Relieving Population Pressure

According to Savills Vietnam, the proposal to merge Ho Chi Minh City with Binh Duong and Ba Ria – Vung Tau provinces is being expedited. Per the plan, the merger resolution will take effect from September 1st, with the new Ho Chi Minh City commencing operations on September 15th.

Post-merger, the new administrative unit will retain the name Ho Chi Minh City, becoming a super-metropolitan in the Southeast region. The political and administrative center of the merged Ho Chi Minh City will be located in the current Ho Chi Minh City. Additionally, two auxiliary administrative centers will be maintained at the existing locations of the other two provinces.

The merger will create a new urban economic center with strong competitiveness. Photo: Pham Nguyen.

Ms. Giang Huynh, Director of Research at Savills Ho Chi Minh City, believes that the merger will result in a new urban economic center with strong competitiveness, maximizing the natural advantages, geography, and infrastructure of the three localities.

The adjacent locations and well-connected transportation system among the three provinces facilitate more efficient economic and urban space planning. The expanded land area provides opportunities for strategies to relieve population pressure, develop satellite cities, and build modern new urban areas.

Additionally, the transportation infrastructure is expected to be standardized, particularly the road, waterway, and seaport systems, which will enhance regional connectivity and improve logistics capabilities.

“To ensure the sustainability and optimization of urban land use in the administrative merger process, four key factors need to be addressed simultaneously,” said Ms. Giang Huynh.

Firstly, administrative and land procedures need to be reviewed and streamlined. Secondly, a comprehensive master plan should be developed, integrating land use and infrastructure planning. Thirdly, an efficient public investment disbursement mechanism for infrastructure needs to be established. Lastly, a clear common development strategy is essential.

Planning on a larger land area post-merger provides room for new decisions, shaping future infrastructure and residential areas. This helps address the issue of population pressure and unblocking new housing supply.

“However, these areas need to ensure good accessibility to the city center to attract genuine residential demand. Simultaneously, a strategy to develop new infrastructure and attract investors to these areas is crucial,” added Ms. Giang Huynh.

Similarly, Mr. Tran Khanh Quang, CEO of Viet An Hoa Real Estate Investment Joint Stock Company, believes that if Binh Duong and Ba Ria – Vung Tau are merged with Ho Chi Minh City, the latter will experience remarkable development, comparable to major global cities by combining industry, services, and seaports.

Specifically, Binh Duong has been well-planned for industry, and its infrastructure is conducive to project development. Ba Ria – Vung Tau is also witnessing remarkable growth, especially in seaports, with Phu My Port being a critical hub in the South.

What Should Investors Do?

Mr. Nguyen Viet Hung, Chairman of Lien Minh Khu Tay Joint Stock Company, stated that the information about the potential merger of Binh Duong and Ba Ria – Vung Tau with Ho Chi Minh City, or Long An with Tay Ninh, could trigger land speculation due to development expectations.

There will likely be an upward shift in real estate prices after the province mergers.

However, whether this speculation materializes depends on post-merger factors, such as clear infrastructure, economic, and social development plans, rather than speculative “sharks” creating an artificial frenzy based on merger information.

“There will likely be an upward shift in real estate prices after the province mergers. Nonetheless, investors must thoroughly research each area to discern whether the price increase is due to genuine potential or artificial inflation,” Mr. Hung cautioned.

The Chairman of Lien Minh Khu Tay Joint Stock Company shared that past experiences with administrative mergers have shown that some mergers led to soaring land prices. Occasionally, real estate prices surged rapidly in the short term, only to plummet soon after when the merger failed to deliver proportional infrastructure development as anticipated.

During this phase, Mr. Hung advised investors to remain calm and rational. In this round of province mergers, investors should base their decisions on two critical factors. Firstly, the existing infrastructure, economy, and services of each area should be assessed. Secondly, the anticipated development and strategic direction post-merger should be considered.

“Investors should refrain from investing based on rumors or speculation. This period is also susceptible to localized artificial price surges instigated by land brokers or savvy real estate businesses manipulating the market,” Mr. Hung warned.

Speaking to Tien Phong, Mr. Dinh Minh Tuan, Southern Region Director of Batdongsan.com.vn, revealed that the circulating information about the potential merger of Ho Chi Minh City with neighboring localities has sparked intense market interest in the real estate sector.

Real estate prices in Binh Duong and Ba Ria – Vung Tau have increased following the merger news.

According to Mr. Tuan, while some view this as an opportunity to buy ahead of the curve, others caution against potential risks associated with such information. Based on big data analysis, three prevalent questions among interested parties are: which areas are attracting the most attention, whether real estate prices will increase, and what are the potential risks.

Mr. Dinh Minh Tuan further shared that while selling prices have increased, there are signs of overheating in certain locations. Specifically, real estate prices in Binh Duong and Ba Ria – Vung Tau have risen following the merger news.

“The price increase is primarily driven by market psychology, but investors should exercise caution in areas showing signs of overheating,” Mr. Tuan warned.

Specifically, during this phase, real estate investments carry heightened risks, especially for newcomers to the market. Real estate prices are influenced not only by merger information but also by various factors such as infrastructure, employment opportunities, immigration, and the local economic foundation.

“Investors should be vigilant against potential risks, including the possibility of purchasing properties at prices higher than their actual value, especially in overheated areas. While the merger presents a significant opportunity, investors must remain rational and make purchases that align with the right place and timing, avoiding herd mentality,” advised Mr. Tuan.

Nonetheless, its infrastructure is under immense pressure due to high centralization, resulting in worsening traffic congestion. Binh Duong, known as the industrial powerhouse, exhibits rapid urbanization. Ba Ria – Vung Tau boasts strengths in both tourism and industry.

“The merger of these three areas will create a robust economic region, encompassing diverse sectors such as industry, housing, trade, services, and tourism. To unlock the full potential, implementing a synchronized planning strategy and efficient administrative procedures is paramount,” emphasized Ms. Giang Huynh.

Is a 20% Property Transfer Tax Feasible?

The Finance Ministry’s report on proposed land and property transaction taxes has sparked intense public interest.

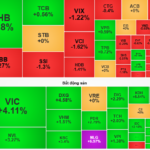

Vietnam Stock Market Outlook: Consolidating the Uptrend for VN-Index

The Vietnamese stock market ended the trading session on May 7th with a notable gain, as the VN-Index rose by 8.4 points, or 0.68%, closing at the 1250-point level.