The macroeconomic backdrop further bolsters this optimism. In April, total retail sales of goods and services rose 11.1% year-over-year, exports surged 20% year-over-year, industrial production increased by 8.9% year-over-year, and FDI disbursement grew by 7.9% year-over-year, demonstrating the long-term commitment of global tech giants to Vietnam.

Despite the World Bank’s downward revision of Vietnam’s GDP growth forecast for 2025 to 5.8% due to tariff impacts, the government remains steadfast in its 8% growth target. A range of supportive policies are in place, including increased public investment and proposed VAT tax breaks through 2026.

A notable long-term catalyst is Resolution 68 by the Political Bureau on private economic development, aiming for a 10-12% annual growth rate for the private sector by 2030 through institutional reforms, investment incentives, and favorable tax policies.

– 6:25 PM, May 9, 2025

Market Beat: Telecoms Shine as VN-Index Surges Over 13 Points

The trading session concluded with significant gains, as the VN-Index climbed by 13.87 points (+1.16%), reaching 1,211 points. Simultaneously, the HNX-Index experienced a notable surge, rising by 3.74 points (+1.8%) to close at 211.45. The market breadth tilted strongly in favor of advancers, with 636 tickers in the green versus 141 decliners. Dominating the VN30 basket, 23 constituents advanced, five declined, and two remained unchanged, painting a bullish picture across the board.

Market Beat: Afternoon Euphoria Sends VN-Index Soaring by 20 Points

The VN-Index defied the morning’s tug-of-war, surging in the afternoon session to close at 1,269.8 points on May 8, a substantial gain of 19.43 points. Mirroring this positive trend, the HNX-Index climbed 1.8 points to 215.21, while the UPCoM-Index inched up 0.06 points to 92.98. Trading value accelerated, surpassing 20,718 billion VND.

Market Beat: Energy & Real Estate Sectors Surge, VN-Index Rallies Further

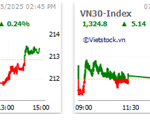

The market closed with positive gains, seeing the VN-Index rise by 8.42 points (+0.68%), settling at 1,250.37. Likewise, the HNX-Index witnessed an increase of 0.52 points (+0.24%), ending the day at 213.41. The market breadth tilted in favor of the bulls, with 402 gainers versus 337 losers. The VN30 basket saw a similar trend, with 14 gainers outperforming 11 losers, while 5 stocks remained unchanged, adding a slight tilt to the bullish sentiment.

Vietstock Daily: Anticipating a Liquidity Rebound

The VN-Index surged once again, testing the old peak reached in November 2024 (around 1,195-1,215 points). However, trading volume has been erratic, fluctuating around the 20-day average, indicating that investor sentiment remains unstable.

The Market Momentum: Can the Uptrend Persist?

The VN-Index witnessed a significant surge, forming a bullish White Marubozu candlestick pattern and breaching the 200-day SMA. This strong performance reflects a buoyant investor sentiment. Should the index sustain these levels and witness a substantial uptick in volume, the outlook would brighten considerably. Notably, the MACD indicator continues to flash a buy signal, and a potential crossover above zero in upcoming sessions remains on the cards. If this materializes, the optimistic short-term sentiment is here to stay.